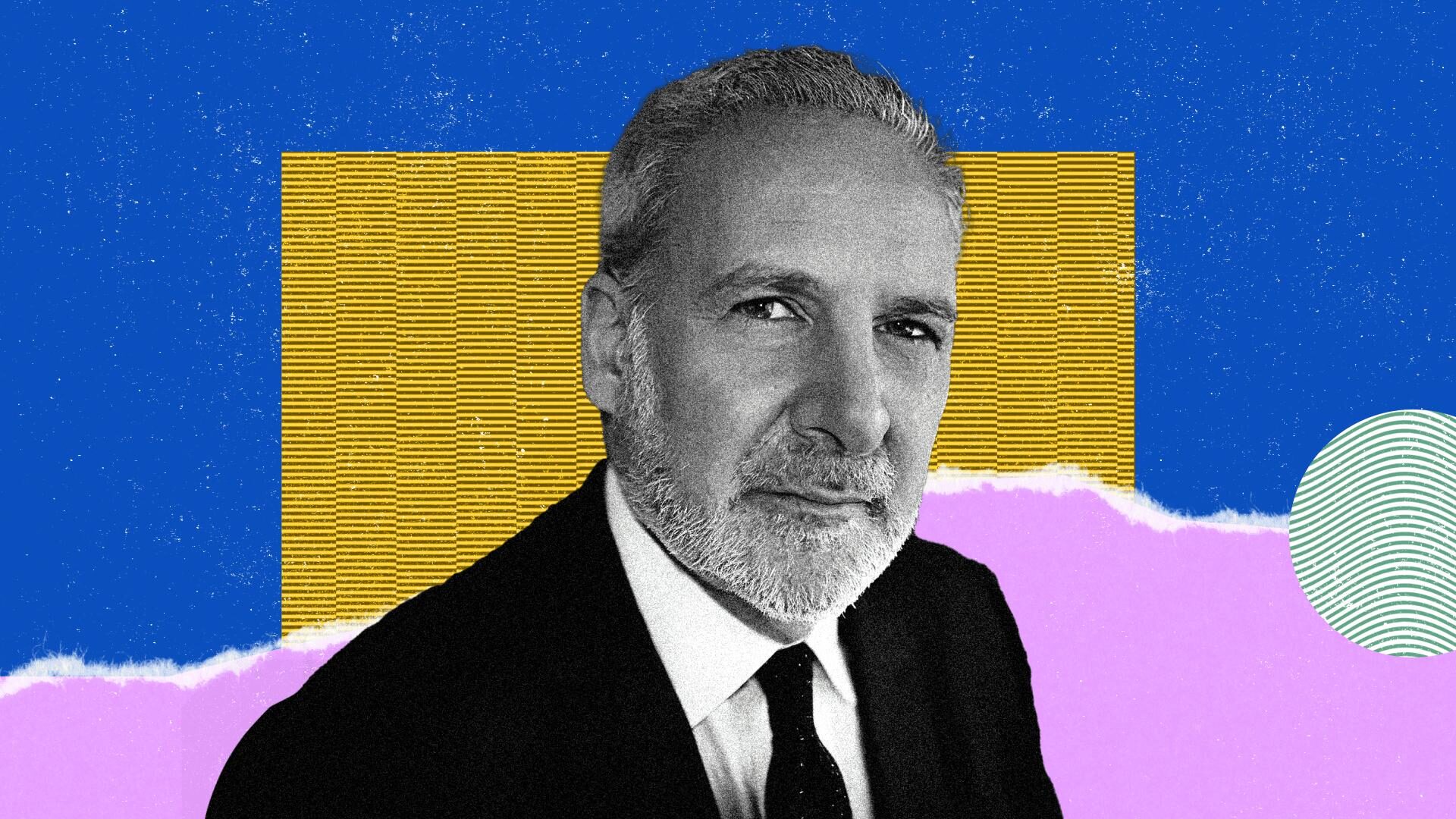

Most Influential: Peter Schiff

Peter Schiff, the outspoken gold advocate and notorious bitcoin critic, has been vindicated by the market’s performance, cementing his stance after years of skepticism towards digital assets.

By James Van Straten|Edited by Cheyenne Ligon

Updated Dec 16, 2025, 3:03 p.m. Published Dec 16, 2025, 3:00 p.m.

In 2025, gold has emerged as the standout asset, delivering returns of more than 50%, marking one of its strongest performances in over a decade. The precious metal became the clear winner of what mainstream commentators dubbed the “debasement trade,” a viral term that captured growing investor anxiety over global debt levels, excessive borrowing, and the weakening U.S. dollar, which suffered its worst year in many. By October, gold’s rally reached record highs, coinciding with a blow-off top at almost $4,400 an ounce, now stabilizing around the $4,000-per-ounce level.

This feature is a part of CoinDesk’s Most Influential 2025 list.

STORY CONTINUES BELOW

This environment validated long-standing warnings about monetary debasement, a concern often voiced by the bitcoin community. Yet ironically, it was gold, not bitcoin, that captured investors’ attention and capital this year. Gold has so far delivered an 8 times better return than bitcoin in 2025. Peter Schiff, the outspoken gold advocate and notorious bitcoin critic, has been vindicated by the market’s performance, cementing his stance after years of skepticism towards digital assets.

While Schiff continues to champion gold’s role as the ultimate store of value, the broader market narrative has evolved between traditional safe havens and digital alternatives.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Krisztian Sandor|Edited by Cheyenne Ligon

1 hour ago

Young sparked a new category of digital assets, yieldcoins, that sits at the intersection of DeFi rails and TradFi basis trades.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language