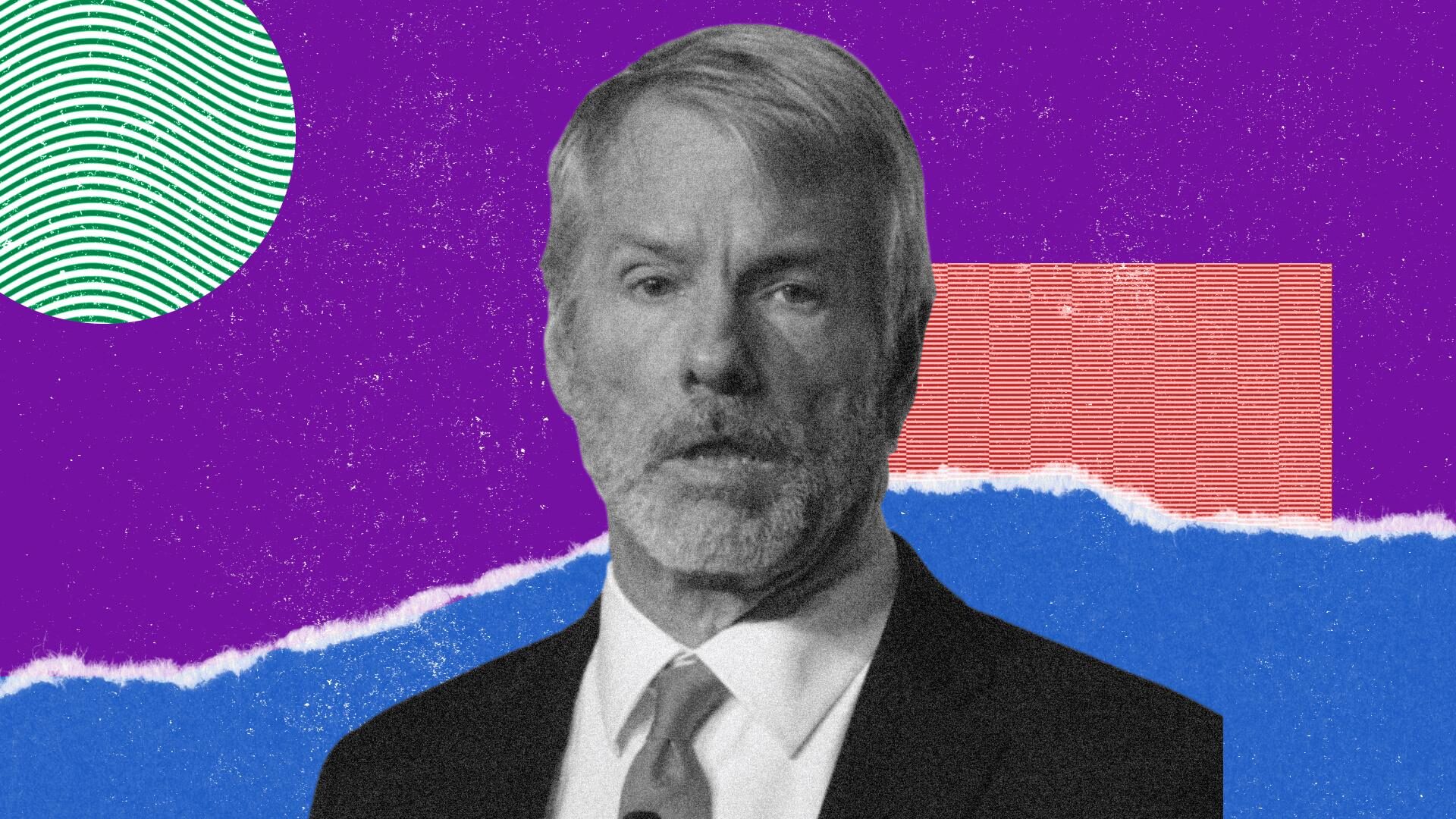

Most Influential: Michael Saylor

Despite facing a year of tough conditions for bitcoin treasury companies, Michael Saylor’s Strategy developed new ways to make money — and acquire more bitcoin for its vast holdings — in 2025.

By James Van Straten|Edited by Cheyenne Ligon

Updated Dec 12, 2025, 3:11 p.m. Published Dec 12, 2025, 3:00 p.m.

Last year, Michael Saylor, executive chairman of Strategy (MSTR), stood among the most influential figures in the bitcoin ecosystem. His company’s stock surged fivefold, even as U.S. bitcoin ETFs entered the market.

This feature is a part of CoinDesk’s Most Influential 2025 list.

STORY CONTINUES BELOW

The story in 2025, however, has been markedly different. MSTR has struggled to replicate the prior year’s extraordinary gains, with shares now negative year-to-date. This underperformance reflects a mix of internal and external pressures, including bitcoin’s volatility compression and the introduction of options on U.S. spot ETFs, which have given investors alternative exposure routes. These factors have led to a significant contraction in MSTR’s multiple to net asset value (mNAV).

In response, Strategy launched four perpetual preferred products in 2025—STRK, STRF, STRD, and STRC—raising $4.6 billion in gross proceeds from IPOs. Three of these have already delivered strong double-digit returns, providing a non-dilutive mechanism for MSTR to expand its bitcoin holdings. The company has also extended its preferred share program internationally in Europe, with a Euro-denominated preferred stock, Stream.

Di più per voi

14 nov 2025

Cosa sapere:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

Di più per voi

Di Krisztian Sandor|Editor Jamie Crawley

27 minuti fa

Phantom users will be able to chat and trade Kalshi’s prediction markets with any Solana-based tokens, CEO said.

Cosa sapere:

- Crypto wallet Phantom is embedding Kalshi to offer prediction markets to its 20 million users.

- Users can trade on real-world outcomes using any Solana-based tokens directly without leaving the wallet.

- The integration of prediction markets is part of a trend among crypto wallets to expand their features and services, such as MetaMask’s partnership with Polymarket.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language