BTC

$113,297.95

+

1.71%

ETH

$2,809.69

+

5.32%

USDT

$1.0004

+

0.03%

XRP

$2.4885

+

2.27%

BNB

$673.20

+

1.27%

SOL

$159.01

+

2.11%

USDC

$0.9997

+

0.01%

TRX

$0.2910

+

1.00%

DOGE

$0.1848

+

4.30%

ADA

$0.6481

+

3.06%

HYPE

$42.84

+

5.70%

SUI

$3.3739

+

9.95%

BCH

$509.54

+

0.18%

WBT

$46.48

+

1.52%

LINK

$14.59

+

2.17%

XLM

$0.2966

–

0.23%

LEO

$9.0164

–

0.64%

AVAX

$19.79

+

5.23%

HBAR

$0.1808

+

5.93%

SHIB

$0.0₄1270

+

3.18%

By Oliver Knight, CD Analytics

Updated Jul 10, 2025, 4:54 p.m. Published Jul 10, 2025, 4:54 p.m.

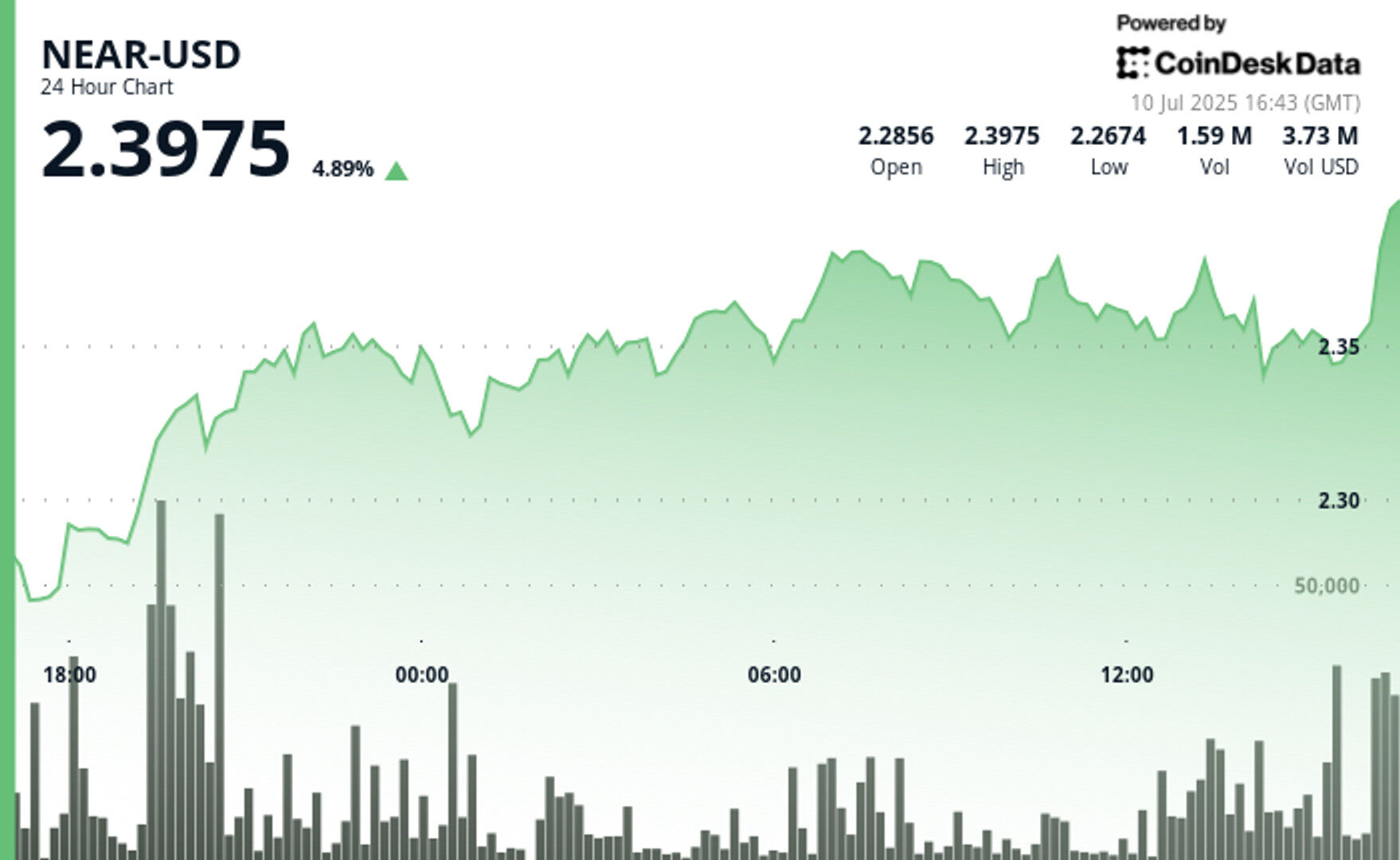

- NEAR Protocol advanced 5.04% during the 23-hour session from July 9 at 4:00 PM to July 10 at 3:00 PM, rising from $2.26 to $2.38 before closing at $2.34.

- Trading volume of 4.62 million units during peak hours substantially exceeded the daily average of 1.73 million, establishing technical support at $2.29.

- Late-session volatility from July 10 at 2:58 PM to 3:57 PM demonstrated institutional profit-taking patterns followed by strategic buying, indicating continued bullish sentiment among sophisticated investors.

NEAR traders are demonstrating bullish sentiment over the past 24 hours, with the token advancing from $2.26 to a session high of $2.38 before settling near $2.34.

The $0.12 trading range represented a notable 5.04% gain, with peak activity occurring during the July 9 7:00 PM hour when trading volume reached 4.62 million units—nearly triple the session average of 1.73 million—indicating substantial participation and establishing technical support at the $2.29 level.

STORY CONTINUES BELOW

The move comes alongside bitcoin’s recent break of $112,000, a new record high as the industry remains patient for a long-awaited altcoin season.

Technical Indicators Analysis

- Price range of $0.12 representing 5% movement from $2.26 to $2.38 peak.

- Volume surge to 4.62 million units during July 9 7:00 PM hour, exceeding 23-hour average of 1.73 million.

- Strong technical support established at $2.29 level.

- New support zone formed around $2.34 following recovery.

- Institutional profit-taking patterns observed during 3:41-3:42 PM timeframe.

- Strategic buying activity confirmed underlying bullish sentiment.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.