Dogecoin rebounding sharply from a heavy-volume flush while Shiba Inu broke key support before staging an aggressive intraday reversal.

By Shaurya Malwa, CD Analytics

Updated Nov 16, 2025, 8:30 a.m. Published Nov 16, 2025, 8:29 a.m.

- Dogecoin rebounded 3.0% after a sharp decline, driven by institutional buying and strong volume support.

- Shiba Inu fell 2.0%, breaking key support before a V-shaped recovery signaled potential stabilization.

- Broader crypto markets face pressure from AI-bubble concerns and Bitcoin ETF outflows, impacting meme-coin volatility.

Both major meme-assets traded through high-velocity volatility windows, with Dogecoin rebounding sharply from a heavy-volume flush while Shiba Inu broke key support before staging an aggressive intraday reversal.

Broader crypto markets continued their risk-off rotation as sentiment remained pressured by AI-bubble concerns, $800M in Bitcoin ETF outflows, and tightening liquidity across speculative assets. The weak macro backdrop left meme-coins particularly exposed to volatility shocks.

STORY CONTINUES BELOW

Despite this, large-holder behavior diverged across DOGE and SHIB. Dogecoin saw an uptick in institutional accumulation following two weeks of heavy whale positioning, while SHIB faced elevated retail-driven selling before buyers stepped in aggressively at intraday lows.

No major token-specific catalysts drove the session’s moves, though traders monitored continued ETF-related discussions and whale positioning trends as key sentiment drivers.

