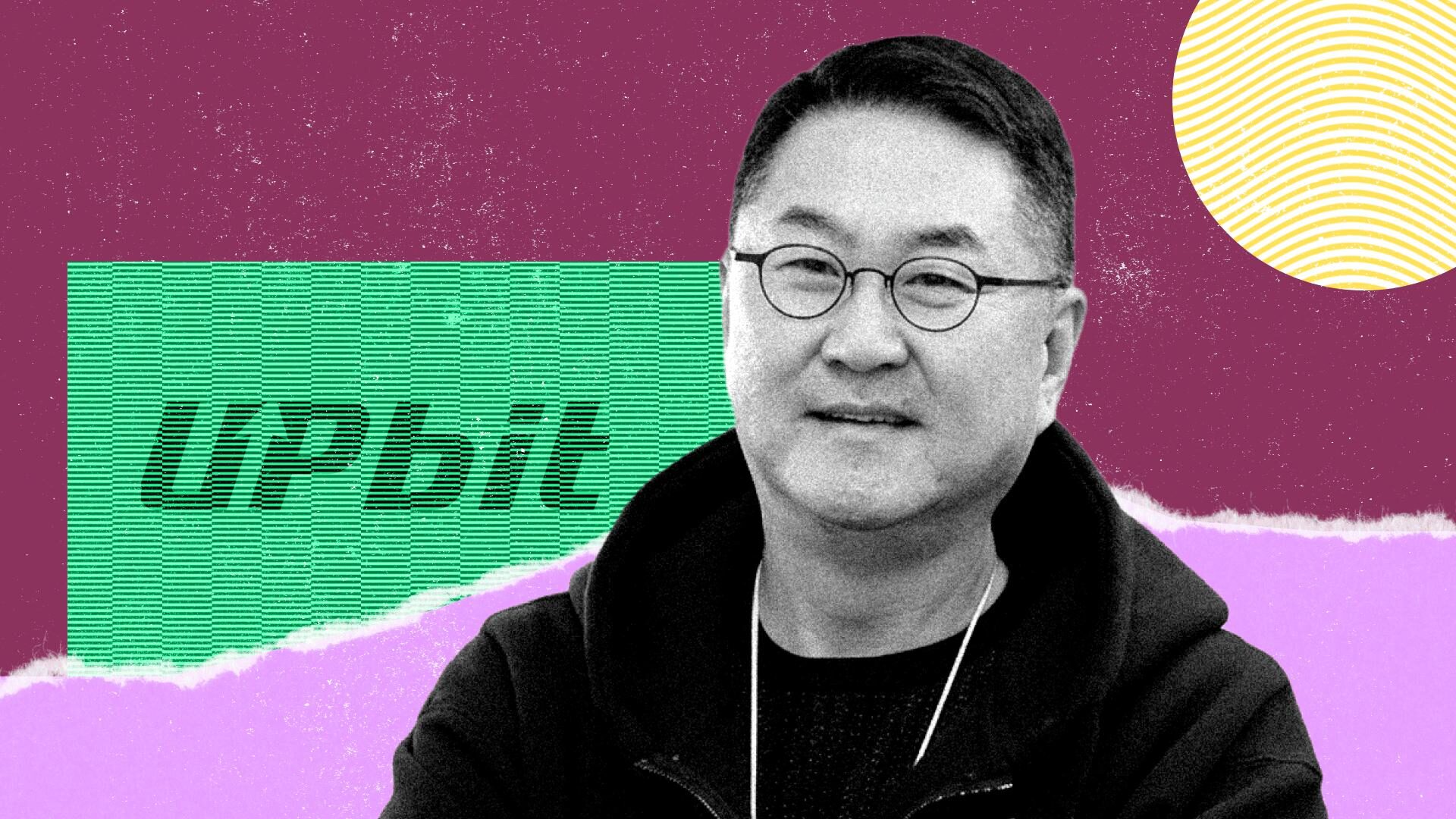

Most Influential: Sirgoo Lee

Lee shaped the exchange that defines Korea’s crypto market, but even after his exit this year, the country’s hyperactive retail engine will keep moving.

By Sam Reynolds|Edited by Cheyenne Ligon

Updated Dec 11, 2025, 3:10 p.m. Published Dec 11, 2025, 3:00 p.m.

South Korea’s crypto market became one of the busiest trading arenas in the world in 2025, with enthusiastic retail investors powering global surges in XRP, Dogecoin, and many of the memecoins that dominated this cycle.

This feature is a part of CoinDesk’s Most Influential 2025 list.

STORY CONTINUES BELOW

At the center of that liquidity stood Upbit, the exchange that routinely captured more than 80% of the country’s onshore volume and at times moved worldwide prices when a coin listed or spiked. That market was shaped by one executive more than any other: Sirgoo Lee.

When he announced in 2025 that he would step down as CEO, it raised an unusual question for the crypto industry, in South Korea and beyond. Could the world’s most hyperactive retail crypto market operate the same way without the leader who defined its structure and risk culture, or would his exit shift liquidity balances in a country that had become crucial to global price formation?

Part of Lee’s impact came from a management style that stood out in a notoriously hierarchical corporate environment. Inside Dunamu, the parent company of Upbit, he was known for a horizontal approach that encouraged open communication and pushed responsibility downward — a management style common in Western startups but unusual in conservative, strict Korea.

At Upbit, that approach shaped how the company handled user risk. Under his leadership, the exchange built systems that recovered more than 94% of misdirected deposits, established an Investor Protection Center that offers education and legal support, and expanded its compliance and security programs through industry certifications.

In a market where risk-embracing ‘degenerate’ trading is a point of personal pride, these measures helped Upbit distinguish itself as the venue South Korean investors considered safest.

Upbit’s dominance did not fade as Lee prepared to exit. Its listings still drive significant volume to flavor-of-the-day memecoins, and traffic continues to grow.

Korea’s retail traders will not slow down, and, thanks to Lee, Upbit remains the venue that amplifies their instincts.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Krisztian Sandor|Edited by Jamie Crawley

28 minutes ago

The USDGO token will be issued under U.S. federal oversight and backed 1:1 by U.S. dollar assets.

What to know:

- Hong Kong-based digital assets platform OSL Group is launching a U.S. dollar stablecoin, issued by Anchorage Digital, a federally chartered crypto bank.

- USDGO is aimed for cross-border payments and on-chain settlements, backed one-to-one by U.S. dollar assets.

- The stablecoin market is projected to grow significantly, with regulatory clarity under the Genius Act boosting adoption in the U.S.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language