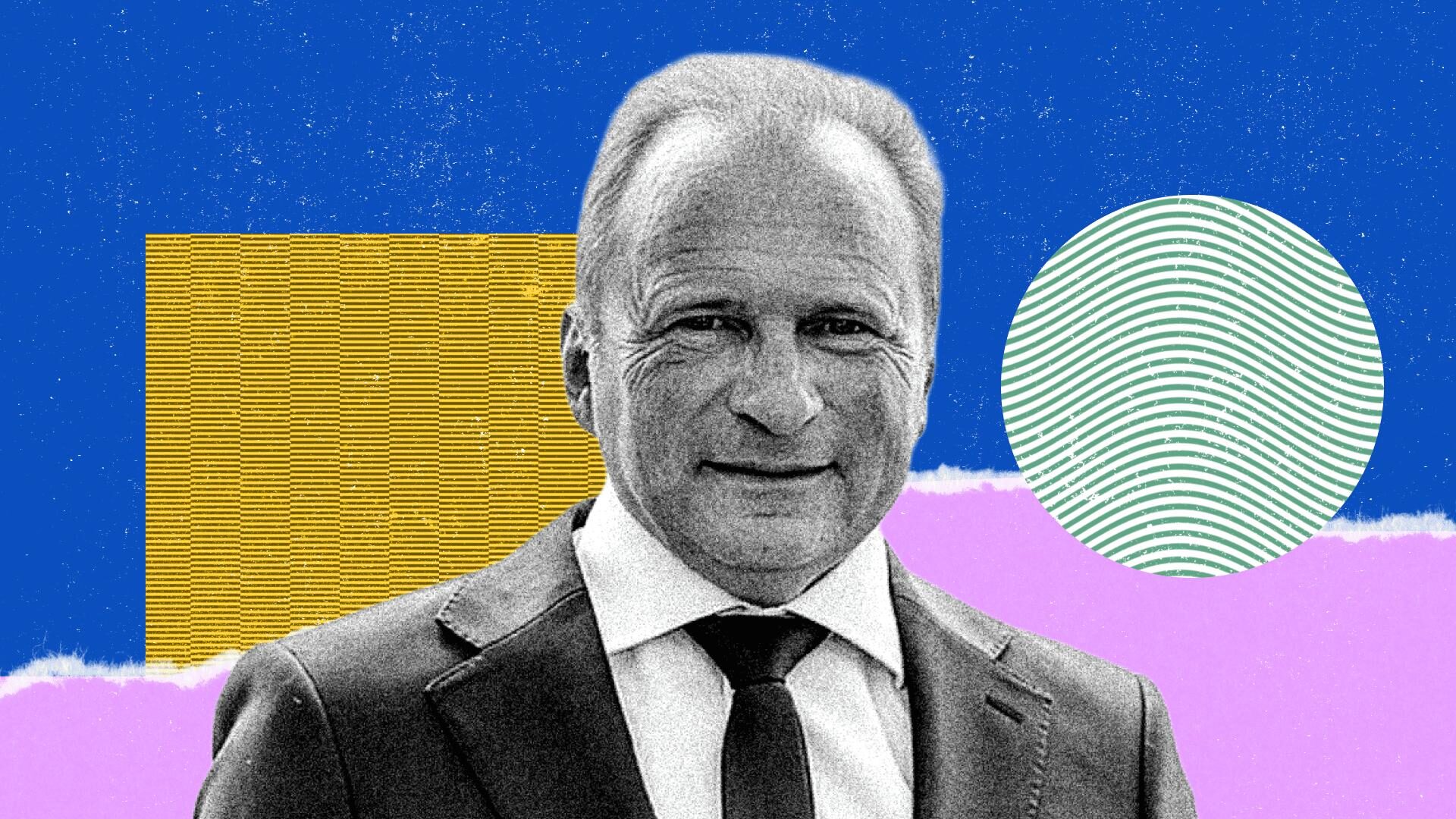

Most Influential: Gilles Roth

Led by Finance Minister Gilles Roth, Luxembourg in the second half of 2025 became the first of the 20-member eurozone to invest in bitcoin.

By Stephen Alpher|Edited by Cheyenne Ligon

Updated Dec 18, 2025, 3:12 p.m. Published Dec 18, 2025, 3:00 p.m.

Led by Finance Minister Gilles Roth, Luxembourg in the second half of 2025 became the first of the 20-member eurozone to invest in bitcoin.

This feature is a part of CoinDesk’s Most Influential 2025 list.

STORY CONTINUES BELOW

Speaking before parliament in October, Roth said he had directed the allocation of 1% of the country’s €745 million ($865 million) sovereign wealth fund into bitcoin.

“By becoming the first eurozone government to invest part of its reserves in bitcoin, Luxembourg once again demonstrates its commitment to support emerging and future-oriented investment trends,” said Luxembourg for Finance, a public/private partnership chaired by Roth.

Speaking about one month later at the Bitcoin Amsterdam Conference, Roth said his country has no intention of expanding its crypto investment beyond bitcoin.

“As [Strategy Chairman] Michel Saylor once said, there is no second best,” Roth told attendees. “We are in it for the long haul.”

“Let me be clear,” he added. “Luxembourg HODLs. We are still very early. I am sure others will soon follow our lead.”

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Jamie Crawley, AI Boost|Edited by Sheldon Reback

38 minutes ago

The move links PayPal’s dollar-pegged token to onchain funding for GPUs and data centers, supported by a $1 billion customer incentive program.

What to know:

- PYUSD will be used to support USD.AI’s onchain financing for AI infrastructure, including GPUs and data centers.

- A one-year incentive program will offer 4.5% yield on up to $1 billion in customer deposits.

- The development highlights growing demand for programmable dollar settlement as AI infrastructure spending accelerates.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language