-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Trading data reveals strong institutional buying interest with volume exceeding daily averages by 86% during key resistance tests.

By CD Analytics, Oliver Knight

Updated Sep 3, 2025, 3:31 p.m. Published Sep 3, 2025, 3:31 p.m.

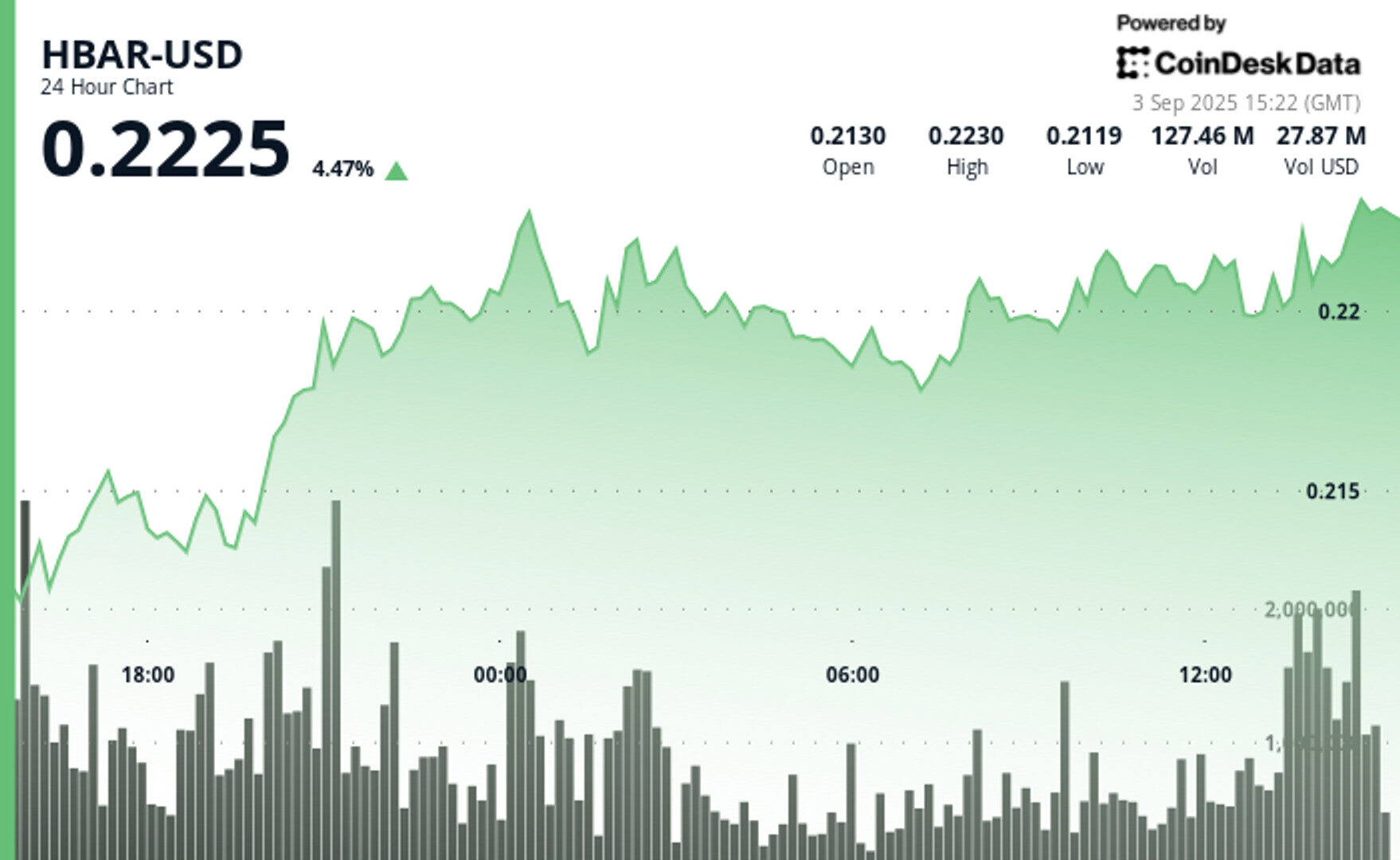

- HBAR gained 3% between Sept. 2–3, holding above $0.22 and finishing near session highs.

- Trading activity hit 69.68 million, nearly double the daily average, with institutional accumulation driving breakout patterns.

- Support formed at $0.21 while resistance at $0.22 was repeatedly tested, suggesting potential for a continuation rally.

Hedera’s native token, HBAR, showed signs of bullish momentum over the past 24 hours, gaining 3% while weathering moderate market turbulence.

Between September 2 at 15:00 and September 3 at 14:00, the digital asset advanced from $0.22 to finish near session peaks, with its trading range spanning 5% of the period’s low.

STORY CONTINUES BELOW

The move came as buying activity consistently supported the token at higher levels, signaling resilience in a volatile environment.

Trading dynamics underscored this strength, with volume surging to 69.68 million, far above the 24-hour average of 37.42 million.

Institutional accumulation and extraordinary bursts of activity — including a single spike of 4.87 million — highlighted aggressive positioning above key resistance thresholds.

On a shorter time horizon, HBAR recorded notable intraday volatility. In the hour between 13:29 and 14:28 on September 3, the token rallied from $0.22 to a session high before stabilizing, reflecting classic breakout patterns with ascending lows and persistent momentum.

With support holding above $0.22, traders will be watching closely to see if HBAR can sustain its bullish posture into the next trading period.

- HBAR formed solid support at $0.21 during opening sessions with substantial volume of 69.68 million, markedly surpassing the 24-hour average of 37.42 million.

- Critical resistance materialized at $0.22, challenged repeatedly during overnight periods with amplified volume, indicating potential breakout development.

- The market structure displayed a textbook accumulation formation with ascending low configuration.

- Volume explosions during bullish movements at 20:00 and 21:00 on September 2nd validated authentic buying momentum rather than speculative activity.

- Exceptional volume bursts reaching 4.87 million at 13:43 confirmed institutional positioning above the pivotal $0.22 resistance threshold.

- The cryptocurrency showcased classic breakout dynamics with ascending low structure and sustained purchasing pressure during upward phases.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

6 minutes ago

South Korea’s largest exchange pauses operations as Stellar prepares for a major network overhaul, with XLM price action showing resistance at $0.37.

What to know:

- Upbit suspended XLM trading as Stellar’s Protocol 23 upgrade began on Sept. 3, aiming to safeguard stability during the network overhaul.

- XLM price consolidated between $0.36 and $0.37, with repeated but unsuccessful attempts to sustain gains above resistance.

- Traders eye $0.45 resistance and $0.30–$0.32 support as key levels to watch following the upgrade’s rollout.