BTC

$104,075.71

–

0.41%

ETH

$2,490.74

–

0.48%

USDT

$1.0004

–

0.01%

XRP

$2.1611

+

0.66%

BNB

$639.34

–

0.33%

SOL

$143.48

–

1.02%

USDC

$1.0001

–

0.01%

TRX

$0.2734

+

1.07%

DOGE

$0.1686

+

0.67%

ADA

$0.5915

–

0.16%

HYPE

$36.25

–

5.93%

WBT

$49.19

+

1.13%

BCH

$483.72

+

5.03%

SUI

$2.8029

+

0.76%

LINK

$12.95

+

0.88%

LEO

$8.9408

–

2.04%

XLM

$0.2478

–

0.56%

AVAX

$17.68

–

3.04%

TON

$2.9291

+

1.03%

SHIB

$0.0₄1147

–

1.11%

By Oliver Knight, CD Analytics

Updated Jun 19, 2025, 4:08 p.m. Published Jun 19, 2025, 4:08 p.m.

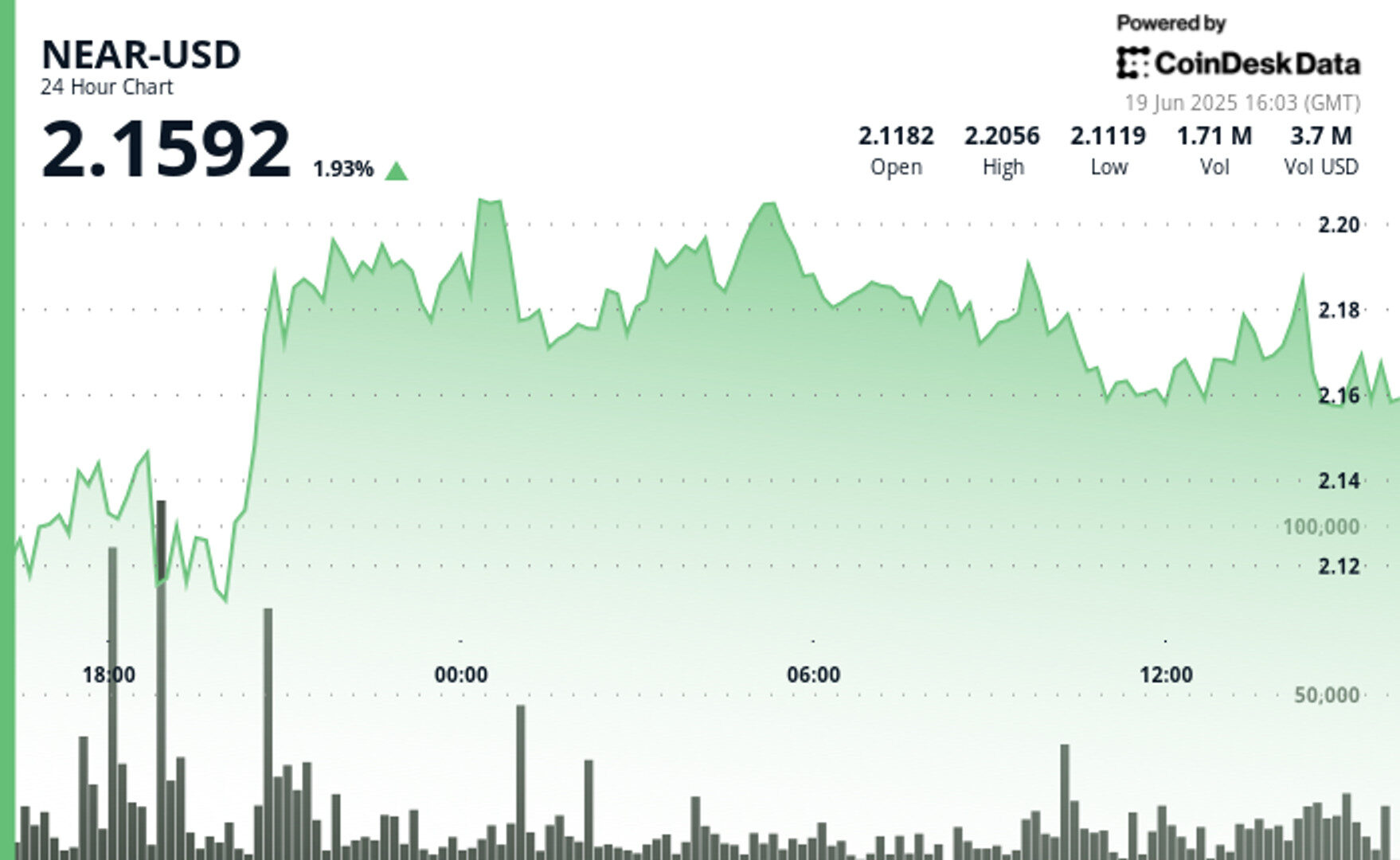

- NEAR Protocol surges 4.5% amid global trade disputes, showing resilience despite broader market uncertainty.

- Rising tension between Iran and Israel has created volatility across cryptocurrency markets, with NEAR establishing strong support at $2.11-$2.12.

The cryptocurrency market faces mounting pressure due to escalating tensions between Iran and Israel in the Middle East.

NEAR Protocol has demonstrated remarkable resilience, climbing 4.5% with significant volume support around the $2.11-$2.12 range.

STORY CONTINUES BELOW

This performance comes as traditional markets struggle to find direction amid conflicting economic signals.

NEAR’s strong performance coincides with heightened trading activity, particularly during peak hours when volume reached 5.14M units. The token continues to test resistance at $2.20, suggesting continued interest despite broader economic concerns.

Technical Analysis

- NEAR-USD experienced a significant bullish breakout, climbing from $2.124 to $2.170, with a notable 24-hour range of $0.095 (4.5%).

- A clear high-volume support zone formed around $2.110-$2.120, where buyers consistently stepped in, particularly during the 18:00-20:00 timeframe when volume peaked at 5.14M units.

- Key resistance level emerged at $2.205-$2.210, tested twice but failing to break through, suggesting potential consolidation before the next leg up.

- Overall trend remains bullish with higher lows forming a supportive trendline, though recent hours show decreasing momentum that warrants caution.

- In the last hour, NEAR-USD continued its bullish momentum with significant price action between $2.169 and $2.173, forming a higher low pattern that reinforces the broader uptrend.

- Notable volume spikes occurred at 13:21 and 13:39, with over 65,000 and 83,000 units respectively, indicating strong buyer interest at these levels.

- Price successfully tested and held above the $2.170 support zone multiple times, culminating in a final push to $2.173 by the end of the period, suggesting continued bullish sentiment despite some consolidation phases.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.