Two preferred stocks with different payout priorities and risk profiles are creating a significant yield gap.

By James Van Straten|Edited by Sheldon Reback

Oct 20, 2025, 9:38 a.m.

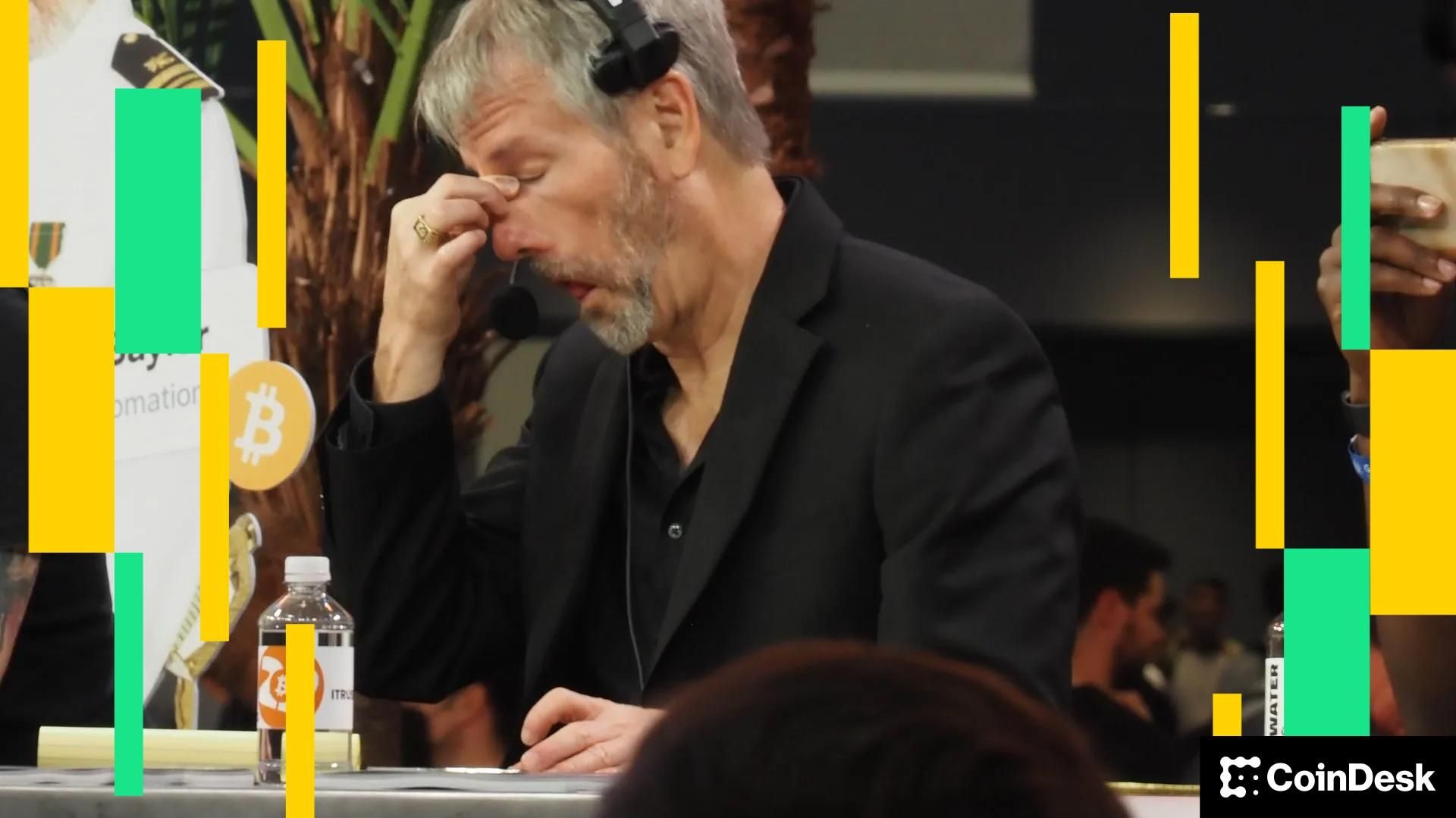

- Michael Saylor, executive chairman of bitcoin investment company Strategy, highlighted the widening credit spread between the company’s STRF and STRD preferred stock offerings.

- STRF offers lower risk and a 9.1% yield due to its senior status, while STRD provides a higher 12.7% yield as a junior security.

- MSTR remains committed to paying STRD dividends to support its price and investor confidence as the company uses the instruments to raise capital for further bitcoin purchases.

Strategy Executive Chairman Michael Saylor said in a recent podcast that his preferred perpetual stock, STRD, is being overlooked by investors because it trades as a junior security, unlike STRF, which is a senior instrument.

STRD’s junior status has caused it to receive less attention despite its higher potential returns, Saylor said.

STORY CONTINUES BELOW

In a capital stack, senior securities are paid out first and typically carry lower risk and lower yields. Junior securities are paid out after senior ones and carry higher risk, offering higher potential returns in compensation.

As a senior security, STRF is protected by penalty provisions and prioritized for payouts, making it attractive to risk-averse investors seeking yield but prioritizing payout security. It is currently trading above par at $109 and delivering an effective yield of 9.1%, generating a lifetime return of 29%.

STRD is the junior version, offering a higher dividend and yield to compensate for its lower payout priority and greater risk. STRD is non-cumulative and junior in the capital stack, with penalty provisions for the company if the dividend is not paid. It is trading below par at $78, with a lifetime return of -7% but a higher effective yield of 12.7%, similar to a junk bond.

The two instruments are structurally similar, with the key difference being the risk-return profile: STRF provides a safer yield, while STRD offers a higher yield for taking on more risk.

Saylor questioned why investors favored STRF over STRD when they could capture a yield that is over 350 basis points higher. He highlighted the emergence of a credit spread between the two instruments, driven by their senior and junior classifications.

Although MSTR is not obligated to pay dividends on the junior stock, Saylor dismissed concerns about potential non-payment. MSTR will maintain those payments, he said, because failing to do so would significantly harm STRD’s price. Furthermore, the company’s goal is to sell these securities to raise capital for additional bitcoin purchases, making a default on STRD not a viable option.

Additionally, Saylor announced on Sunday via X that MSTR has purchased more bitcoin, even as the company’s stock continued to struggle, down 4% year-to-date at $289.87, compared with bitcoin’s 10% gain over the same period. Strategy currently holds 640,250 BTC.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Francisco Rodrigues|Edited by Sheldon Reback

48 minutes ago

The exchange-traded product is already been listed on several European exchanges.

What to know:

- BlackRock’s bitcoin exchange-traded product (ETP) started trading on the London Stock Exchange under the ticker IB1T.

- The ETP is already been listed on several European exchanges, and comes to the UK after Financial Conduct Authority lifted its ban on certain bitcoin-based exchange-traded products.

- BlackRock has seen success in its crypto offerings, including its flagship bitcoin ETF, the iShares Bitcoin Trust (IBIT), which has $85.5 billion in net assets.