BTC

$104,261.00

–

0.34%

ETH

$2,524.12

+

0.54%

USDT

$1.0003

–

0.01%

XRP

$2.1542

+

0.40%

BNB

$655.26

+

0.42%

SOL

$153.18

–

0.00%

USDC

$0.9997

–

0.00%

DOGE

$0.1912

–

0.06%

TRX

$0.2674

–

0.25%

ADA

$0.6706

+

0.06%

SUI

$3.2732

–

0.43%

HYPE

$33.08

+

3.10%

LINK

$13.69

–

1.48%

AVAX

$20.49

–

0.77%

XLM

$0.2656

+

0.38%

BCH

$399.94

–

0.57%

LEO

$8.4550

–

1.93%

TON

$3.1594

+

1.29%

SHIB

$0.0₄1284

–

0.63%

HBAR

$0.1682

+

0.80%

By Oliver Knight, AI Boost|Edited by Stephen Alpher

Jun 2, 2025, 2:41 p.m.

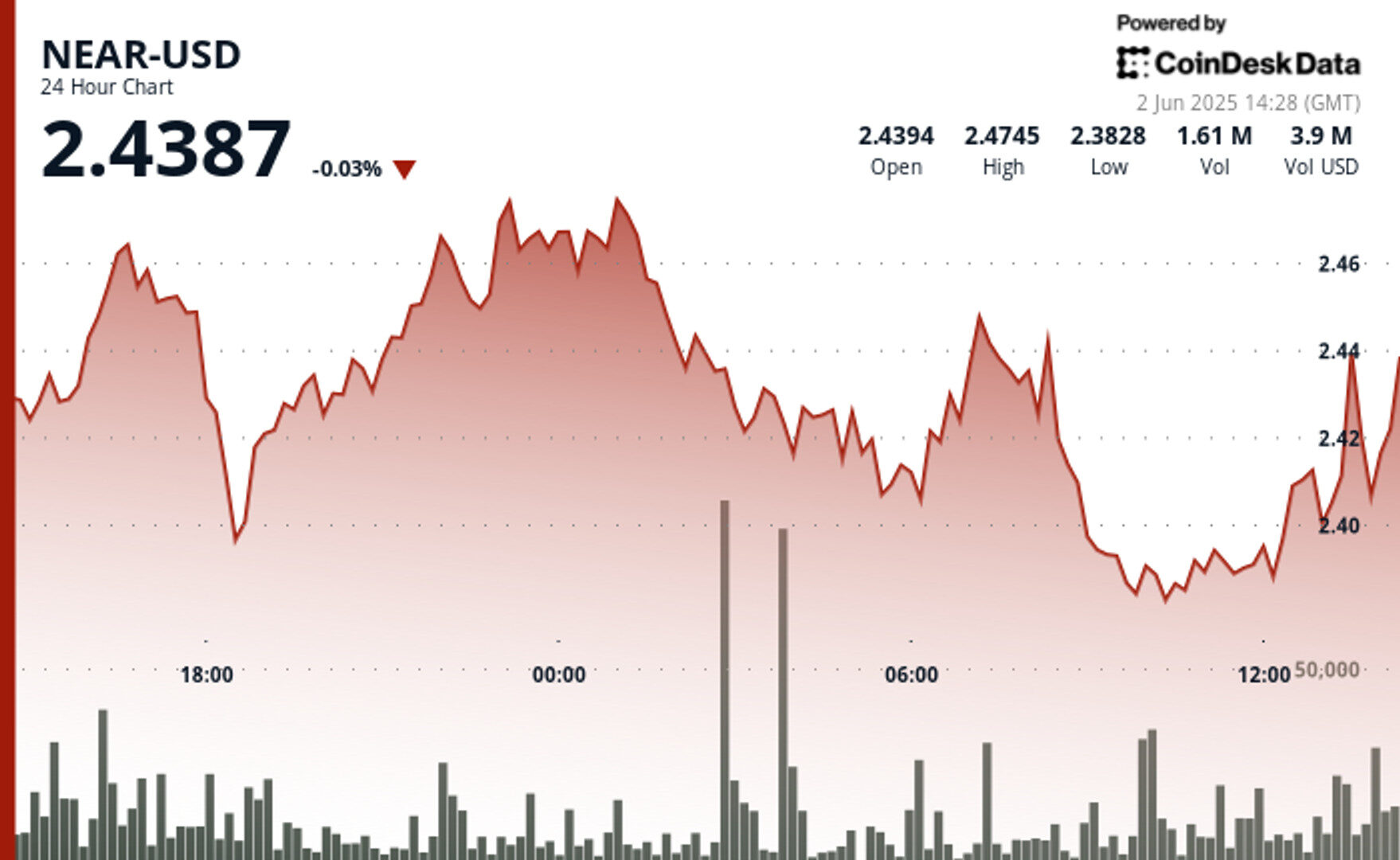

- NEAR is currently trading at $2.41 after failing to break out above $2.49.

- Price stabilization at within narrow range indicates potential continuation of upward movement if volume remains strong.

NEAR Protocol has been caught in the crosscurrents of global economic uncertainty, with its price action reflecting broader market turbulence as investors navigate complex geopolitical developments.

The cryptocurrency experienced significant volatility over the past 24 hours, establishing a trading range between $2.38 and $2.49.

STORY CONTINUES BELOW

The token’s performance mirrors the tension in traditional markets, where escalating US-China trade disputes threaten global supply chains and create particular uncertainty for technology-focused assets like NEAR.

Meanwhile, the European Central Bank’s signals toward potential rate cuts amid slowing inflation provide a mixed outlook for digital assets as monetary policy shifts across major economies.

Adding to the market complexity, intensifying Middle East conflicts have triggered new sanctions affecting oil prices, further contributing to the market volatility reflected in NEAR’s price fluctuations.

- High-volume support zone formed around $2.38-$2.40, with consistent buyer intervention during the 09:00-11:00 timeframe on above-average volume exceeding 2.5 million units.

- Descending resistance trendline established after reaching $2.481 at 01:00, indicating persistent bearish momentum despite recovery attempts.

- Bullish surge from $2.399 to $2.439 (1.67% gain) in the final hour, with a notable resistance breakthrough at $2.420 followed by consolidation near $2.435.

- Sharp pullback to $2.399 at 14:00 before recovering to $2.414, suggesting strong buying interest at the $2.400 support level.

- Price stabilization within a narrower range indicates potential continuation of upward movement if volume support remains strong.

Disclaimer: Parts of this article were created using AI.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.