By Oliver Knight, CD Analytics

Updated Jul 3, 2025, 4:31 p.m. Published Jul 3, 2025, 4:31 p.m.

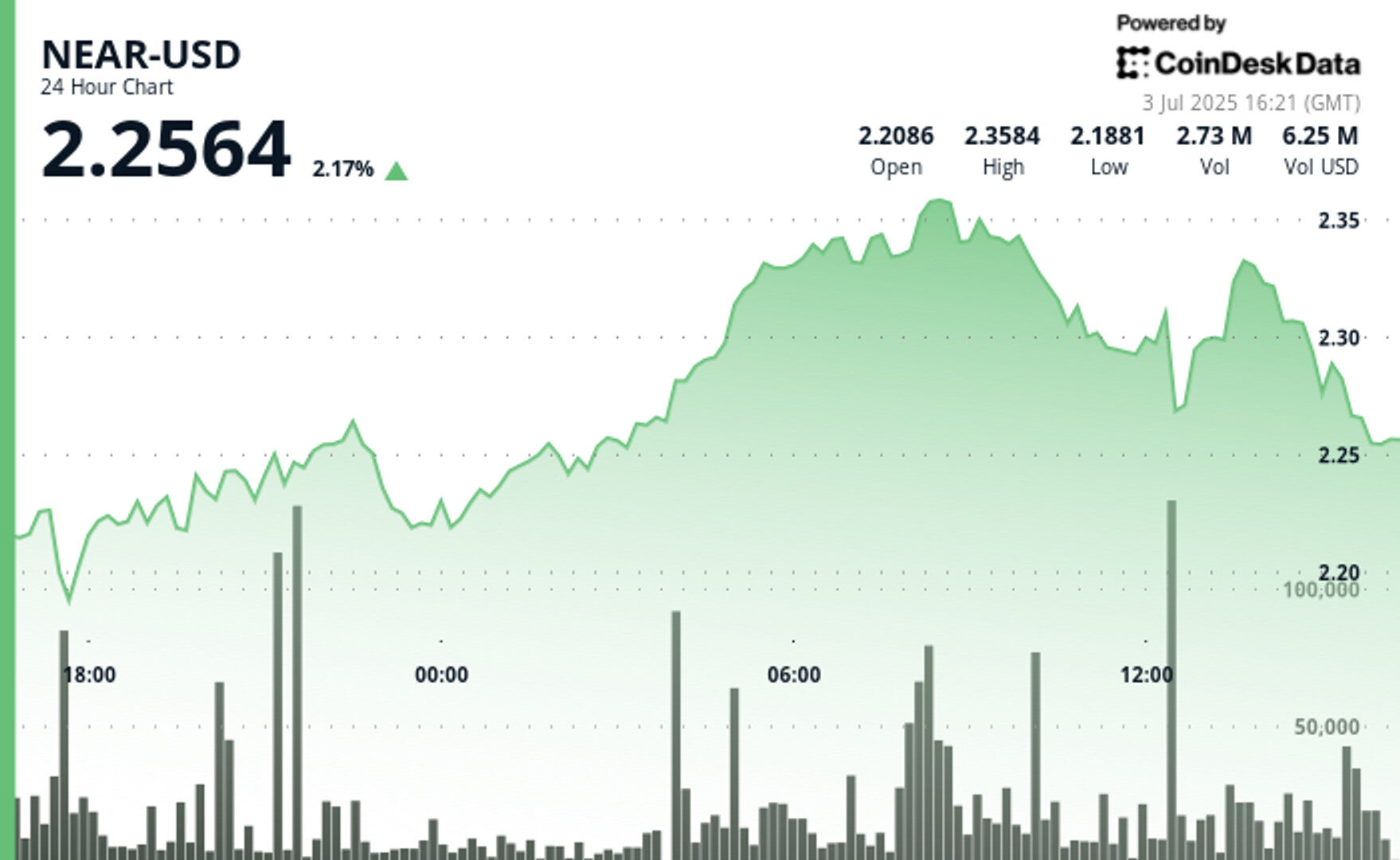

- NEAR token surged 9.77% from $2.15 to $2.36 between July 2-3, breaking through the $2.30 resistance level with strong volume confirmation.

- Profit-taking emerged after reaching the new high, with price retracing to $2.27 by session close, finding support at the 23.6% Fibonacci retracement level.

- NEAR rose on Wednesday after fund manager Bitwise announced the launch of a NEAR exchange-traded product (ETP) in Germany.

AI-focused NEAR token halted its 10% rally on Thursday as traders began to take profits from a rally that was spurred by Bitwise’s announcement that it is launching a NEAR exchange traded product (ETP) in Germany.

“The NEAR Staking ETP on Xetra opens a new bridge to NEAR for institutions by providing a regulated, exchange-traded way to earn staking rewards,” Illia Polosukhin told CoinDesk. “Investors gain compliant access to the NEAR ecosystem and user-owned AI without needing to handle private keys or node operations, and with full price transparency.”

STORY CONTINUES BELOW

The token has now established a key level of support at $2.26 as it looks to consolidate before continuing to the upside.

Technical analysis

- NEAR established strong support at $2.26 with above-average volume during the 24-hour period from 2 July 16:00 to 3 July 15:00.

- Price broke through the $2.30 resistance level in the early hours of 3 July, reaching a new high at $2.36 during the 08:00 hour with substantial volume confirmation.

- The 23.6% Fibonacci retracement level provided support during the profit-taking phase, suggesting the underlying uptrend remains intact.

- During the 60-minute period from 3 July 14:50 to 15:49, NEAR experienced a steep sell-off at 15:04-15:07, where volume spiked to over 310,000 units.

- A new support zone has been established between $2.26-$2.27, with the closing price of $2.26 suggesting continued bearish pressure in the short term.

CoinDesk 20 Index Jumps 2% Before Late Session Selloff

Over the last 24 hours from 3 July 15:00 to 2 July 16:00, CD20 exhibited significant volatility with an overall range of $37.27 (2.11%), reaching a peak of $1,811.11 during the 14:00 hour on 3 July before sharply retracing to $1,791.50 by session close.

The asset demonstrated remarkable strength during the mid-session rally, gaining over $21 (1.18%) from its overnight low of $1,778.85, with particularly aggressive buying momentum observed during the 09:00 and 13:00 hours that suggests institutional accumulation despite the late session profit-taking.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.