BTC

$104,734.66

–

0.18%

ETH

$2,510.89

–

1.05%

USDT

$1.0004

+

0.02%

XRP

$2.1499

–

2.15%

BNB

$643.02

–

1.22%

SOL

$145.66

–

2.35%

USDC

$1.0001

+

0.03%

TRX

$0.2703

–

2.06%

DOGE

$0.1679

–

1.66%

ADA

$0.5972

–

3.78%

HYPE

$39.64

–

1.29%

WBT

$48.82

–

0.19%

SUI

$2.7852

–

3.49%

BCH

$465.29

–

0.90%

LINK

$12.86

–

2.37%

LEO

$9.1412

–

0.57%

XLM

$0.2496

–

2.74%

AVAX

$18.39

–

2.05%

TON

$2.8930

–

3.84%

SHIB

$0.0₄1159

–

0.95%

By Oliver Knight, CD Analytics

Updated Jun 18, 2025, 2:20 p.m. Published Jun 18, 2025, 2:20 p.m.

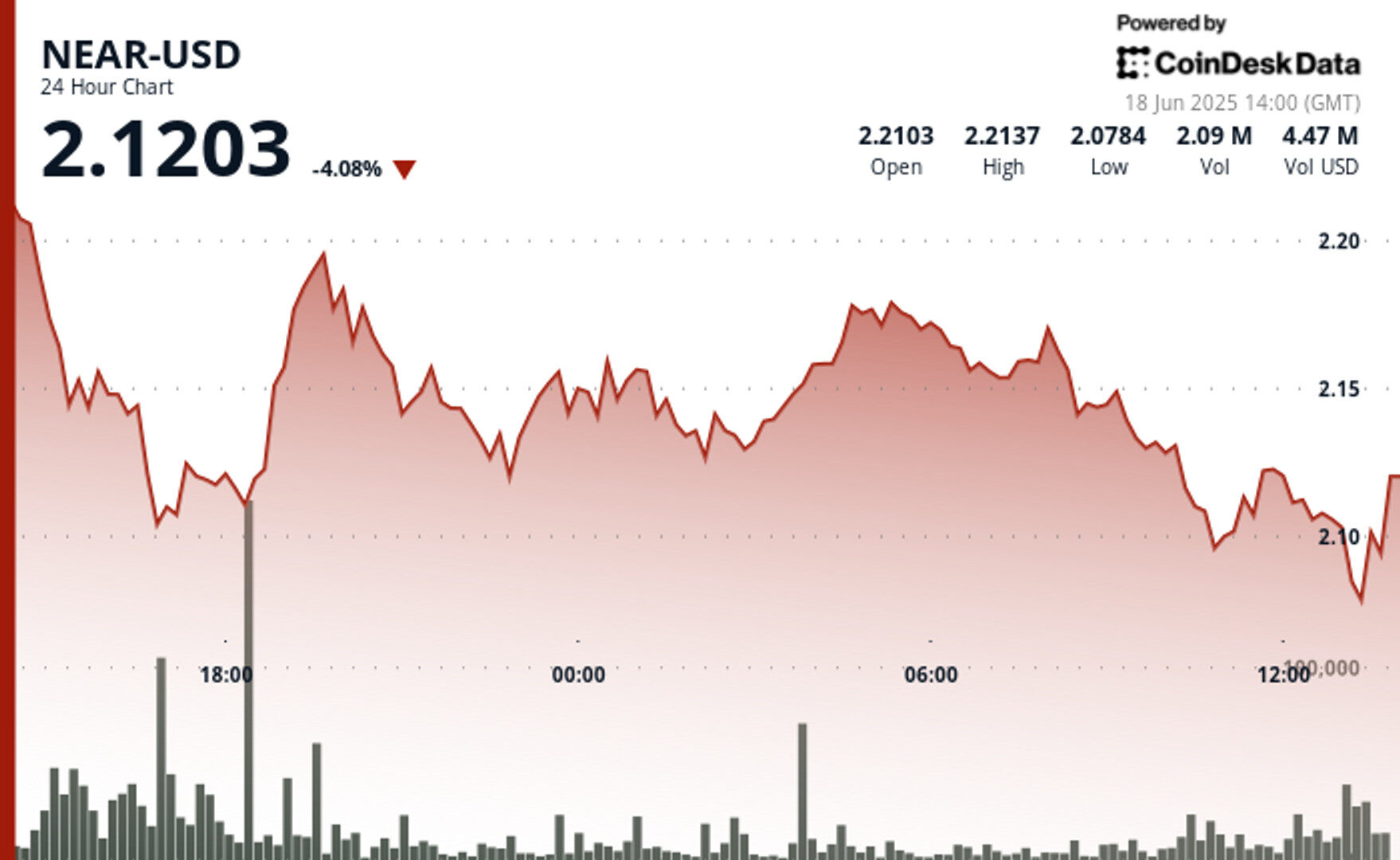

- NEAR Protocol experiences significant price volatility, trading between $2.219 and $2.085 with strong selling pressure establishing resistance around $2.18-2.22.

- Growing tension in the Middle East is creating ripple effects across cryptocurrency markets, with NEAR particularly affected.

- Despite market challenges, NEAR Protocol recently crossed 46 million monthly active users, showing real adoption beyond speculation and closing the gap with major networks like Solana.

The cryptocurrency market faces renewed pressure as conflict between Iran and Israel intensify, with NEAR Protocol showing notable price sensitivity to these geopolitical developments.

The digital asset has established key support around $2.09-2.10, where increased trading volume suggests potential accumulation despite the overall bearish trend.

STORY CONTINUES BELOW

Technical analysis

- NEAR-USD exhibited a 6.1% trading range ($2.219 high to $2.085 low) with substantial selling pressure during the 15:00-16:00 timeframe.

- Above-average volume of 6.26M and 4.94M established a key resistance zone around $2.18-2.22.

- Support emerged at $2.09-2.10 with increased volume during the 10:00 hour, suggesting potential accumulation.

- The overall trend appears bearish with lower highs forming throughout the period.

- Final hours showed signs of stabilization as prices consolidated between $2.09-2.12, potentially forming a base for a technical bounce.

- In the last hour, NEAR-USD continued downward, dropping from $2.119 to $2.112.

- A significant sell-off occurred between 12:37-12:39 when price plummeted to $2.105.

- A key support zone formed around $2.106-$2.108, tested multiple times with increasing volume (68,050 units at 12:50).

- The asset attempted recovery in the final minutes, climbing from $2.105 to $2.112, forming a potential double bottom pattern.

- Short-term consolidation with decreasing selling volume indicates possible exhaustion of bearish momentum, though the overall trend remains negative.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.