BTC

$105,881.63

–

1.52%

ETH

$2,421.00

–

2.13%

USDT

$1.0005

+

0.02%

XRP

$2.1861

–

0.37%

BNB

$647.32

–

1.37%

SOL

$147.19

–

6.62%

USDC

$1.0001

+

0.01%

TRX

$0.2782

–

0.25%

DOGE

$0.1592

–

3.36%

ADA

$0.5465

–

3.53%

HYPE

$38.78

–

2.44%

BCH

$514.94

+

0.31%

WBT

$44.58

–

2.48%

SUI

$2.6896

–

3.50%

LINK

$13.00

–

2.69%

LEO

$8.9095

–

2.13%

AVAX

$17.29

–

4.05%

XLM

$0.2334

–

0.80%

TON

$2.7966

–

4.82%

SHIB

$0.0₄1121

–

1.88%

By Oliver Knight, CD Analytics

Updated Jul 1, 2025, 2:51 p.m. Published Jul 1, 2025, 2:51 p.m.

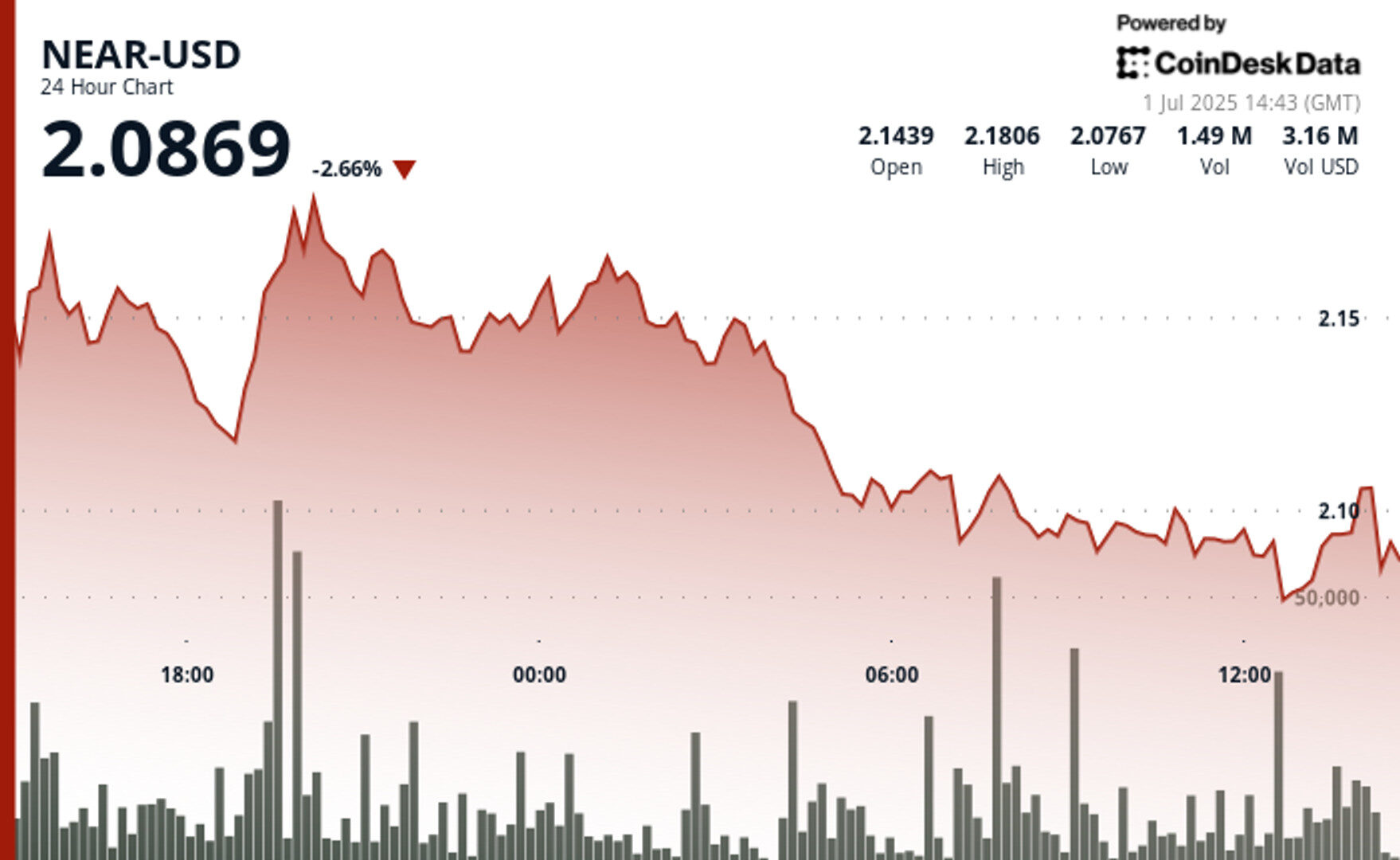

- NEAR-USD experienced a notable downtrend over the last 24 hours from 30 June 15:00 to 1 July 14:00, declining from $2.14 to $2.09, representing a 2% decrease.

- The price action revealed clear bearish momentum with the overall range spanning from the high of $2.19 to the low of $2.08, creating a volatility band of $0.11 (5%).

- A significant support level has formed around $2.08-$2.10, confirmed by multiple bounces with above-average volume, particularly during the 7-hour session where price recovered from $2.08 despite heavy selling pressure.

AI-focused NEAR token is down by 2% on Tuesday to reflect broader altcoin market weakness and a negative response to a governance proposal by trading firm DWF Labs.

DWF proposed to cut NEAR’s inflation from 5% to 2.5%. While this might have a bullish impact on prices in that tokens will be more scarce, network validators might switch to other networks if their rewards are slashed too much, creating a debate over a potential lack of decentralization.

STORY CONTINUES BELOW

Technical analysis

- The 19:00-20:00 period on June 30th marked the peak with the highest price point, followed by consistent lower highs, suggesting continued selling pressure that could test the established support zone in the near term.

- In the last 60 minutes from 1 July 13:06 to 14:05, NEAR-USD demonstrated a strong bullish trend, rising from $2.08 to $2.10, representing a 1% gain.

- The price action formed a clear upward channel with higher lows and higher highs, particularly accelerating between 13:25-13:33 when price broke above the $2.08 resistance and quickly established support at $2.09.

- A notable volume spike occurred at 13:40-13:41, creating a brief pullback to $2.08 before buyers stepped in, pushing price to the session high of $2.10 by 14:05.

- This recovery from the mid-session dip confirms strong underlying demand and suggests potential continuation of the uptrend.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.