-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Hedera Hashgraph faces mounting pressure from institutional investors as trading volumes surge to 110 million tokens during overnight sessions.

By CD Analytics, Oliver Knight

Updated Sep 1, 2025, 4:16 p.m. Published Sep 1, 2025, 4:16 p.m.

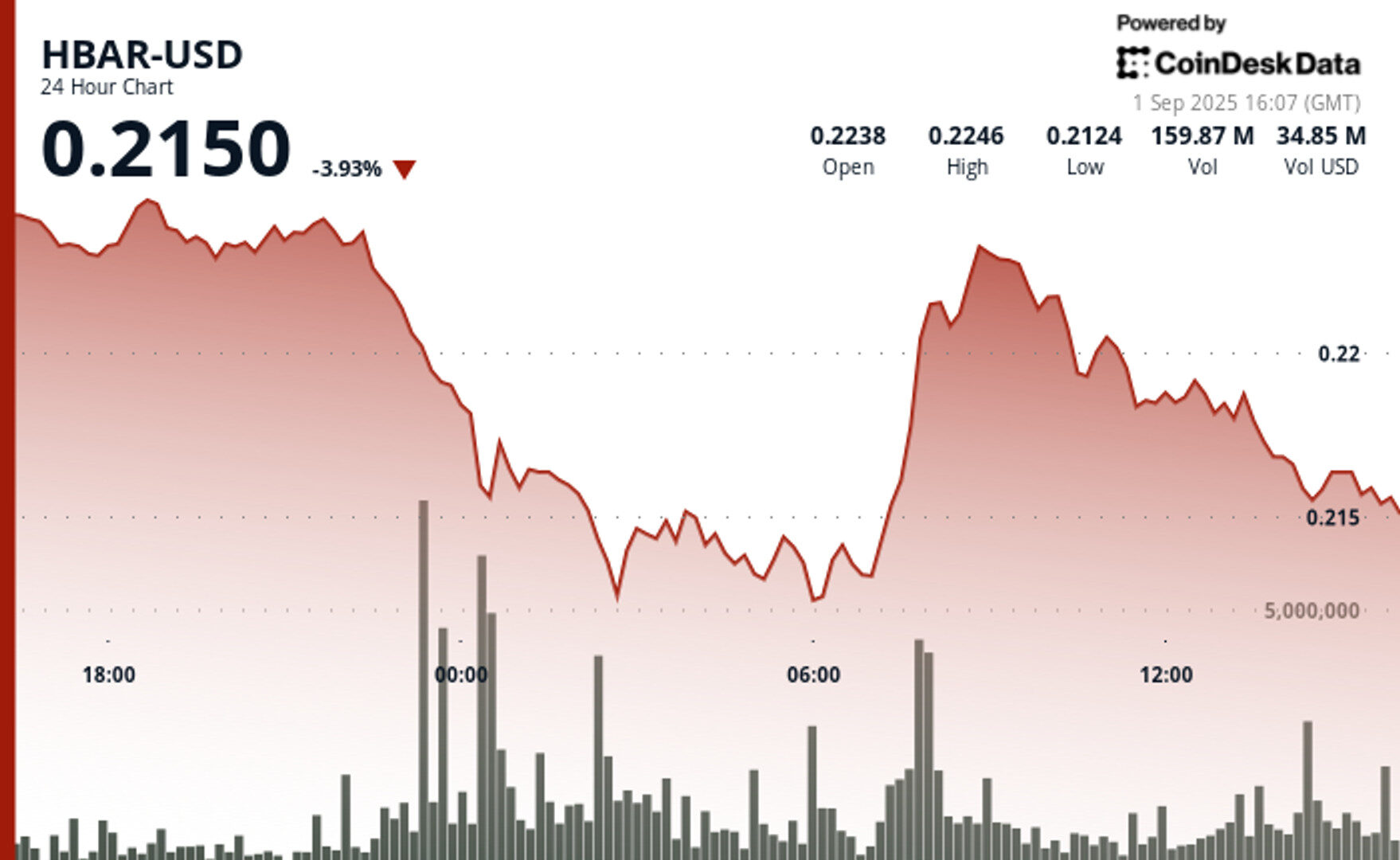

- Institutional selling drove HBAR lower, with more than 110 million tokens offloaded during after-hours trading as the token slipped around 4% between Aug. 31 and Sept. 1.

- Support sits near $0.21–$0.22, resistance around $0.22–$0.23, where consistent selling pressure capped recovery attempts throughout the session.

Hedera’s HBAR token faced renewed selling pressure as institutional investors trimmed exposure, pushing the asset down about 4% between Aug. 31 and Sept. 1. Trading activity was concentrated around the $0.22 mark, with intraday swings ranging from $0.23 highs to $0.22 lows.

The heaviest selling emerged during after-hours, when more than 110 million tokens exchanged hands, underscoring signs of coordinated divestment. Market makers sought to stabilize the price in the $0.21–$0.22 range, but resistance hardened just above $0.22, capping any meaningful recovery.

STORY CONTINUES BELOW

Despite the downturn, Hedera continues to position itself as a platform for enterprise adoption. Daily trading volume fell 46% to $172.85 million while the network maintained a market capitalization near $9.5 billion.

Selling pressure accelerated into the final hour of Sept. 1 trading, when HBAR briefly breached multiple support levels. Roughly 3.5 million tokens changed hands in a single minute as the token slid below its $0.22 resistance, closing the session near its lows. With sellers maintaining control and institutional flows leaning negative, the market is signaling that further corporate repositioning could continue in the near term.

- Share price declined from $0.22 to $0.22 representing trading ranges of $0.01 or 5% between maximum and minimum session levels.

- Trading volume exceeded 110 million tokens during overnight hours indicating significant institutional activity and potential portfolio rebalancing.

- Support levels emerged around the $0.21-$0.22 range with subsequent recovery attempts failing to gain institutional backing.

- Resistance formed near $0.22-$0.23 levels where price discovery consistently encountered selling pressure throughout the trading period.

- Multiple support level breaches occurred at $0.22 and $0.22 with sellers maintaining market control.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Aoyon Ashraf

13 minutes ago

Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

What to know:

- BNB’s price saw sharp intraday swings, trading between $849.88 and $868.76, but ultimately failed to hold gains.

- Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

- The price action is ahead of key economic data from the US, including jobs data, which could influence the Federal Reserve’s interest rate decision, with a near 90% chance of a 25 bps cut currently priced in.