-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley, CD Analytics|Edited by Sheldon Reback

Aug 18, 2025, 3:48 p.m.

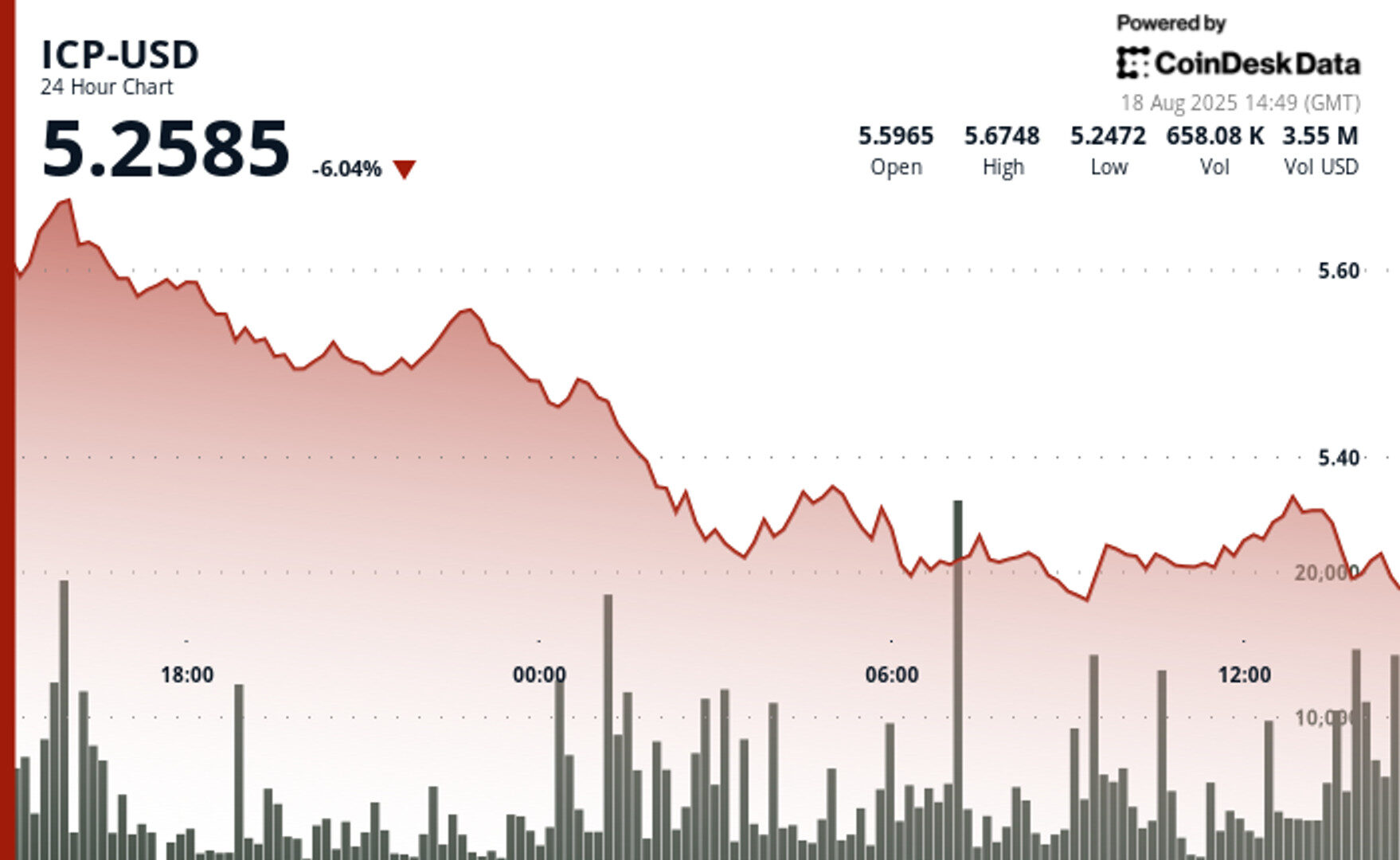

- ICP slid 7% from $5.67 to $5.27 between Aug. 17–18, breaching the $5.48 support zone.

- Trading volume surged to 708,905 units, nearly twice the 24-hour average.

- Brief recovery attempts failed as institutional selling pressure dominated.

Internet Computer Protocol (ICP) fell over the last 24 hours, losing 7% of its value.

The token dropped to a low of $5.27, breaking through critical support levels and raising concerns about sustained institutional interest in the project, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Market data showed ICP falling below the $5.48 support threshold during the early hours of Aug. 18, with trading activity spiking to 708,905 units, nearly double the daily average of 386,248 units. Analysts flagged this pattern as evidence of coordinated selling among large investors and corporate treasury desks. A bounce was short-lived, with the token falling back to $5.29.

The crypto market at large is dealing with bearish pressure following an ignition of concerns over U.S. inflation after last week’s Producer Price Index (PPI) reading for July 2025 was hotter than expected.

A downturn in the broader crypto market can increase selling pressure on tokens like ICP due to a general risk-off sentiment, reduced liquidity, and the tendency of investors to sell more speculative assets first.

- ICP fell 7% from $5.67 to $5.27 on Aug. 17–18.

- Critical support level at $5.48 was breached during early Aug. 18 trading.

- Volume surged to 708,905 units, almost double the 24-hour average of 386,248 units.

- Recovery attempts failed, with a 1.12% drop from $5.35 to $5.29.

- Current price consolidation near $5.29 reflects waning institutional participation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Jamie has been part of CoinDesk’s news team since February 2021, focusing on breaking news, Bitcoin tech and protocols and crypto VC. He holds BTC, ETH and DOGE.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Omkar Godbole, AI Boost|Edited by Sheldon Reback

1 hour ago

Protection against price drops in BlackRock’s spot bitcoin (BTC) ETF, IBIT, is now at its priciest since the early April market slide.

What to know:

- One-year IBIT puts trade at 4.4 implied volatility premium to calls, the widest spread since early April.

- It’s a sign of growing demand for downside protection.