-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Aug 14, 2025, 4:03 p.m. Published Aug 14, 2025, 4:03 p.m.

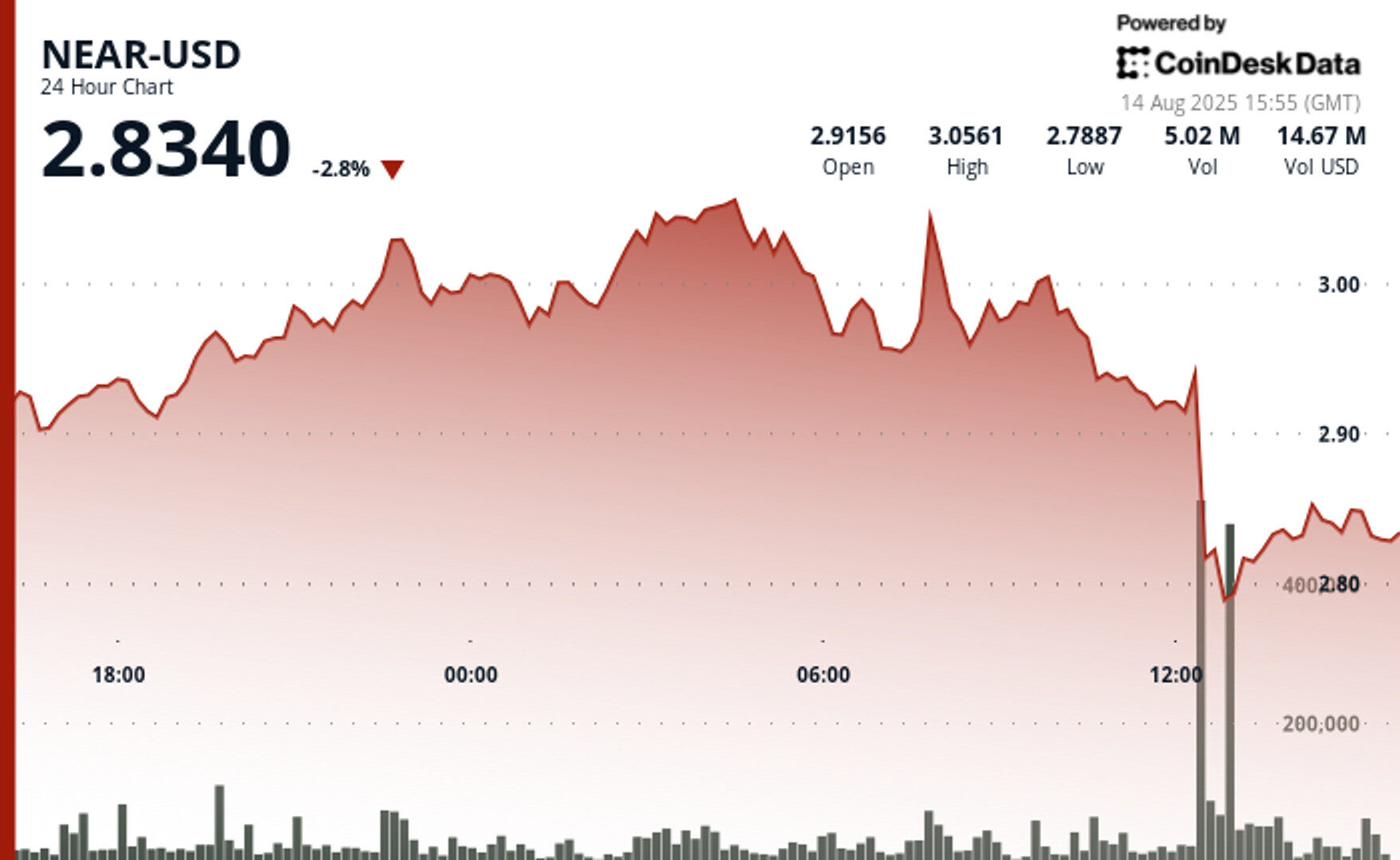

- NEAR traded between $2.78 and $3.05 in the 24 hours ending Aug. 14, with peak institutional sell volumes of 19.99M and 12.22M tokens driving a drop to $2.75 before recovering to $2.82.

- In the following hour, the token gained 0.35% to $2.83, trading within a $0.07 band and breaching short-term resistance at $2.83–$2.84, with preliminary support emerging near $2.81–$2.82.

NEAR Protocol saw heightened volatility in the 24 hours ending August 14 at 14:00 UTC, with prices fluctuating between $2.78 and $3.05 before settling at $2.82.

The decline from the $3.05 resistance to $2.75 support was driven by heavy institutional selling, totaling nearly 20 million tokens during peak pressure. Despite this, the asset’s fundamentals remain strong, supported by a sizable active user base of 16 million weekly participants.

STORY CONTINUES BELOW

In the hour following the selloff, NEAR gained 0.35% to $2.83, trading within a controlled $0.07 range between $2.81 and $2.85. Key institutional buying appeared at several intervals, helping the token breach short-term resistance at $2.83–$2.84 and reach session highs of $2.85.

Trading volume eased to roughly 100,000 tokens per minute, suggesting accumulation rather than speculative retail activity, with preliminary support forming near $2.81–$2.82.

- NEAR Protocol recorded substantial price volatility with a $0.26 trading range representing 8.53% movement between the session high of $3.05 and low of $2.78.

- The cryptocurrency initially demonstrated upward momentum from $2.90 to reach $3.05 during evening trading hours, establishing technical resistance at the $3.04-$3.05 level.

- Significant institutional selling occurred during August 14 between 12:00-13:00 UTC with exceptional trading volumes of 19.99 million and 12.22 million tokens respectively.

- Daily trading activity substantially exceeded the 24-hour average of 5.47 million tokens, reflecting heightened institutional selling pressure.

- Market price declined to $2.75 before corporate buying interest supported a recovery to $2.82 at session close.

- High-volume institutional selling patterns suggest potential continued downside risk despite modest recovery attempts, according to market strategists.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

By Helene Braun, Krisztian Sandor|Edited by Sheldon Reback

59 minutes ago

Market strategists said the crypto rally’s broader outlook remains positive despite the largest long liquidations since early August.

What to know:

- Bitcoin’s pullback from record highs to $118,000 rippled through the crypto market, triggering over $1 billion liquidations across digital assets.

- The sell-off marks a healthy profit-taking, not a reversal, as Fed rate-cut hopes and ETF inflows still support bullish momentum, analysts said.

- Rising core inflation data and stretched valuations pose near-term risks, but institutional demand for crypto remains strong.