BTC

$105,351.48

–

0.53%

ETH

$2,661.57

+

2.01%

USDT

$1.0000

–

0.04%

XRP

$2.2537

–

0.39%

BNB

$669.32

+

0.46%

SOL

$157.30

–

2.25%

USDC

$0.9995

–

0.02%

DOGE

$0.1927

–

1.60%

TRX

$0.2731

+

0.72%

ADA

$0.6866

–

0.20%

HYPE

$36.86

–

0.37%

SUI

$3.2189

–

2.27%

LINK

$14.15

–

0.80%

AVAX

$21.05

–

1.25%

XLM

$0.2710

–

1.38%

LEO

$8.9012

+

1.19%

BCH

$406.29

–

0.14%

TON

$3.1763

–

1.06%

SHIB

$0.0₄1304

–

1.26%

HBAR

$0.1705

–

2.18%

By CD Analytics, Francisco Rodrigues

Jun 4, 2025, 4:01 p.m.

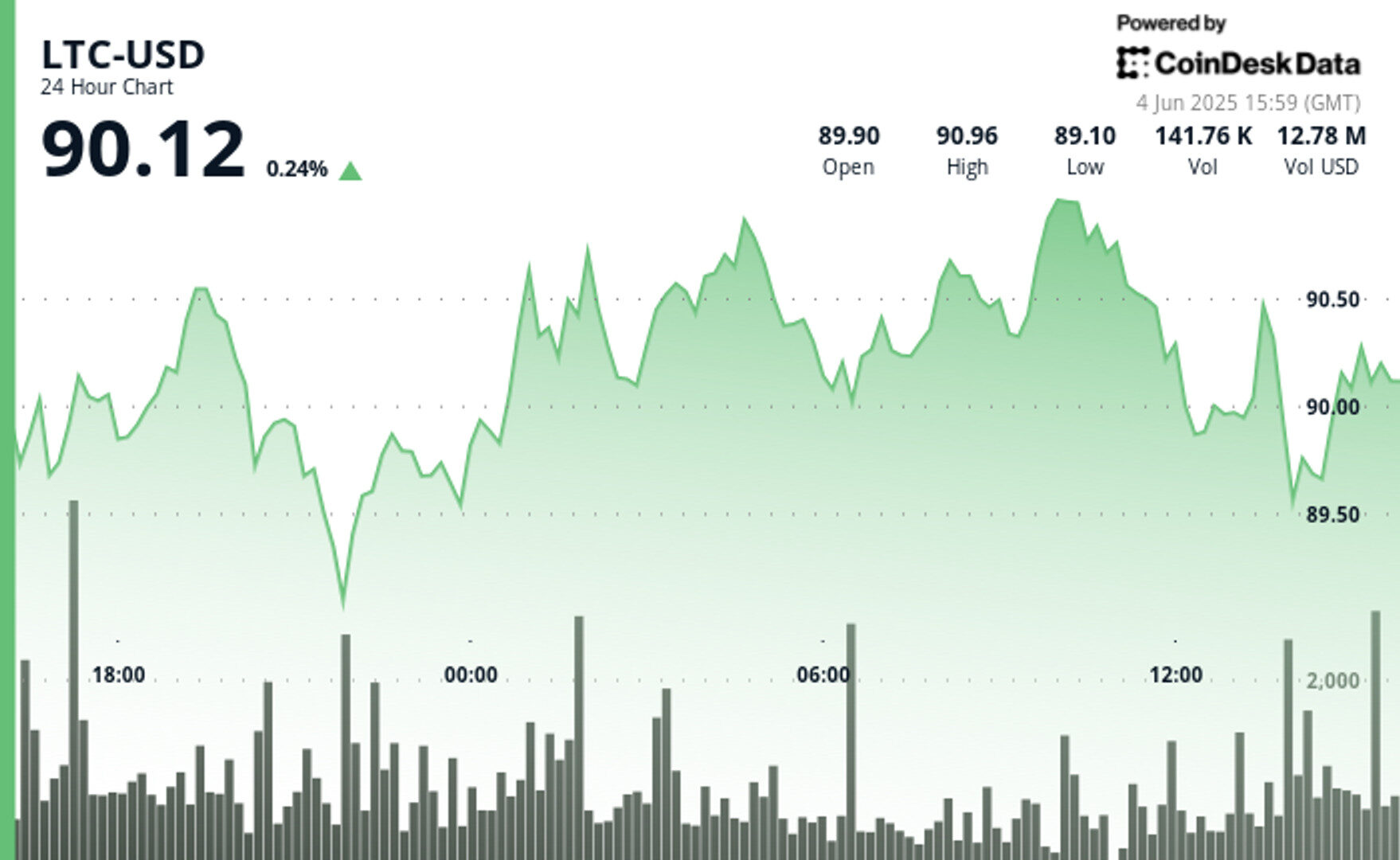

- Litecoin is holding onto key technical support around $89, despite forming a bearish head-and-shoulders pattern.

- Litecoin’s short-term outlook is being shaped by positive fundamental developments, including the launch of LitVM, a zero-knowledge Layer-2 network.

Litecoin

is clinging to key technical support around $89 as a mix of fundamental and macro developments shape its short-term outlook, according to CoinDesk Research’s technical analysis data model.

The cryptocurrency traded in a tight range over the last 24 hours, testing lows near $88.92 before recovering. Despite forming a bearish head-and-shoulders pattern, volume support at $89 suggests buyers are stepping in.

STORY CONTINUES BELOW

This stability comes amid broader market uncertainty. The CD20 index of major cryptocurrencies fell around 1% over the same period, reflecting reduced risk appetite as geopolitical tensions and a weakening U.S. dollar shift capital toward hard assets like gold.

Still, Litecoin is seeing new tech upgrades and rising interest.

Lunar Digital Assets recently launched LitVM, a zero-knowledge Layer-2 network for Litecoin. Built on BitcoinOS and Polygon’s CDK, the system introduces EVM-compatible smart contracts and allows cross-chain swaps with Bitcoin

and Cardano

.

These features aim to boost Litecoin’s role in decentralized finance while addressing long-standing security risks around blockchain bridges.

Litecoin also continues to see growing retail access. IG Group added LTC among various other tokens as it launched crypto trading in the UK. It’s impact, given the cryptocurrency’s scale, is likely to be limited if any.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.