BTC

$109,296.58

+

0.77%

ETH

$2,660.22

+

3.26%

USDT

$1.0001

–

0.00%

XRP

$2.3777

+

3.86%

BNB

$662.97

+

0.66%

SOL

$154.57

+

2.62%

USDC

$0.9999

+

0.00%

TRX

$0.2875

+

0.45%

DOGE

$0.1735

+

2.10%

ADA

$0.6091

+

4.74%

HYPE

$39.24

+

3.76%

SUI

$2.9650

+

2.79%

BCH

$507.18

+

0.81%

WBT

$45.97

+

2.79%

LINK

$14.01

+

3.12%

XLM

$0.2905

+

14.09%

LEO

$9.0413

–

0.33%

AVAX

$18.64

+

2.95%

HBAR

$0.1701

+

6.69%

SHIB

$0.0₄1212

+

2.41%

By Oliver Knight, CD Analytics

Updated Jul 9, 2025, 4:08 p.m. Published Jul 9, 2025, 4:08 p.m.

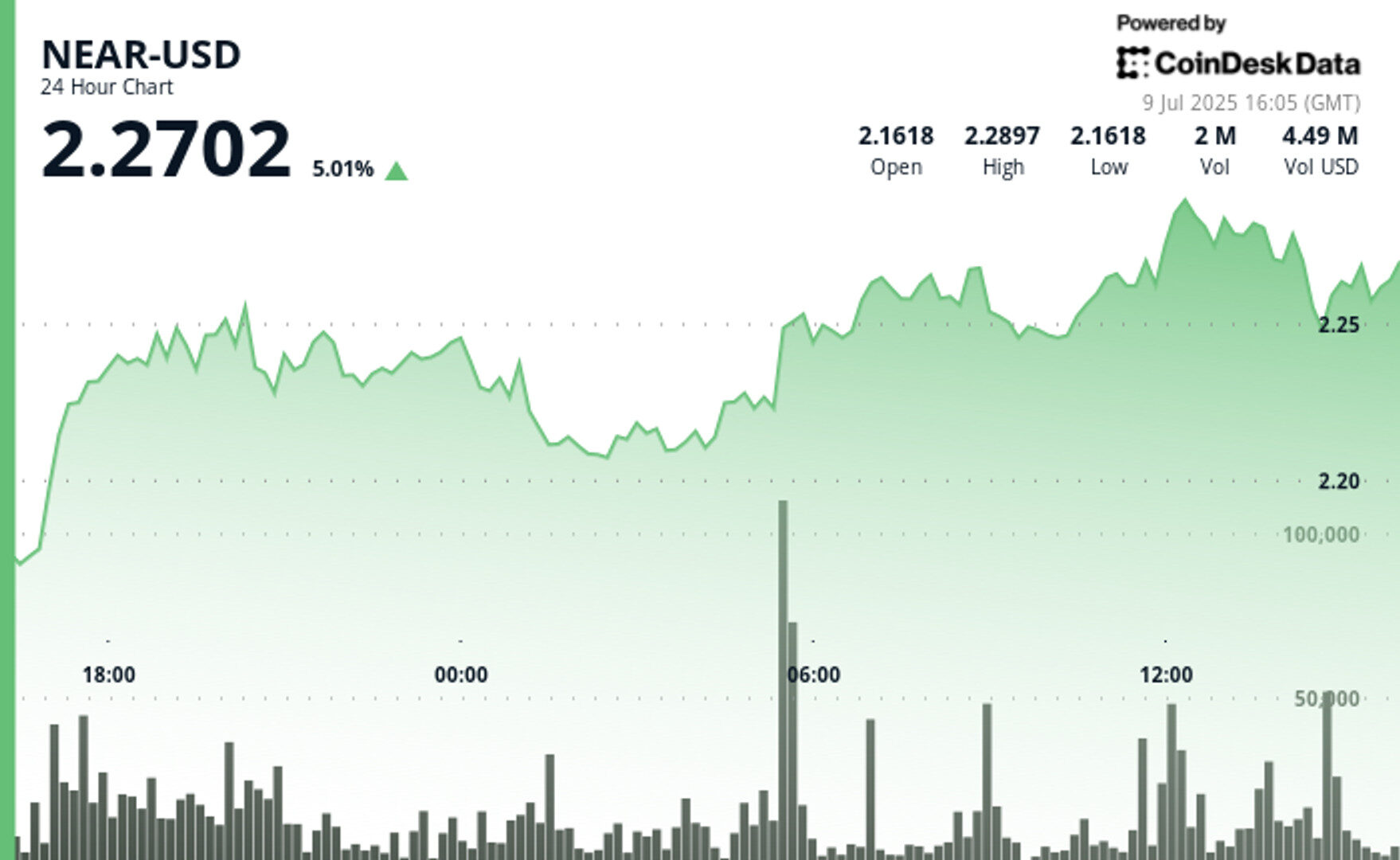

- NEAR Protocol rallies 5% in volatile 24-hour session ending 9 July 15:00, closing at $2.27 amid sharp intraday swings.

- Grayscale includes NEAR in Decentralized AI Fund rebalancing, allocating 28.41% weight alongside Bittensor’s 29.10% position.

NEAR Protocol posts 5% gains in the 24-hour period ending 9 July 15:00, closing at $2.27 despite heavy volatility.

The rally coincides with Grayscale’s quarterly rebalancing, positioning NEAR at 28.41% of its Decentralized AI Fund.

STORY CONTINUES BELOW

The move comes amid renewed optimism across the altcoin sector, with analysts calling for a long-awaited “altcoin season,” which would likely occur if bitcoin

breaks a new record high and consolidates, prompting a capital flow to altcoins.

Technical Analysis

- NEAR opens at $2.16, closes at $2.27 for 5.09% session gain.

- Token swings $0.14 or 6.20% between $2.15 low and $2.29 peak.

- 17:00 hour sees 4.16 million unit surge, driving price from $2.18 to $2.23.

- Spike exceeds 24-hour average of 1.87 million units.

- Volume establishes resistance at $2.24, support at $2.21.

- $2.25 level holds through multiple resistance-support tests.

- Late buying pushes close toward session highs, signaling momentum continuation.

- Early pressure drops token to $2.25 by 14:36, down 1.64% in nine minutes.

- 515,008-unit spike at 14:56 triggers reversal from $2.25 to $2.26.

- Final 30 minutes show 1.20% bounce from session lows.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.