-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Krisztian Sandor, AI Boost|Edited by Cheyenne Ligon

Aug 27, 2025, 4:51 p.m.

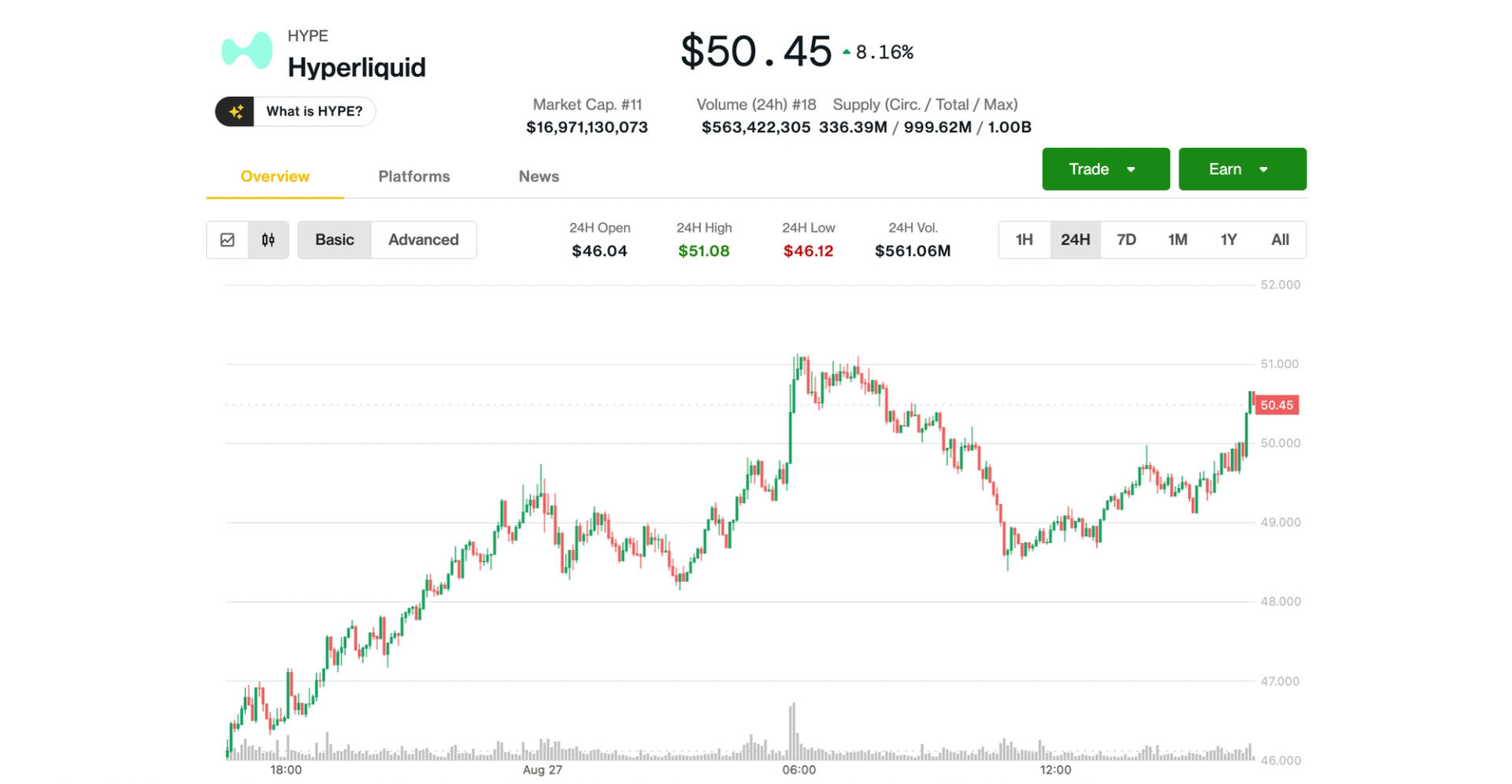

- Hyperliquid’s native token HYPE surged 8% over the past 24 hours to a new all-time high above $50.

- The rally has been driven by record trading activity and an automated buyback mechanism. The decentralized exchange saw a surge in derivatives volume to over $357 billion in August, generating $105 million in trading fees that has been mostly funneled to token buybacks.

- ByteTree analysts described it as one of “most compelling protocols in DeFi,” but risks loom.

The native token of Hyperliquid (HYPE) surged to a fresh all-time high early Wednesday, continuing its meteoric climb this year as the decentralized exchange best known for on-chain perpetual trading has attracted record activity.

The token broke through the $50 mark for the first time, gaining about 8% in the past 24 hours. HYPE is now up 430% since its April nadir and up roughly 15x since it began trading in late November at around $3.

STORY CONTINUES BELOW

The rally has been fueled by record trading activity across the exchange and its automated buyback mechanism, which steadily absorbs tokens from the market and reduces circulating supply.

Read more: Hyperliquid Now Dominates DeFi Derivatives, Processing $30B a Day

The decentralized exchange recorded more than $357 billion in derivatives volume in August, according to DefiLlama data, up from $319 billion in July and nearly ten times higher than a year ago. Spot trading volumes also set a record, surpassing $3 billion for the week ending Aug. 24, Blockworks data shows.

These flows translated into a windfall for the protocol. Hyperliquid booked $105 million in trading fees during August, the highest this year, per DefiLlama data.

Much of those earnings are funneled directly into purchasing HYPE on the market through Hyperliquid’s Assistance Fund. The facility is an automated on-chain mechanism that buys back tokens on the open market, creating sustained buy pressure for HYPE and effectively reducing the circulating supply.

Since its launch in January, the fund’s holdings ballooned from 3 million tokens to 29.8 million HYPE, now worth over $1.5 billion, fueling the token’s rally.

On the news front, digital asset custodian BitGo added support on Tuesday for the HyperEVM network, which underpins the Hyperliquid ecosystem, unlocking institutional access to HYPE and related applications.

In a recent research note, ByteTree analysts Shehriyar Ali and Charlie Morris described Hyperliquid as a “powerhouse” that has become the largest decentralized perpetual futures venue.

“All things considered, HyperLiquid is among the most compelling protocols in DeFi today,” they wrote. “Its strong fundamentals, record-breaking fee generation and dominant market share make it impossible to ignore.”

Despite the bullish fundamentals, the report also flagged concerns about the token’s valuation. HYPE currently trades at a fully diluted valuation (FDV) of over $50 billion, with only about third of supply in circulation with a 16.8 billion market capitalization.

Scheduled token unlocks starting in November could also introduce selling pressure, potentially testing the strength of demand, the report noted.

“Although the token has already seen a sharp run-up in recent months, its robust on-chain activity continues to underpin its valuation,” the analysts said.

Read more: XPL Futures on Hyperliquid See $130M Wiped Out Ahead of the Plasma Token’s Launch

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

More For You

By Siamak Masnavi, AI Boost|Edited by Aoyon Ashraf

5 minutes ago

Solana’s SOL surged past $208, outpacing broader markets as analysts weigh breakout signals, treasury demand, and new institutional validator activity.

What to know:

- SOL gained 7.68% in 24 hours, outperforming the CoinDesk 20 Index and broader crypto market.

- Analysts point to breakout levels, treasury demand and potential spot ETF approval by the U.S. SEC as key drivers.

- Staking service provider Chorus One, in partnership with crypto research firm Delphi Digital, launched a new institutional-grade Solana validator.