-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Despite the drop, PEPE’s derivatives market activity remains strong, with open interest reaching $560 million and trading volume at $1.2 billion.

By AI Boost, Francisco Rodrigues|Edited by Stephen Alpher

Sep 30, 2025, 2:37 p.m.

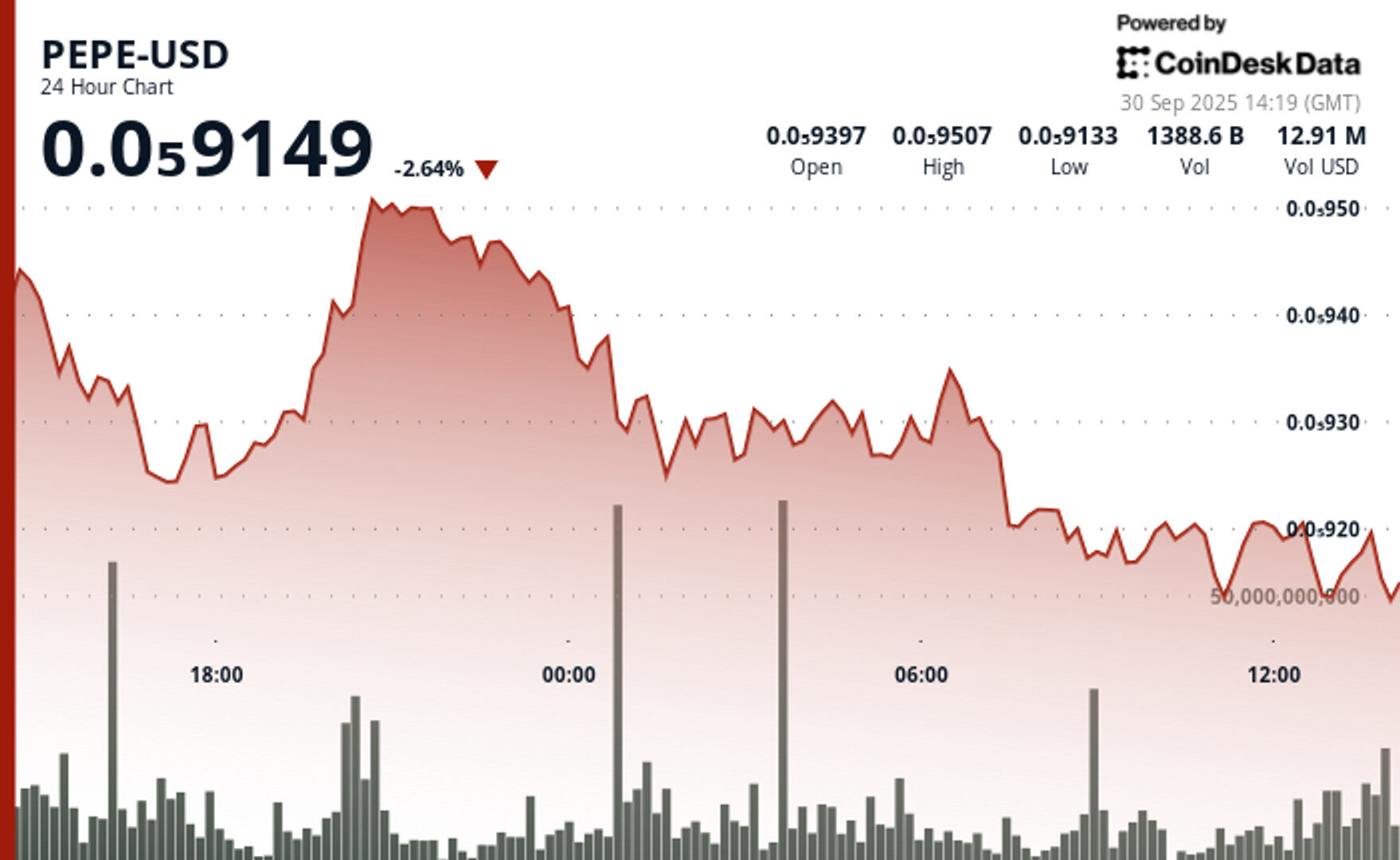

- PEPE fell 2.6% in 24 hours to $0.0000915, underperforming the wider crypto market but slightly outperforming the wider memecoin sector.

- Despite the drop, PEPE’s derivatives market activity remains strong, with open interest reaching $560 million and trading volume at $1.2 billion.

- Traders are focused on whether PEPE can maintain support above $0.000091 or risks a further decline, with a break above $0.000095 potentially shifting sentiment.

Meme-inspired cryptocurrency PEPE fell 2.6% over the past 24 hours to trade near $0.0000915, significantly underperforming the wider crypto market as the CoinDesk 20 (CD20) index is down 1.4% in the same period.

The token traded in a range between $0.0000913 and $0.0000951, with a brief attempt at a rally stalling near resistance before giving way to a slow decline, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The session opened near $0.0000939 and peaked early around $0.000095 before consistent selling pressure weighed on the token. PEPE’s price steadily declined throughout the overnight and morning hours, briefly consolidating near $0.000092 before sliding lower.

Despite the drop, activity in derivatives markets continued to build and PEPE has managed to outperform the memecoin sector, which as measured by the CoinDesk Memecoin Index (CDMEME) is down 3% in the past 24 hours.

Open interest in PEPE futures reached $560 million according to CoinGlass data, while total trading volume climbed to $1.2 billion.

For now, market watchers are focused on whether PEPE can maintain its foothold above the $0.000091 support zone or risks slipping toward lower ranges.

A break above $0.000095 could shift sentiment, but any such move would need to be supported by stronger volume and confirmation from broader market conditions.

PEPE’s 24-hour trading range covered a $0.0000034 spread, about 4% between session highs and lows. