-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Network activity has declined, with daily active addresses dropping to fewer than 3,000, and technical analysis suggesting a possible 15% drop.

By CD Analytics, Francisco Rodrigues|Edited by Parikshit Mishra

Sep 4, 2025, 11:42 a.m.

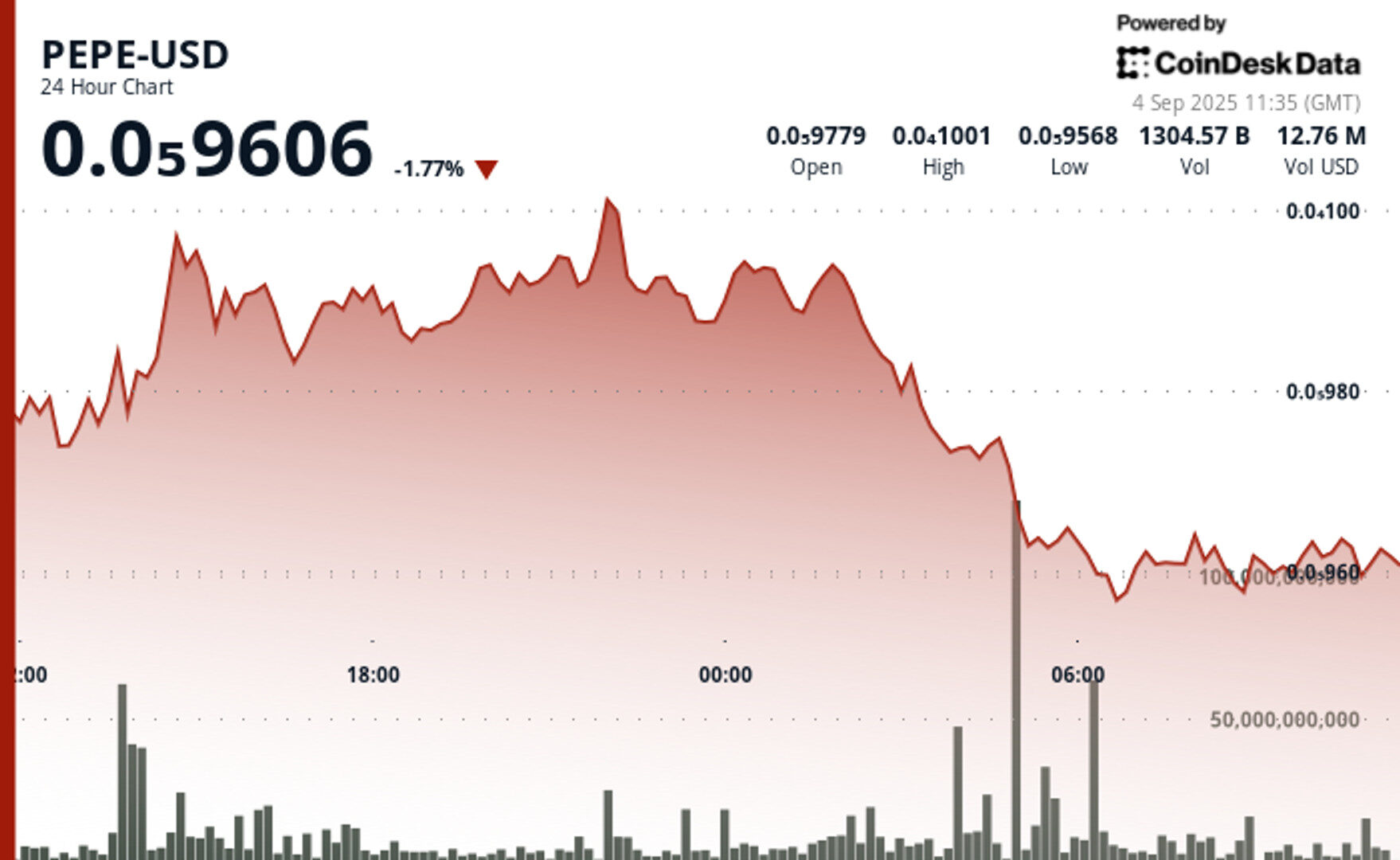

- PEPE’s price is under pressure after slipping below a key support level, with trading volumes and open interest declining, and derivatives data showing an imbalance in favor of long liquidations.

- Network activity has declined, with daily active addresses dropping to fewer than 3,000, and technical analysis suggesting a possible 15% drop.

- Despite the price decline, the top 100 PEPE addresses on Ethereum added 0.2% to their holdings, but PEPE on exchanges rose 1.13%.

Meme-inspired cryptocurrency PEPE PEPE$0.0₅9609 is under pressure after slipping below a key support level, sparking warnings of a possible 15% drop.

The move comes as trading volumes fell to $980 million and open interest contracted 4% to $535 million based on CoinGlass data, signaling waning conviction among traders.

STORY CONTINUES BELOW

Derivatives data show long liquidations hit $326,000, far outpacing just $9,900 in shorts, based on the same data source, highlighting an imbalance that could accelerate downward momentum.

Meanwhile, activity on the PEPE network has collapsed to fewer than 3,000 daily active addresses, Glassnode data shows. That’s a sharp drop from late 2024, when a peak 27,500 addresses were active during a major price rally.

According to trader Alpha Crypto Signal, the price of PEPE could see a major breakdown and slow towards the $0.0000085 to $0.0000080 area as it comes off of a symmetrical triangle.

Meanwhile, Nansen data for the past week shows the top 100 PEPE addresses on the Ethereum blockchain added just 0.2% to their holdings, while PEPE on exchanges rose 1.13%.

PEPE showed volatility during the latest trading cycle, with a 5% range between $0.000010028 at the high and $0.000009567 at the low, according to CoinDesk Research’s technical analysis data model.

A rally earlier in the week briefly pushed prices to the $0.000010000 mark on volume of 2.6 trillion tokens, but the move stalled and sellers regained control.

Since then, the token has drifted lower, testing $0.000009610, a 4% pullback from recent highs. Hourly trading also showed resistance forming near $0.000009640 despite sharp volume spikes above 89 billion, suggesting distribution rather than accumulation.

More For You

By Oliver Knight|Edited by Sheldon Reback

36 minutes ago

Both bitcoin and the CoinDesk 20 Index are lower, and the negative sentiment is echoed in the options and perpetual futures markets.

What to know:

- Both bitcoin and the CoinDesk 20 Index have dropped in the past 24 hours.

- All but one member of the broader index have slipped since midnight UTC.

- Positioning in the derivatives market has a bearish feel, with more than $4.5 billion in crypto options set to expire on Deribit on Friday.