BTC

$107,545.32

+

0.16%

ETH

$2,432.36

–

0.21%

USDT

$1.0001

–

0.01%

XRP

$2.1884

+

0.05%

BNB

$648.78

+

0.05%

SOL

$151.65

+

0.29%

USDC

$0.9998

+

0.01%

TRX

$0.2755

+

0.36%

DOGE

$0.1644

–

0.03%

ADA

$0.5609

–

1.00%

HYPE

$38.57

+

1.87%

WBT

$46.70

–

1.01%

BCH

$492.66

+

0.40%

SUI

$2.8126

+

0.49%

LINK

$13.38

–

0.05%

LEO

$9.0225

–

0.38%

AVAX

$18.15

+

1.02%

XLM

$0.2364

–

0.81%

TON

$2.8792

+

0.83%

SHIB

$0.0₄1158

+

0.33%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Jun 29, 2025, 9:12 p.m.

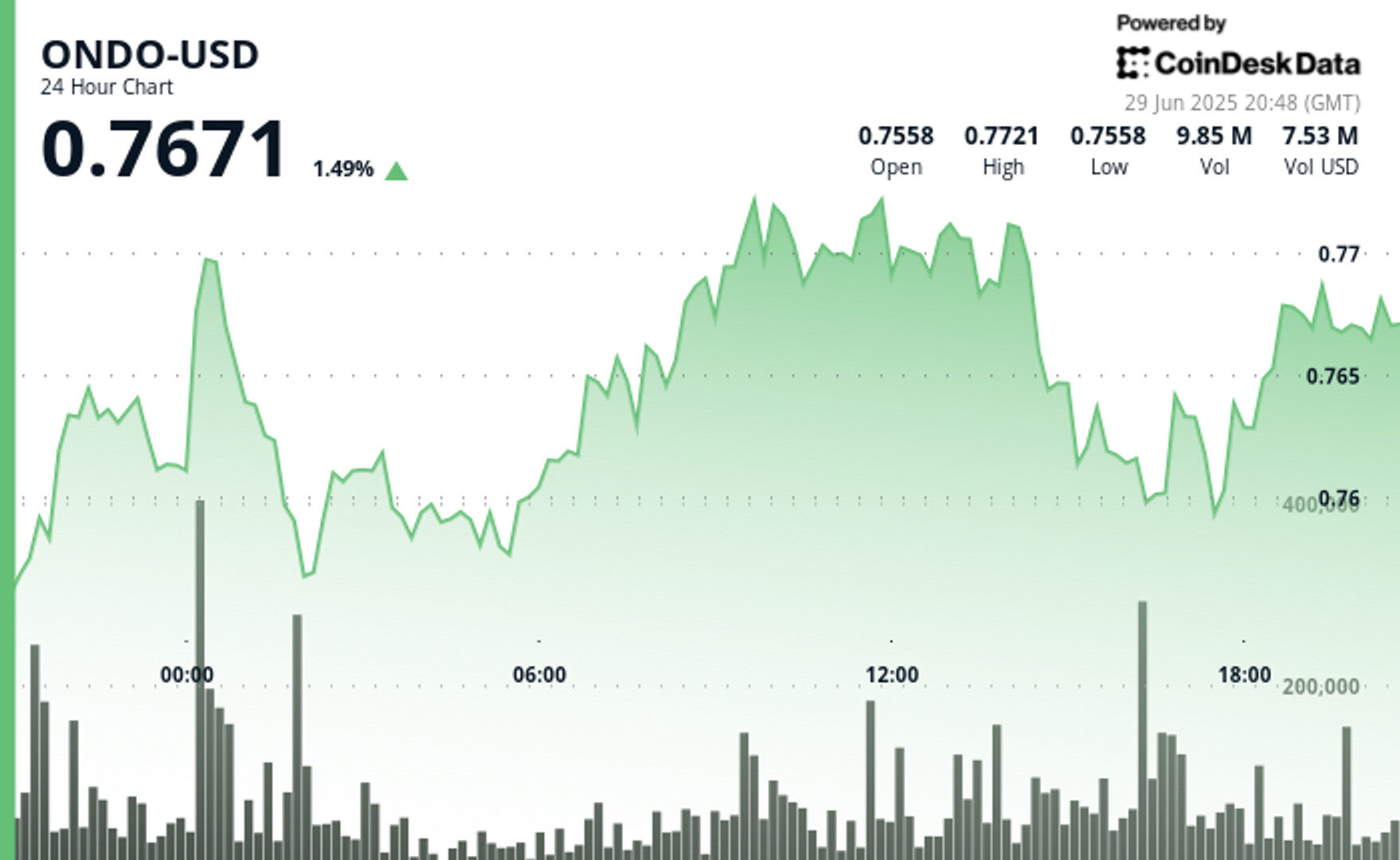

- ONDO climbed 1.5% to $0.7671, breaking above key resistance on moderate volume.

- Price action formed a bullish channel, with support established at $0.755.

- Ondo Finance launched a global industry alliance on June 17 to promote standards for tokenized securities.

Ondo

rose 1.5% to $0.7671 over the past 24 hours, holding near recent highs after a week of gains, according to CoinDesk Research’s technical analysis model.

The move comes roughly two weeks after Ondo Finance disclosed a new industry collaboration focused on setting standards for tokenized securities.

STORY CONTINUES BELOW

In a June 17 blog post, the firm announced the creation of the Global Markets Alliance, a group of wallets, exchanges, and custodians working together to improve interoperability, investor protections, and access to tokenized real-world assets. Participants include the Solana Foundation, BitGo, Fireblocks, Jupiter, 1inch, Trust Wallet, Bitget Wallet, Rainbow Wallet, and Alpaca.

The announcement comes ahead of Ondo’s planned launch of Ondo Global Markets, a platform aimed at allowing crypto wallets and applications to offer tokenized exposure to U.S. publicly traded securities, such as stocks, ETFs, and mutual funds, for users based outside the U.S. According to the company, the initiative is intended to reduce frictions associated with traditional capital market infrastructure and broaden global access.

