-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley, CD Analytics|Edited by Oliver Knight

Updated Aug 14, 2025, 12:06 p.m. Published Aug 14, 2025, 12:06 p.m.

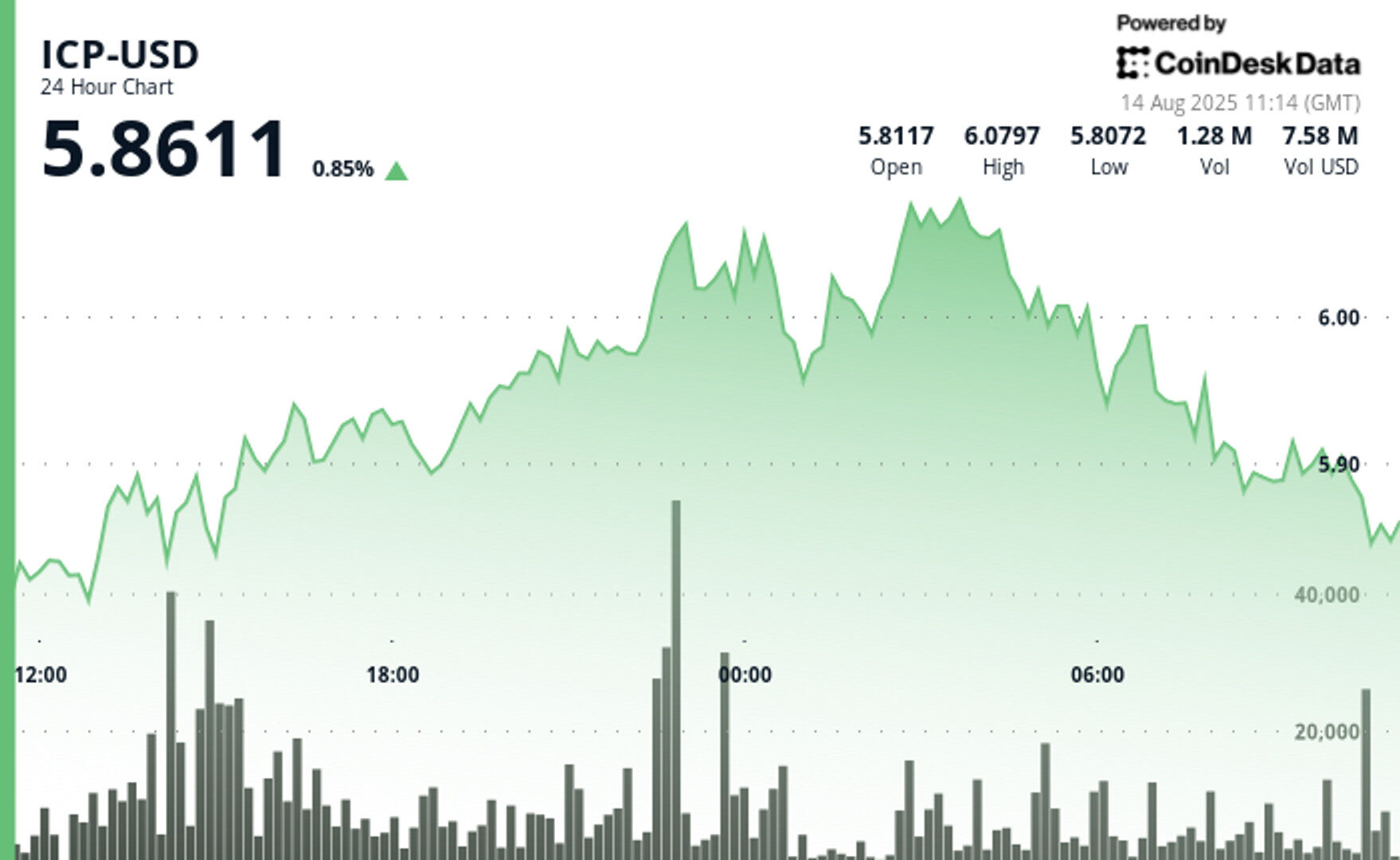

- ICP surged from $5.84 to $6.08 before reversing sharply within a 23-hour trading window.

- Security breach at Odin.fun reignites concerns over Internet Computer authentication vulnerabilities.

- Final hour consolidation in tight range signals market indecision following earlier volatility.

Internet Computer Protocol (ICP) saw a volatile 24 hours, climbing from $5.84 to a session high of $6.08 before succumbing to selling pressure.

The 5% swing unfolded within a $0.28 trading corridor, reflecting both strong buying interest and swift profit-taking, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Early momentum carried ICP through multiple resistance points, with the rally peaking at $6.08 around 03:00 UTC on August 14. Elevated volume at these highs confirmed institutional selling activity, establishing a clear resistance zone between $6.06 and $6.08. On the downside, support developed in the $5.87–$5.90 range, where buyers consistently stepped in to absorb supply.

ICP’s volatility subsequently compressed sharply. The token traded in a narrow $0.04 band between $5.88 and $5.92 from 09:25 to 10:24 UTC, indicating a consolidation phase as traders reassessed positions.

Market sentiment had been shaken by a high-profile security incident at Bitcoin-based memecoin platform Odin.fun, which suspended trading after losing 58.2 BTC in a suspected exploit. The breach, which triggered a 40% collapse in ODINDOG’s value, scrutiny over Internet Computer’s security framework, particularly its “Sign-In With Bitcoin” authentication system.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Jamie has been part of CoinDesk’s news team since February 2021, focusing on breaking news, Bitcoin tech and protocols and crypto VC. He holds BTC, ETH and DOGE.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Parikshit Mishra

35 minutes ago

Despite the price decline, whale accumulation of PEPE continued, with the top addresses on Ethereum increasing their holdings by 1.5% in the last 30 days.

What to know:

- Pepe (PEPE) fell 4% in the past 24 hours, underperforming the wider market as trading activity in the meme token sector cooled.

- Despite the price decline, whale accumulation of PEPE continued, with the top 100 PEPE addresses on Ethereum increasing their holdings by 1.5% in the last 30 days.

- Technical analysis suggests that PEPE is facing distribution pressure from sellers, and unless it can reclaim and hold above the $0.000012 resistance zone, it may retest lower support levels.