Traders exit positions as cryptocurrency breaks key technical levels amid broader market uncertainty.

By CD Analytics, Oliver Knight

Updated Oct 10, 2025, 4:54 p.m. Published Oct 10, 2025, 4:54 p.m.

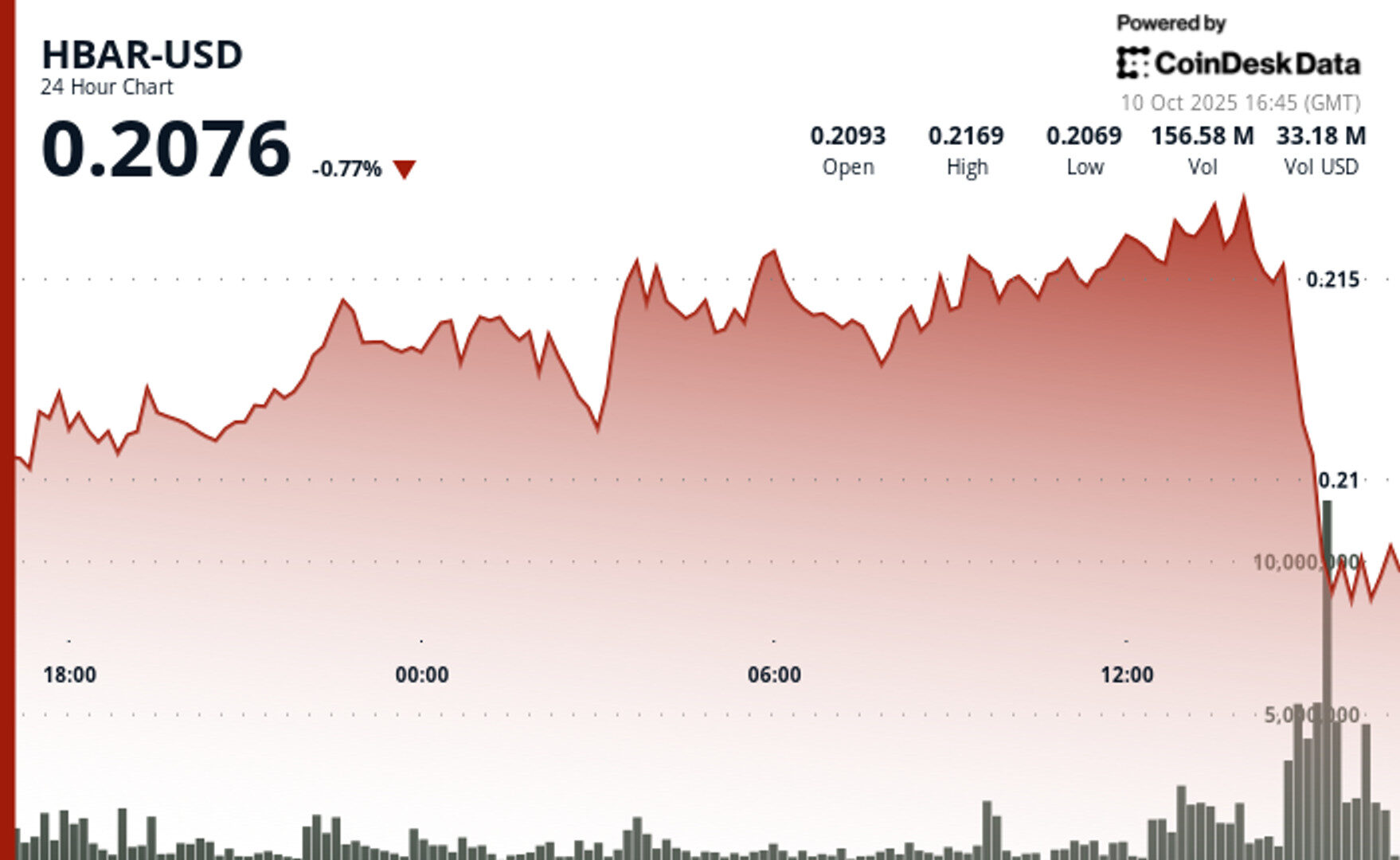

- HBAR faced coordinated selling from institutional traders, who drove a sharp reversal after midday gains near $0.22.

- Trading volume jumped to 262.49 million in the final hour—six times the session average—marking the heaviest institutional activity of the day.T

- The cryptocurrency breached multiple support zones between $0.21 and $0.22 before stabilizing as market activity halted in the closing minutes.

Hedera Hashgraph’s HBAR token came under heavy institutional selling pressure over the 24-hour trading period ending October 10, with prices fluctuating within a volatile 6% range between $0.21 and $0.22. Despite early resilience that saw HBAR climb toward intraday highs near $0.22, the digital asset reversed sharply in the final trading hour, as institutional investors initiated broad-based selloffs that erased earlier gains.

Trading data pointed to exceptional activity during this selloff, with volumes surging to 262.49 million—nearly six times higher than the session’s 47.32 million average. Analysts identified the 3:00 PM hour on October 10 as the inflection point, where the heaviest liquidation occurred. The abrupt spike in volume and price pressure suggested coordinated selling by institutional players, possibly as part of broader portfolio rebalancing.

STORY CONTINUES BELOW

Technically, HBAR broke through multiple short-term support levels during this final hour, with price action stabilizing only as trading activity ceased in the closing minutes. The sharp drop and subsequent lull may reflect temporary liquidity constraints or trading desk closures as institutions moved to limit exposure ahead of potential regulatory updates.

- Key resistance levels formed around $0.22-$0.22 where institutional buying interest repeatedly failed to materialize at higher price levels.

- Corporate support emerged around the $0.21-$0.21 range before being decisively broken during the final hour’s institutional selling wave.

- The most significant institutional liquidation occurred during the 3:30-3:35 PM window, where corporate trading volume spiked to over 12.80 million and 16.90 million respectively.

- Price action declined from $0.21 to a session low of $0.21, before corporate buyers attempted a modest recovery to $0.21 by 3:44 PM.

- Institutional trading activity ceased entirely during the final four minutes (3:56-3:59 PM), suggesting corporate trading desk closures or temporary liquidity constraints ahead of regulatory developments.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Krisztian Sandor, Helene Braun|Edited by Stephen Alpher

2 hours ago

Cryptos came under pressure as a potential U.S.-China trade war once again on the table.

What to know:

- Cryptocurrencies fell sharply in late morning U.S. action on Friday after President Trump floated plans for increasing tariffs on Chinese goods as a response to rare earth metals export controls.

- Bitcoin plunged back below $119,000, with other major cryptocurrencies like ETH and SOL also tumbling.

- Crypto-related stocks, including Circle (CRCL), Robinhood (HOOD) and Coinbase (COIN) declined 5%-6%.