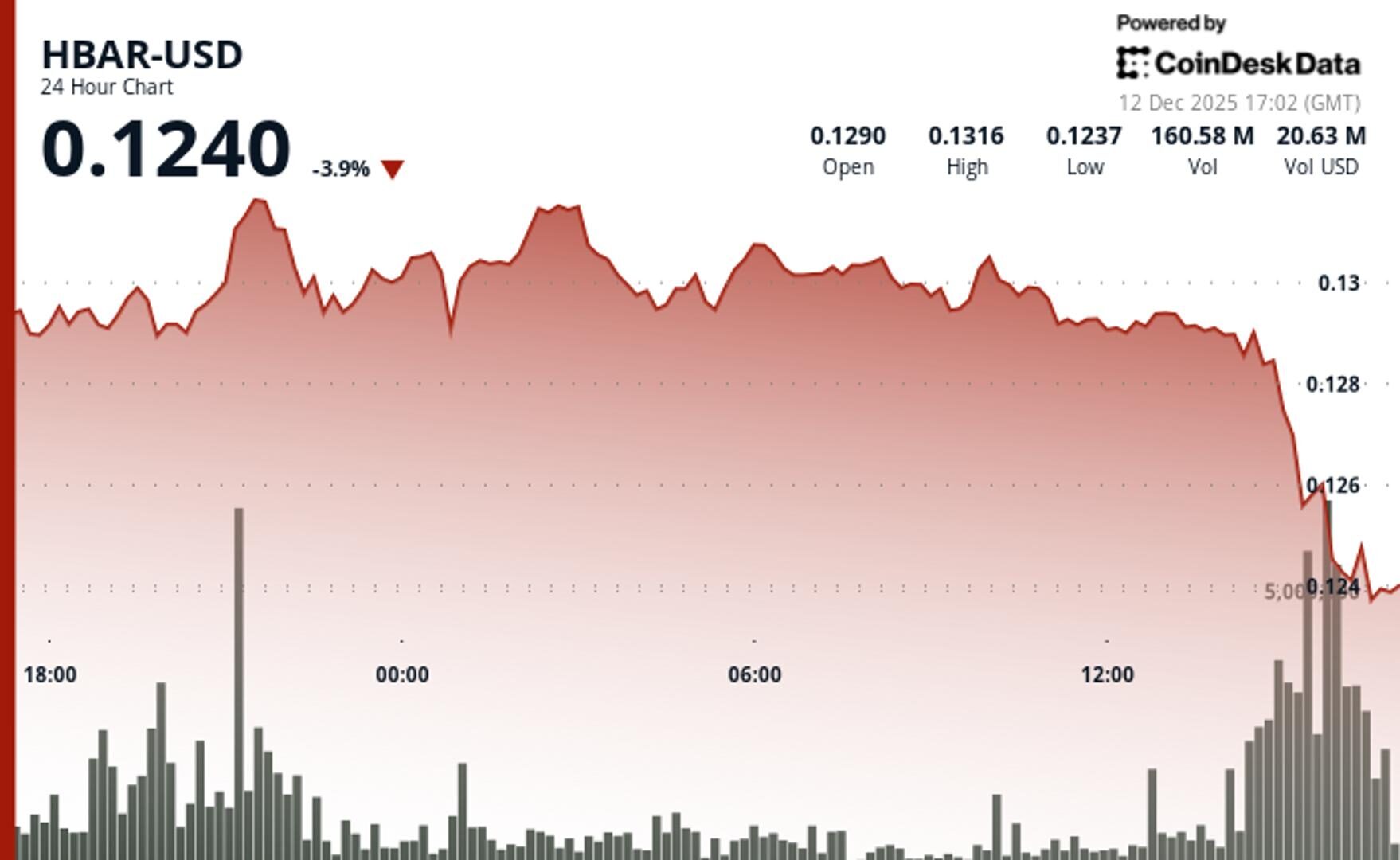

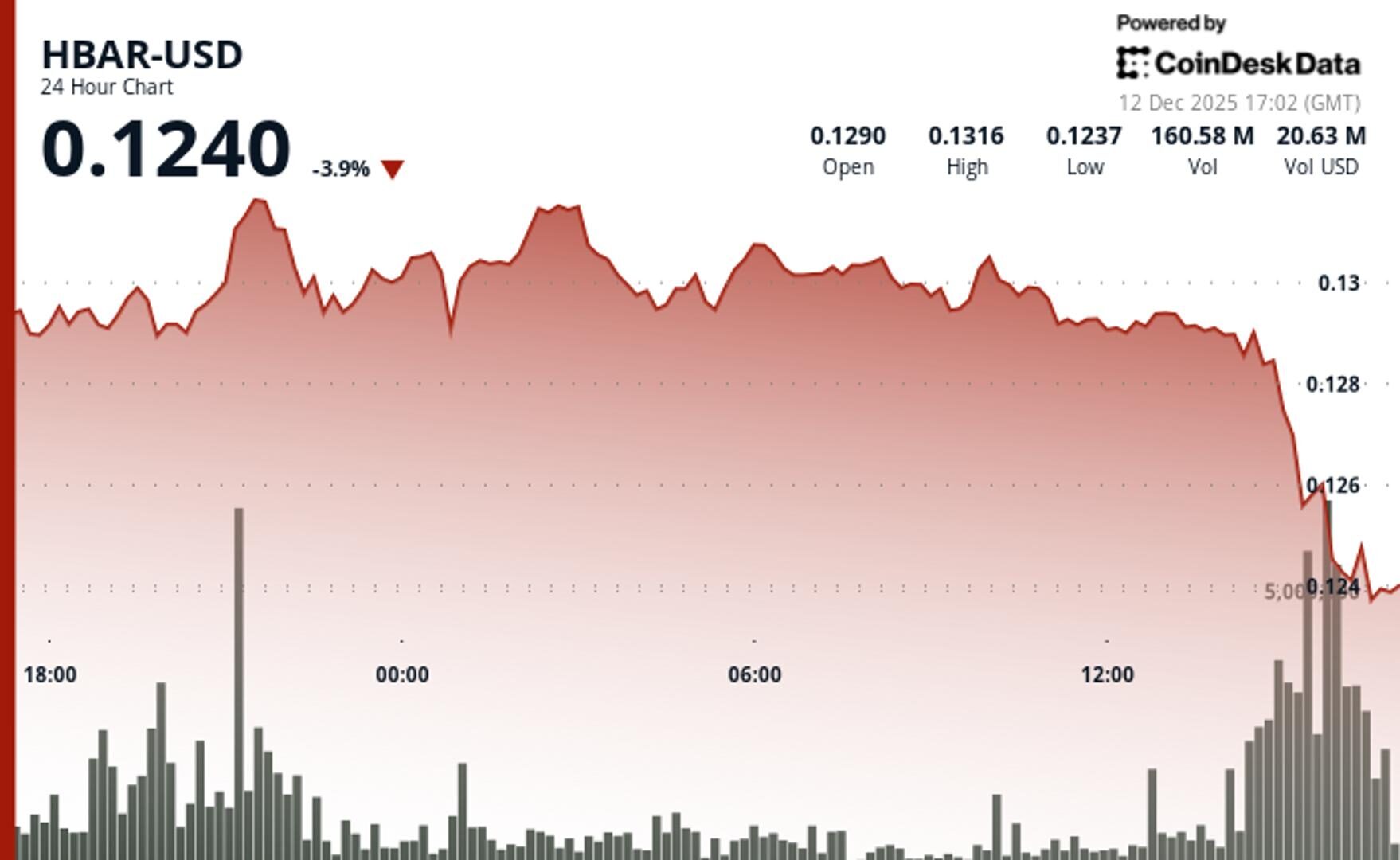

Hedera’s native token retreated from resistance levels as institutional volume surged during key reversal hour.

Hedera Tumbles 4% as Altcoins Continue to Suffer

Hedera’s native token retreated from resistance levels as institutional volume surged during key reversal hour.