Each member of the alliance is contributing in a different capacity. Wallet providers like Trust Wallet and Rainbow Wallet are integrating Ondo’s tokenized asset standards, while exchanges such as Jupiter and aggregators like 1inch are expected to support programmatic access to tokenized assets. BitGo and Fireblocks are providing institutional custody and infrastructure, and Alpaca is handling brokerage and regulatory services tailored to tokenized securities.

The firm said the group will work to align technical and compliance standards for tokenized securities, improve cross-platform access and liquidity, and support use cases such as self-custody and onchain trading. While the alliance has not committed to a specific timeline, its members have framed the initiative as part of a longer-term shift toward integrating traditional financial products into blockchain-based systems.

In a post on X dated June 28, Ondo Finance wrote that “2025 will be the year of tokenized stocks,” indicating the team’s belief that adoption of tokenized financial instruments may accelerate in the coming quarters.

Technical Analysis Highlights

- Between June 28 15:00 UTC and June 29 14:00 UTC, ONDO rose from $0.749 to $0.769, a 2.67% gain within a 3.33% trading range.

- Strong support was confirmed at $0.755 with high volume during the 21:00 UTC hour on June 28.

- Key resistance at $0.765 was broken during the 00:00 UTC hour on June 29, when volume spiked to 8.9 million.

- From 13:05 to 14:04 UTC on June 29, ONDO fell slightly from $0.773 to $0.769, a 0.58% drop, with notable selling at 13:33 UTC.

- A temporary support level formed at $0.768 as multiple recovery attempts above $0.769 failed in the final minutes.

- Price action during the final hour formed a descending channel with lower highs, but the last candle hinted at potential reversal.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.