Kalshi Raises $1B Reports TechCrunch

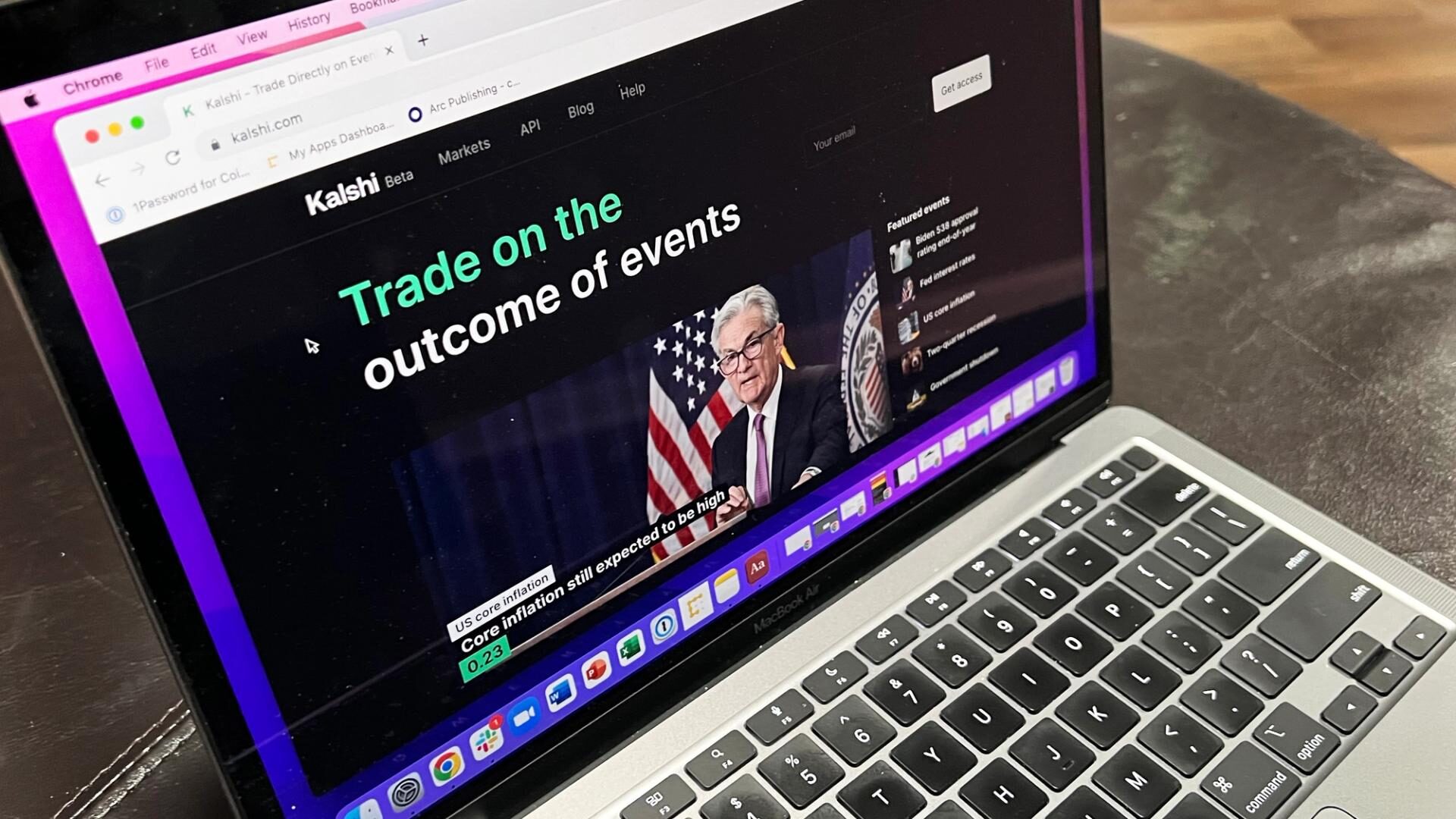

The CFTC-regulated exchange is gaining ground on crypto-native Polymarket, offering event contracts with fiat access and legal clarity.

By Helene Braun, AI Boost|Edited by Stephen Alpher

Nov 20, 2025, 9:10 p.m.

- Kalshi raised $1 billion in a new funding round at an $11 billion valuation, according to TechCrunch.

- The regulated platform is closing in on rival Polymarket’s reported $12 billion to $15 billion valuation target, highlighting growing investor interest in prediction markets.

- Kalshi and Polymarket compete with opposing models — Kalshi as a CFTC-regulated exchange, Polymarket as a decentralized, crypto-native alternative.

Kalshi, a regulated prediction market platform, has closed a $1 billion funding round that values the company at $11 billion, according to TechCrunch. The round was led by returning investors Sequoia Capital and CapitalG, with participation from Andreessen Horowitz, Paradigm, Anthos Capital, and Neo.

The new valuation brings Kalshi closer to the $12 billion to $15 billion valuation target reportedly sought by its crypto-native rival Polymarket. The milestone also comes just a month after Kalshi announced a $300 million round at a $5 billion valuation, underscoring investor appetite for the growing prediction market space.

STORY CONTINUES BELOW

Kalshi operates as a regulated exchange under the oversight of the Commodity Futures Trading Commission (CFTC), offering event contracts on topics ranging from inflation rates to political outcomes. It has positioned itself as a U.S.-compliant alternative to offshore or decentralized platforms, focusing on institutional and retail traders who want legal certainty and fiat onramps.

Polymarket, by contrast, is built on blockchain rails and operates as a decentralized information market. Users wager crypto on yes-or-no outcomes, often tied to political elections, market data or pop culture events.

The two firms have emerged as frontrunners in a sector that blends financial speculation with news-driven engagement. While Kalshi touts regulatory compliance and a path toward mainstream adoption, Polymarket’s decentralized design appeals to crypto-native users seeking transparency and censorship resistance.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Olivier Acuna|Edited by Stephen Alpher

3 hours ago

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

What to know:

- Ray Dalio said he has about a 1% allocation to bitcoin.

- Dalio believes bitcoin faces challenges as a global reserve asset due to its traceability and potential vulnerabilities from quantum computing.

- He warns that the U.S. economy is nearing a bubble similar to those before the 1929 crash and the 2000 dot-com collapse.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language