-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Hedera’s token sees heightened Wall Street activity as trust and ETF filings surface, though regulatory hurdles remain.

By CD Analytics, Oliver Knight

Sep 12, 2025, 2:44 p.m.

- HBAR ETF buzz: Grayscale flagged plans for a Hedera trust while the DTCC listed a Canary HBAR ETF under ticker HBR.

- Institutional flows: Resistance at $0.245 capped gains, with $0.240 holding as a critical support amid heavy trading volumes.

- Regulatory roadblocks: Analysts warn DTCC listings are preliminary, with SEC approval still required before any ETF launch.

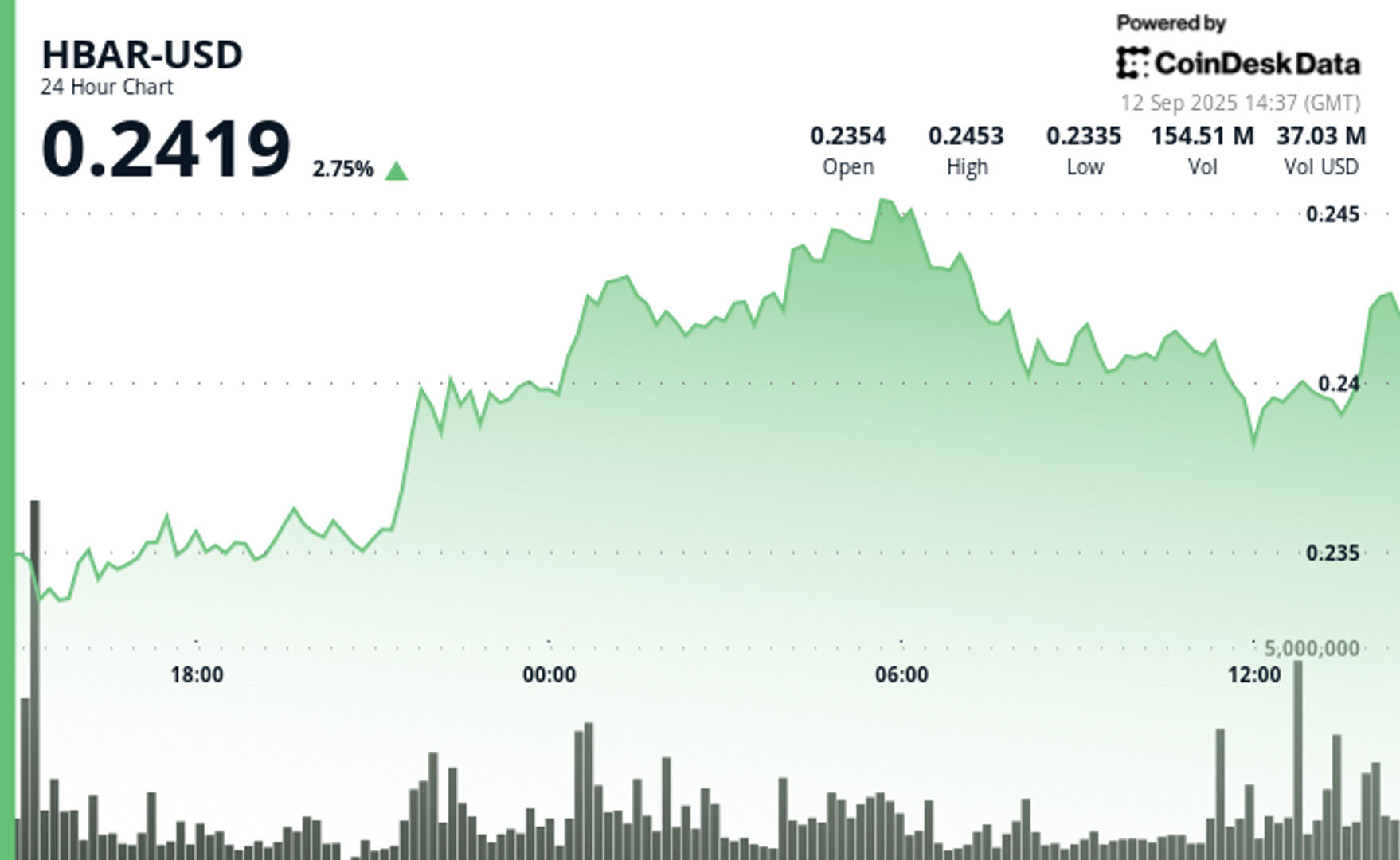

Hedera’s native token HBAR posted modest gains during the September 11–12 trading window, climbing from $0.237 to as high as $0.245 before closing at $0.240. The move reflected a surge in institutional participation, with market activity closely tied to fresh developments around potential exchange-traded products.

Corporate momentum built after Grayscale Investments revealed plans for a potential HBAR trust and the Depository Trust and Clearing Corporation (DTCC) added a Canary HBAR ETF filing to its regulatory database. The listing, under the proposed ticker HBR, accompanied similar submissions for Solana and XRP, underscoring growing Wall Street appetite for digital assets beyond Bitcoin.

STORY CONTINUES BELOW

Traders reacted sharply to the news. Technical resistance at $0.245 triggered profit-taking, while $0.240 emerged as a key institutional support level, reinforced by late-session volume spikes that topped 17 million tokens. Analysts say the speculation could set up a test of the $0.25 psychological threshold if momentum continues.

Still, industry observers caution that DTCC inclusions represent only preliminary steps, not SEC approval. Regulators remain focused on addressing market manipulation risks and investor protection standards for non-Bitcoin crypto assets, leaving the timeline for any HBAR-based ETF uncertain. For now, the filings have placed Hedera firmly on Wall Street’s radar, driving institutional attention even amid regulatory fog.

- Intraday trading established a $0.012 range representing 4.24% volatility between the session high of $0.2456 and low of $0.2335.

- Primary upward momentum occurred during the 21:00-05:00 trading window as HBAR advanced from $0.235 to peak levels near $0.245.

- Volume activity averaged 54.7 million during key breakout periods, exceeding the 24-hour average of 50.1 million and indicating institutional participation.

- The $0.240 price level demonstrated strong institutional support with high-volume defensive trading throughout the session.

- Selling pressure intensified near $0.245 on elevated volume, suggesting coordinated profit-taking by institutional holders.

- Late-session volume surge of 17.08 million at 11:32 triggered systematic selling and price consolidation around support levels.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

52 minutes ago

New challenger Remittix raises $25.2M with aggressive referral program while technical forecasts project XLM’s potential surge toward $1.96.

What to know:

- Price action: XLM swung between $0.384 and $0.400 over 24 hours before closing at $0.393, with selling pressure emerging late in the session.

- Sector competition: Payments challenger Remittix raised $25.2M and launched a 15% USDT referral incentive, targeting XRP and XLM’s market dominance.

- Technical outlook: Elliott Wave analysis points to a possible 400% rally for XLM, while speculation grows over Ripple-Stellar collaboration on cryptographic infrastructure.