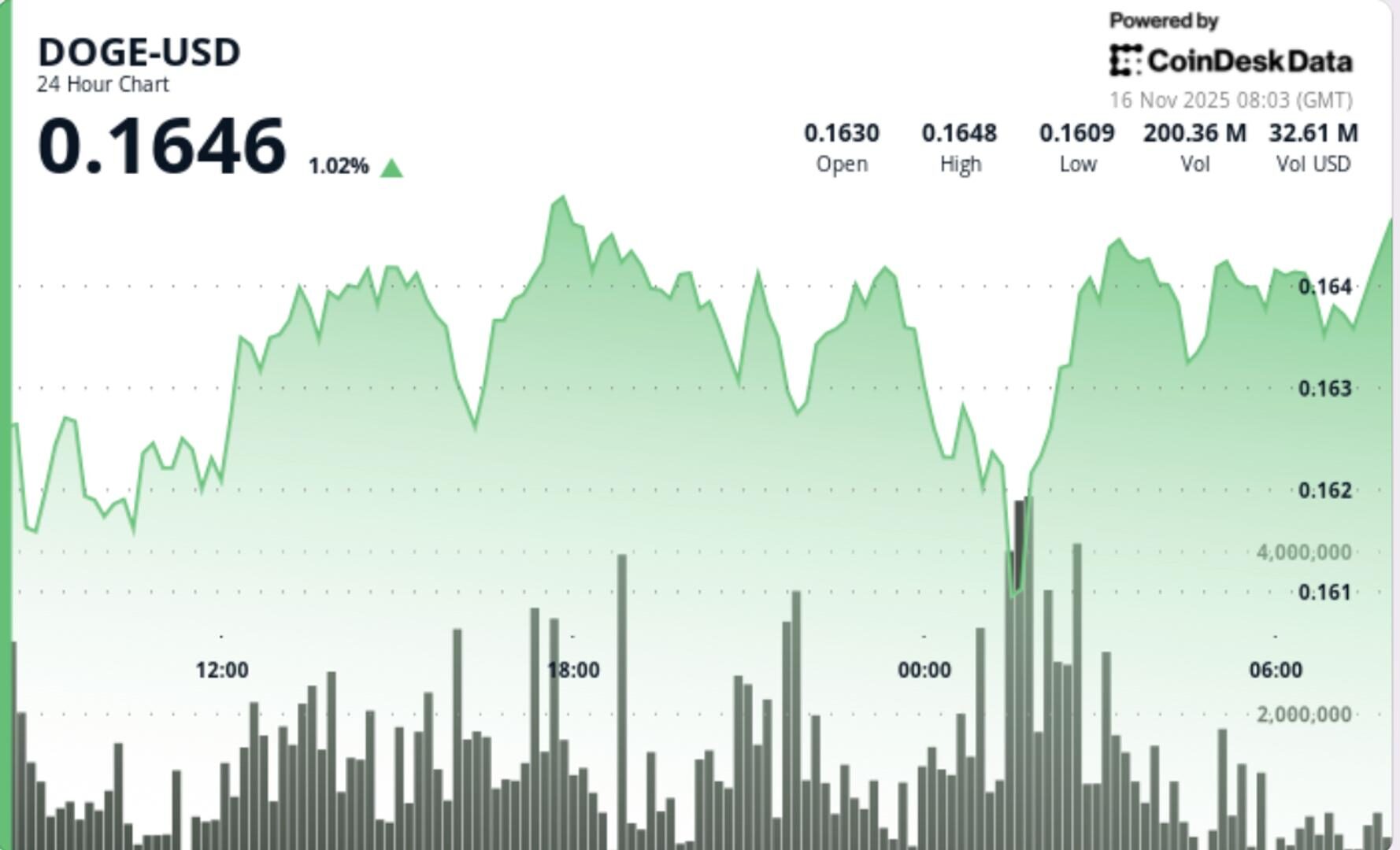

DOGE climbed 3.0% to close at $0.1641, rebounding from a sharp early-session decline that flushed price to $0.1551.

• Volume spiked to 613M during the support test — 186% above the 214M average

• Breakout above $0.1640 established an ascending intraday trendline

• Late-session trading held DOGE in a $0.1638–$0.1643 consolidation band

The rebound produced a clear higher-lows pattern, confirming momentum rotation despite broader market weakness.

SHIB fell 2.0% from $0.000009233 to $0.000009045, breaking daily support at $0.000009240.

• Heavy selling at 08:00 GMT surged to 412.35B tokens — 67% above average

• Price dropped to $0.000008975 before reversing violently

• A V-shaped spike back to $0.000009082 printed on 32.34B hourly volume

The intraday recovery reclaimed short-term resistance at $0.000009060, signaling stability despite the broader downtrend.

Support/Resistance:

• Major support validated at $0.1551

• New support: $0.1638–$0.1640

• Resistance: $0.1650, then $0.1680

Volume:

• 613M peak confirms institutional buying

• Recovery maintained above baseline, signaling sustained demand

Chart Structure:

• Ascending trendline intact

• Higher-lows pattern reinforces bullish momentum

Support/Resistance:

• Strong support: $0.000009020 (triple defense)

• Resistance: $0.000009240, then $0.000009307

Volume:

• Breakdown: 412.35B (+67%)

• Recovery: consistent elevated flows across 02:10–02:12

Chart Structure:

• Daily downtrend intact (lower highs)

• Hourly V-reversal suggests near-term stabilization

- DOGE and SHIB present opposite near-term technical dynamics despite similar macro pressures.

- Dogecoin’s near-term outlook leans bullish, with continuation favored if price clears the $0.1650 barrier, while a failure to hold $0.1620 risks a return to the $0.1600–$0.1580 support cluster.

- Whale accumulation and strong volume defense along the $0.155–$0.161 zone continue to underpin the upside case. Shiba Inu, meanwhile, requires a decisive close back above $0.000009240 to confirm stabilization; a breakdown below $0.000008975 would expose a deeper slide toward the mid-$0.00000870 region.

- The hourly V-shaped reversal is constructive, but the broader daily structure remains fragile until key resistance levels are reclaimed.

- Overall, DOGE shows intraday bullish rotation, while SHIB sits at a tactical inflection, requiring confirmation before trend reversal can be assumed.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Shaurya Malwa, CD Analytics

54 minutes ago

The market remains bearish with XRP struggling to break above the $2.23–$2.24 resistance zone.

What to know:

- XRP experienced a significant selloff, dropping from $2.31 to $2.22, despite the launch of a new U.S. spot XRP ETF.

- The market remains bearish with XRP struggling to break above the $2.23–$2.24 resistance zone.

- Institutional interest is evident from ETF inflows, but broader market pressures continue to suppress crypto momentum.