-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Hedera Hashgraph token faces regulatory uncertainty as trading volumes reach 55 million amid corporate investor reassessment.

By CD Analytics, Oliver Knight

Updated Sep 30, 2025, 4:39 p.m. Published Sep 30, 2025, 4:39 p.m.

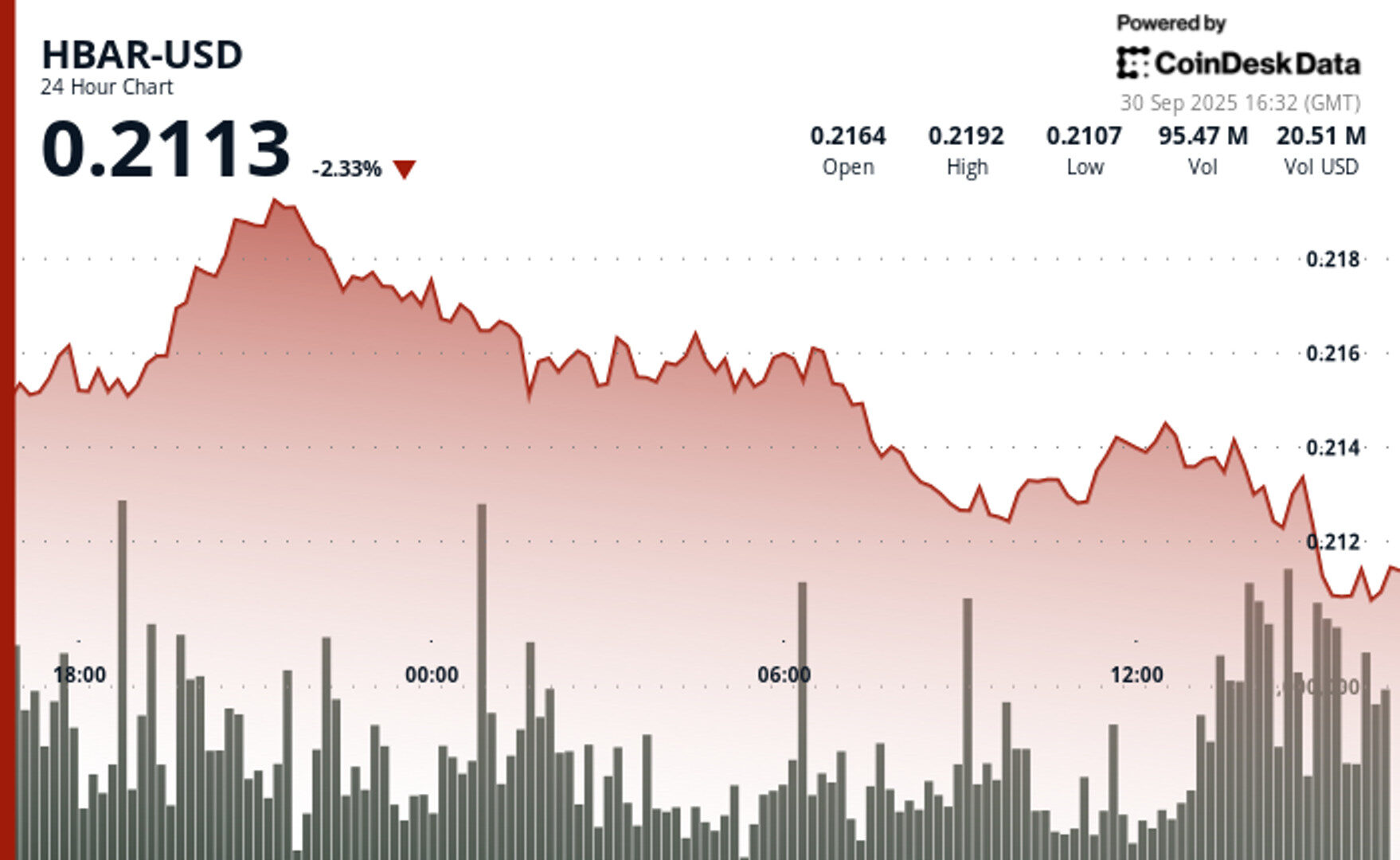

- HBAR fell from $0.22 to $0.21 in the 24 hours through Sept. 30 as corporate investors trimmed exposure.

- Trading volumes spiked in the final hour, signaling concentrated institutional repositioning.

- Analysts point to compliance guidance and regulatory headwinds as drivers of corporate portfolio adjustments.

Hedera Hashgraph’s HBAR token slipped nearly 3% in the 24 hours through September 30, falling from $0.22 to $0.21 as institutional investors pared back exposure to enterprise-focused cryptocurrencies. The decline came after HBAR met resistance at the $0.22 level during evening trading on September 29, with volumes climbing above 34 million tokens as corporate holders began to take profits.

Market participants said support around the $0.21 threshold initially held through the morning of September 30, but heavy selling in the afternoon pushed volumes sharply higher, peaking at nearly 55 million tokens in the final hour of trading. Analysts suggested that the move reflected growing caution among corporate treasuries in the wake of evolving regulatory frameworks for enterprise blockchain adoption.

STORY CONTINUES BELOW

By late afternoon on September 30, HBAR briefly recovered before slipping again to intraday lows around $0.21. Elevated trading activity during the final hour—topping 5.9 million tokens in a single interval—highlighted the intensity of institutional rebalancing. The token ended the session with modest stabilization near $0.21, but market watchers warned continued volatility may persist as corporate strategies adapt to shifting regulatory headwinds.

- Resistance established at $0.22 during September 29 evening trading with institutional profit-taking on above-average volume.

- Support zone identified around $0.21-$0.21 with multiple corporate buying opportunities throughout morning sessions.

- Volume surge to 54.88 million tokens in final hour indicating accelerated institutional risk management protocols.

- Extraordinary trading activity reaching 5.90 million tokens during 3:10 PM interval and 4.51 million at 3:11 PM.

- Break below established support zone suggesting potential continued corporate de-risking in enterprise blockchain sector.

- Price stabilization efforts near $0.21 level by session end with sustained institutional trading volumes.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Oliver Knight

51 minutes ago

The token fell from $0.38 to $0.36 over a 23-hour stretch, with heavy resistance at $0.38 and sustained downside momentum signaling bearish sentiment.

What to know:

- XLM dropped 4% in 23 hours, sliding from $0.38 to $0.36, with resistance repeatedly tested and rejected at $0.38.

- Heavy volumes at $0.36 suggest potential accumulation, but the pattern of lower highs and lows points to ongoing bearish pressure.

- Failed recovery attempts near $0.37 capped the session, confirming institutional selling and setting up the risk of further downside.