ICP Price Falls to $3.77 After Rejection From $4.28 Resistance

By Jamie Crawley, CD Analytics|Edited by Nikhilesh De

Nov 3, 2025, 4:47 p.m.

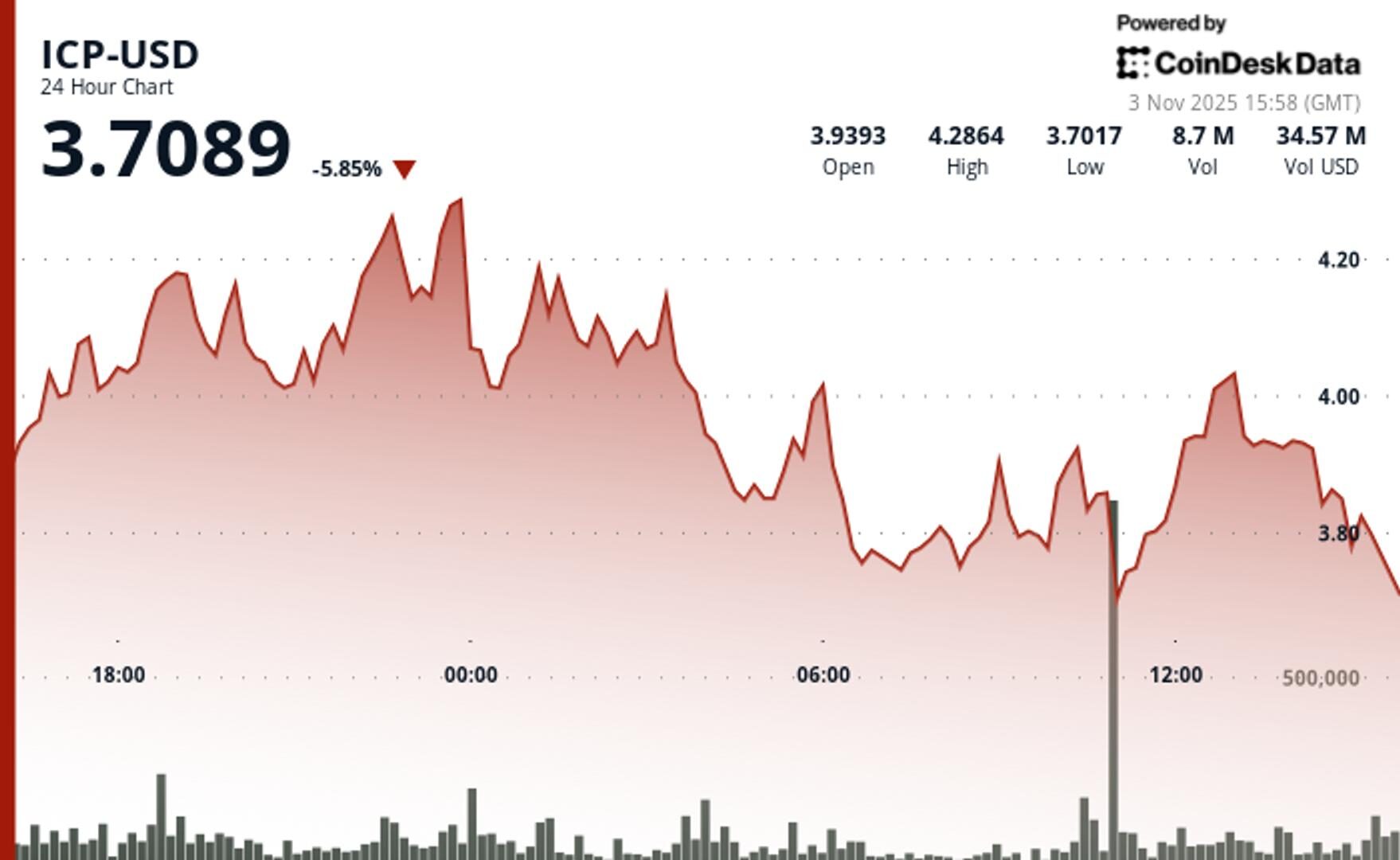

- ICP fell 5.48% to $3.77 after failing to hold above $4.20 resistance.

- Volume surged to 8.7M tokens, 70% above the 24-hour average.

- Key support now sits near $3.70, with resistance capped at $3.95–$4.05.

ICP$3.7801 lost ground after a weekend rally, sliding 5.48% to $3.77 as momentum faded following a failed attempt to break above short-term resistance near $4.28.

ICP climbed to nearly $4.30 late on Sunday, before tracking downward throughout much of Monday. Trading volume reached 8.7 million tokens, approximately 70% above the daily average, confirming that the retracement was driven by strong participation rather than low-liquidity drift, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

ICP fell to $3.70 by the late European morning before climbing back above $4 over the next two hours. This rally however faltered and ICP tracked back to $3.70. The day’s wide $0.58 range represented nearly 15% intraday volatility, underscoring the persistent tug-of-war between bullish accumulation and profit-taking.

Despite the setback, the broader uptrend structure remains intact so long as ICP holds above $3.70, which now represents an important pivot level for short-term direction. A recovery back above $3.95 could restore bullish confidence and open a path toward $4.10–$4.15, while a break below $3.70 may trigger further downard pressure into the $3.60 range.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Oliver Knight

8 minutes ago

XLM steadies after a sharp 5.5% sell-off, with traders watching the $0.277 level as the critical line between recovery and renewed downside pressure.

What to know:

- Stellar’s price rebounded from a $0.277 low after heavy liquidation, confirming the level as pivotal short-term support.

- Volume surged 887% during the breakdown before normalizing, hinting at short-term stabilization.

- XLM faces strong resistance at $0.3014, with consolidation near $0.281 suggesting a balanced but fragile market.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language