BTC

$105,906.40

+

5.12%

ETH

$2,466.59

+

11.18%

USDT

$1.0005

–

0.01%

XRP

$2.2021

+

11.57%

BNB

$642.86

+

3.62%

SOL

$145.34

+

9.77%

USDC

$0.9999

–

0.01%

TRX

$0.2736

+

2.23%

DOGE

$0.1653

+

9.82%

ADA

$0.5893

+

10.17%

HYPE

$38.19

+

10.58%

WBT

$47.94

+

0.67%

SUI

$2.8036

+

15.10%

LINK

$13.63

+

18.11%

BCH

$452.19

+

2.55%

LEO

$9.1134

+

0.92%

XLM

$0.2491

+

9.99%

AVAX

$18.28

+

11.75%

TON

$2.9186

+

6.28%

SHIB

$0.0₄1176

+

9.41%

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Jun 24, 2025, 4:18 p.m.

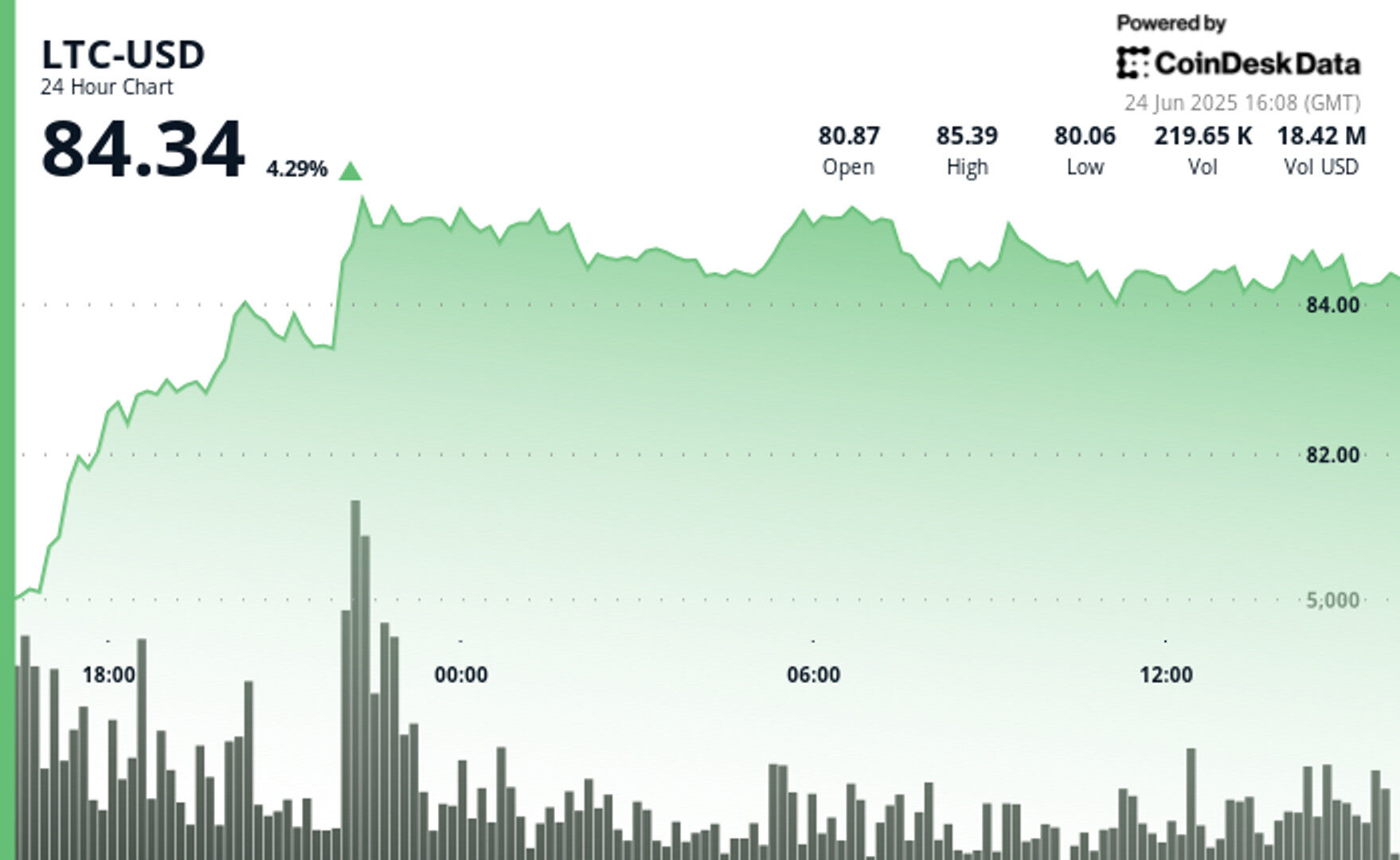

- Litecoin’s price jumped 4% to $85.45, holding near $84 on above-average volume, indicating conviction behind the breakout.

- The next catalyst for litecoin’s price could be regulatory, with the U.S. SEC reviewing bids for a spot LTC ETF.

- Technically, Litecoin’s price is bouncing between $84.00-$84.20 support and $85.30-$85.45 resistance.

Litecoin shook off last week’s slump, rising 4% to an intraday high of $85.45 and then holding ground near $84. The move came on volume above its 20-day average, signaling conviction behind the breakout.

An easing in global stress helped, with a supposed ceasefire between Israel and Iran.

STORY CONTINUES BELOW

The next catalyst may be regulatory. The U.S. Securities and Exchange Commission is reviewing two bids for a spot Litecoin ETF.

A green light to such a fund this year, to which Polymarket traders assign an 83% chance, would open LTC exposure to investors betting on crypto through traditional brokerages. Bloomberg analysts see a 95% chance of a spot LTC ETF approval.

- Litecoin’s price burst through the $83.40 ceiling backed by 331,459 LTC being traded in a single hour, according to CoinDesk Research’s technical analysis data model.

- LTC has since been bouncing between $84.00-$84.20 support and $85.30-$85.45 resistance.

- A descending intraday channel printed lower highs until buyers defended $84.20.

- Holding above $84 keeps $90 in play while a close below $84 risks a slide to $79.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.