-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Aug 27, 2025, 3:42 p.m. Published Aug 27, 2025, 3:42 p.m.

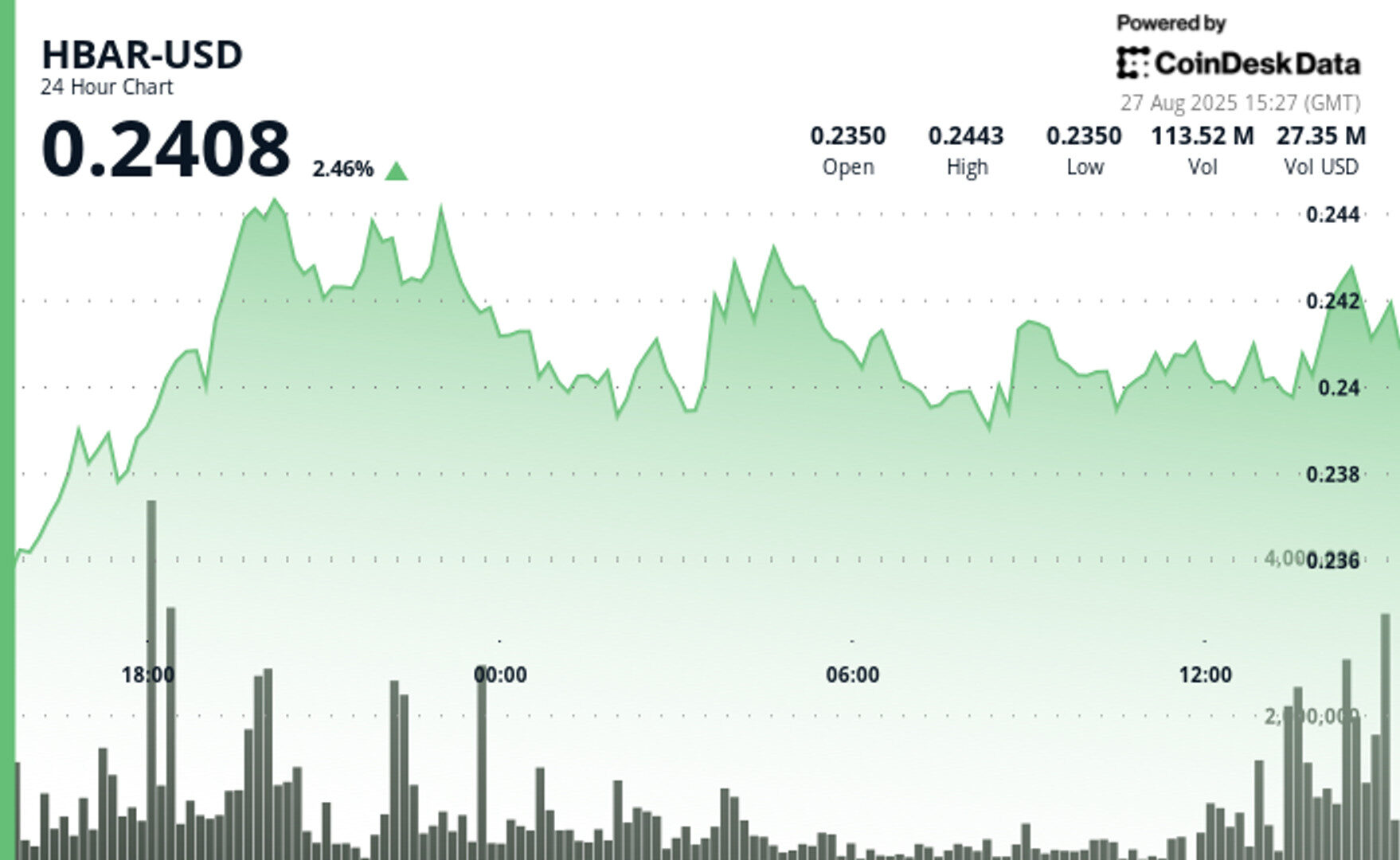

- HBAR traded in a tight $0.01 corridor ($0.24–$0.25) over a 23-hour period, with volume surging to 70.13 million units, well above session averages.

- The token briefly peaked at $0.25 on Aug. 26 before consolidating near $0.24, where multiple support tests confirmed a strong technical base.

- Institutional interest is mounting, with SWIFT testing Hedera for tokenized settlement and Grayscale establishing a Delaware trust for HBAR.

Hedera’s HBAR token showed strong momentum in a 23-hour trading window between Aug. 26 at 15:00 and Aug. 27 at 14:00, oscillating within a narrow $0.01 range that reflected a 4% spread between its $0.25 high and $0.24 low.

The token gained early traction on Aug. 26, surging from $0.24 to its peak at $0.25 by 19:00, supported by unusually heavy trading volume of 70.13 million units. Afterward, the market settled into consolidation, with repeated tests of support at $0.24 and resistance near the upper band, establishing a stable corridor for the remainder of the session.

STORY CONTINUES BELOW

HBAR saw renewed strength in the final hour of trading, advancing from $0.24 to close slightly higher, underscoring continued bullish pressure even within tight market conditions.

Analysts noted that the session’s elevated activity marked one of the more robust liquidity events for the token in recent weeks, highlighting growing interest among traders despite broader market caution.

The token’s technical resilience comes as institutional players step deeper into Hedera’s ecosystem. Payments network SWIFT has launched live blockchain tests using Hedera for tokenized settlement infrastructure, while asset manager Grayscale has established a Delaware trust for HBAR.

- Trading corridor of $0.01 indicating 4% differential between session high of $0.25 and low of $0.24.

- Maximum bullish strength materialized around 19:00 on 26 August with advancement from $0.24 to $0.25.

- Substantial trading volume reached 70.13 million units surpassing typical session metrics.

- Foundation level formed near $0.24 through multiple successful support confirmations.

- Resistance materialized around $0.24 establishing well-defined trading channel.

- Concluding 60-minute session demonstrated 1% appreciation from $0.24 to $0.24.

- Trading volume surge of 7.08 million units materialized at 13:42 during dramatic price movement.

- $0.24 level functioned as crucial pivot point transitioning from resistance to support.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

By CD Analytics, Oliver Knight

44 minutes ago

Despite overnight selling, XLM maintained support near $0.38 with trading volumes spiking 115%, signaling institutions remain active as regulatory uncertainty looms.

What to know:

- XLM traded in a 4% band between $0.38 and $0.40, with volumes above average, pointing to sustained institutional participation despite overnight selling pressure.

- Daily turnover jumped 115% to $402.21 million, as ETF-related regulatory filings spurred increased corporate and institutional interest in Stellar and other digital assets.

- Intraday price action showed resilience, with XLM rebounding from $0.38 to $0.39 and holding support, suggesting institutional flows are shaping near-term technical levels.