BTC

$106,316.68

–

1.27%

ETH

$2,430.98

–

1.84%

USDT

$1.0006

+

0.02%

XRP

$2.1971

–

0.22%

BNB

$646.80

–

1.80%

SOL

$147.95

–

5.88%

USDC

$1.0002

+

0.00%

TRX

$0.2793

+

0.26%

DOGE

$0.1598

–

3.37%

ADA

$0.5486

–

3.92%

HYPE

$39.46

–

2.85%

BCH

$520.46

+

0.52%

WBT

$44.46

–

0.03%

SUI

$2.7039

–

4.09%

LINK

$13.06

–

2.31%

LEO

$8.9004

–

2.26%

AVAX

$17.33

–

3.88%

XLM

$0.2312

–

1.91%

TON

$2.7964

–

5.58%

SHIB

$0.0₄1123

–

2.43%

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Jul 1, 2025, 3:10 p.m.

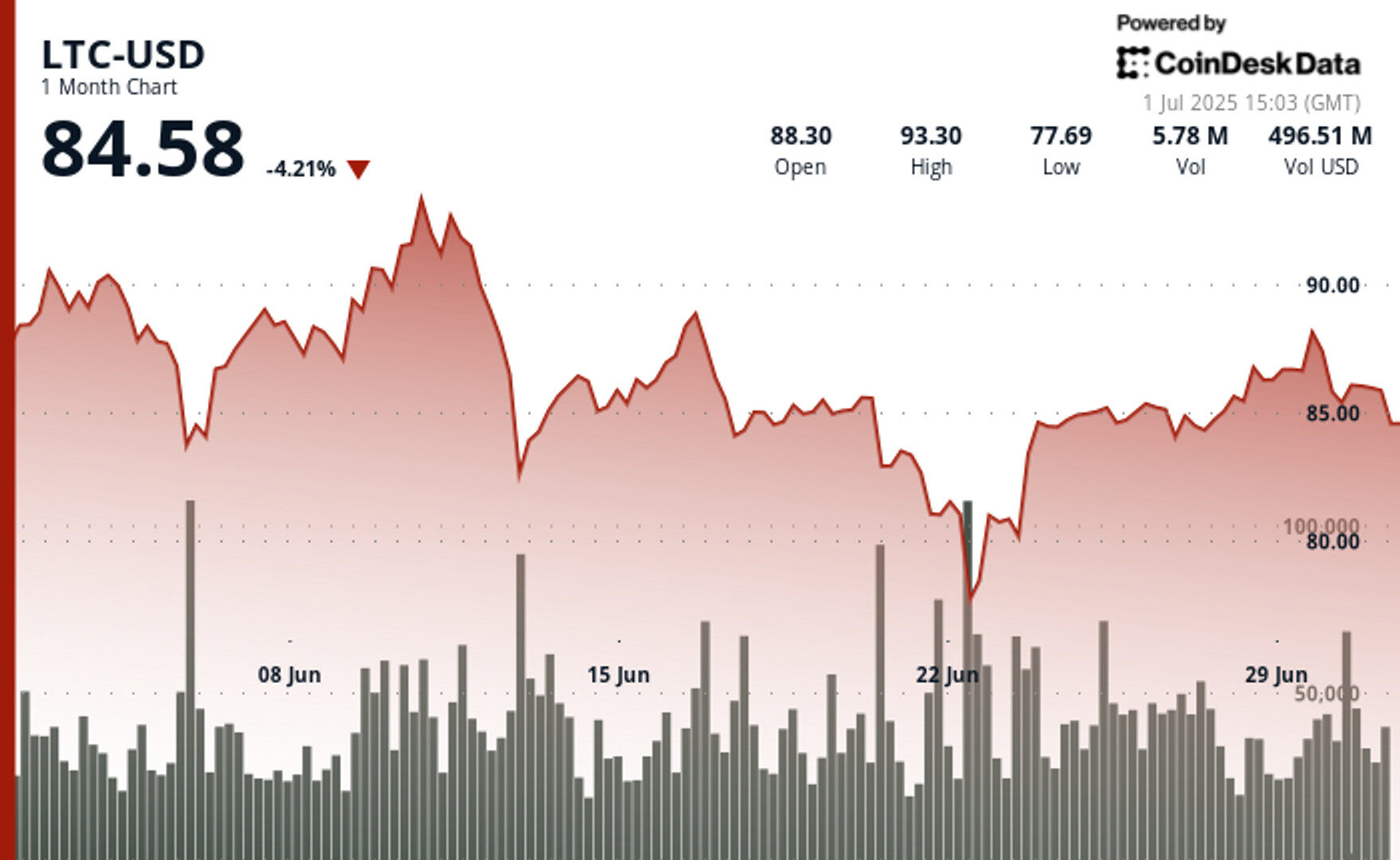

- Litecoin (LTC) has traded sideways over the last 24 hours, oscillating between $85 and $87, as buyers and sellers battle for control.

- Technical analysis suggests a potential “golden cross” pattern, which could precede a multi-week rally.

- Prospects for LTC are looking bright, with Bloomberg analysts estimating a 95% chance of spot exchange-traded funds for LTC being approved by year-end.

Litecoin

has traded sideways over the last 24-hours, after coming down from a two-week high above the $88 mark. The token has been bouncing between $85 and $87 in today’s trading session, underlining a tug-of-war between dip-buyers and sellers who treat $87 as a ceiling.

Charts hint at a looming “golden cross,” the moment a 50-day moving average climbs above the 200-day line, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The pattern often precedes multi-week rallies, yet momentum remains weak until bulls punch through $87. The wider crypto market, as measured by the CoinDesk 20 (CD20) index, dropped just 0.25% over the last 24 hours.

Future prospects tell a bright story. Bloomberg analysts on Monday raised the chance that the Securities and Exchange Commission will green-light spot exchange-traded funds for XRP, solana and litecoin to 95% by year-end.On Polymarket, the odds stand at 86%.

Approval would give mainstream investors a simple way to own LTC through brokerage accounts, potentially broadening demand.

Over the past 24 hours, Litecoin’s price swung through a $2.09 range, equal to a 2.46% move, as traders tested both support and resistance levels. Sellers stepped in forcefully around $86.65 to $87.10, a zone confirmed by a surge of high-volume selling.

Yet buyers have repeatedly defended the area between $85.02 and $85.23, which acted as a floor during midday trading on July 1.

While the broader 24-hour chart sketches a bearish tone, marked by lower highs that trace a descending trendline, shorter time frames hint at brewing optimism.

Litecoin earlier began to recover, climbing modestly from $85.22 to $85.59, a 0.43% increase. The rally gained traction during a brief window, when buying volume spiked past 5,500 tokens per minute, helping LTC break above a minor resistance at $85.50.

Another pocket of support surfaced between $85.03 and $85.18 during the same hour.

Combined with a short-term ascending channel showing higher lows, the pattern suggests that despite bigger-picture caution, LTC could be staging an attempt at upward momentum.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.