HBAR Dips 1.4% to $0.1675 Breaking Below Key Support Zone

HBAR’s technical structure turned firmly bearish after repeated failures at the $0.1700 resistance zone, while a surge in volume confirmed a decisive support break.

By CD Analytics, Oliver Knight

Updated Oct 23, 2025, 3:07 p.m. Published Oct 23, 2025, 3:07 p.m.

- HBAR repeatedly failed to break above the $0.1690–$0.1700 zone, confirming strong overhead pressure.

- A 68% surge in trading volume to 105.45 million tokens coincided with the breakdown below $0.1650 support, signaling institutional selling.

- With $0.1650 flipped into resistance, the next key support sits at $0.1620, where previous volume absorption occurred.

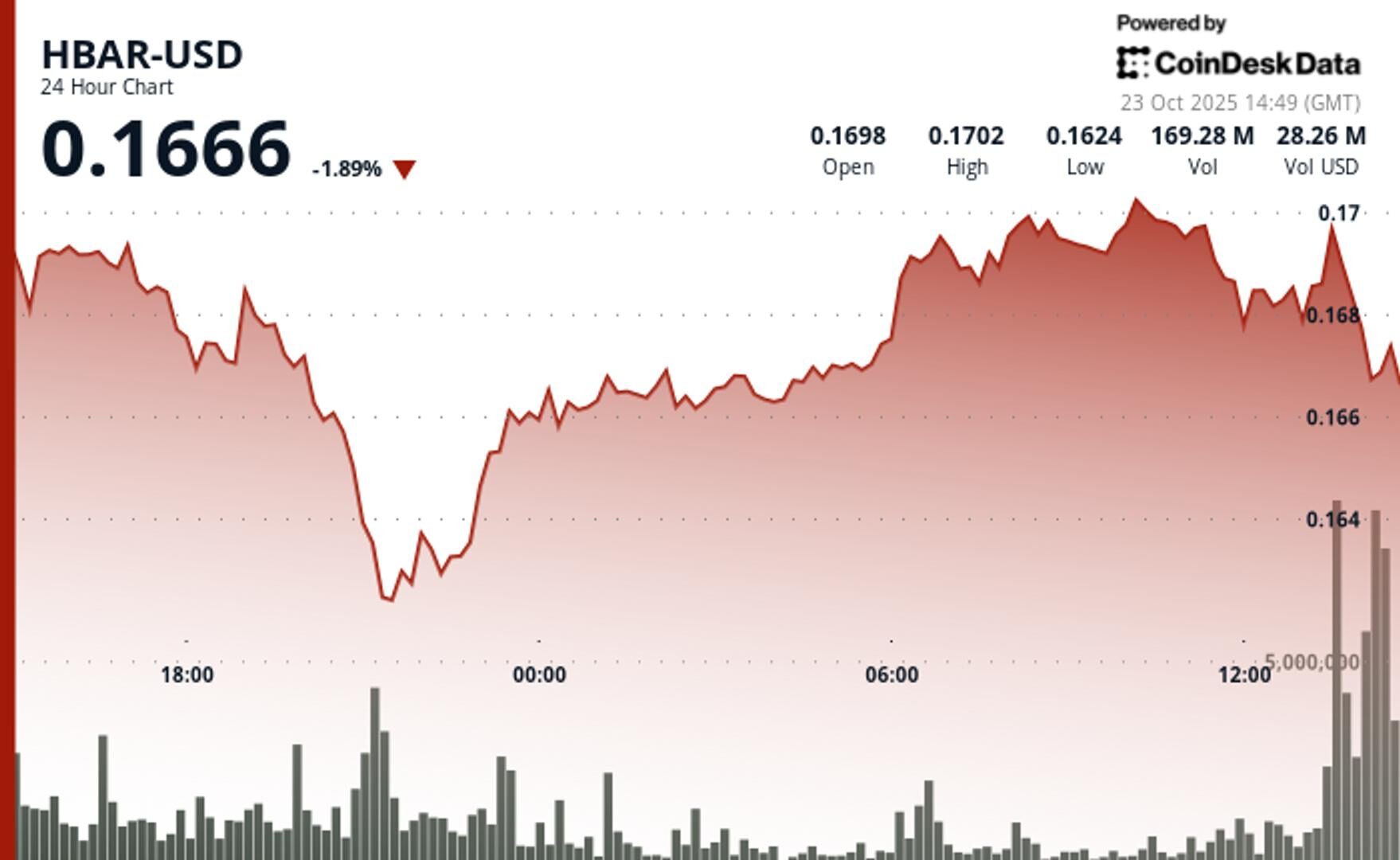

HBAR slipped 1.4% on Tuesday as bearish momentum intensified, driving the token from $0.1698 to $0.1675. The move followed a failed attempt to reclaim the $0.1700 resistance level, with sellers pushing prices below key support at $0.1650. Trading volume surged 68% above its 24-hour average to 105.45 million tokens around 21:00 UTC, coinciding with the decisive breakdown that confirmed bearish control.

Intraday volatility reached 4.9% as HBAR’s price swung within a $0.0084 range. Short-term data showed a sharp rejection from the $0.1690–$0.1697 zone, which now acts as resistance after repeated failures to sustain upward momentum. The subsequent drop toward $0.1676 solidified a bearish reversal pattern, signaling weakening market sentiment.

STORY CONTINUES BELOW

Technical factors remain in focus with limited fundamental catalysts driving action. The inability to recover above $0.1700 coupled with volume-backed support breaks has shifted structure firmly to the downside. Traders are watching $0.1690 for signs of reversal, while continued weakness below $0.1650 could open the path toward the next support near $0.1620.

A brief rebound to $0.1675 on thin volume suggests only a technical retracement rather than a sustained recovery. Unless buying pressure strengthens meaningfully, HBAR’s near-term outlook remains tilted toward further declines.

Key Technical Levels Signal Bearish Structure for HBAR

- Support/Resistance Analysis

- Primary resistance: $0.1690–$0.1700 zone after multiple failed breakout attempts

- Critical support at $0.1650 broken during high-volume move, now acting as resistance on retests

- Secondary support at $0.1620, where institutional volume absorption previously occurred

- Volume Analysis

- Institutional volume spike: 105.45M tokens, 68% above the 24-hour SMA, confirming support breakdown

- Diminishing volume on recovery to $0.1675 signals weak buying interest

- Volume trends indicate distribution, not accumulation, at current price levels

- Chart Patterns

- Bearish reversal confirmed with lower highs and lower lows

- Failed breakout above $0.1700 offered a selling

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Oliver Knight

1 hour ago

Double-top reversal at $0.3147 resistance overshadows collaborative payment infrastructure developments.

What to know:

- XLM continues to trade within a tight band between $0.3027 support and $0.3160 resistance, with recent breakdowns confirming short-term weakness.

- A 62.1 million volume spike—180% above average—established key support at $0.3027, highlighting strong buyer interest but limited follow-through.

- Despite positive sentiment around Ripple–Stellar collaboration on humanitarian payments, price action remains dominated by technical resistance at $0.3147–$0.3160.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language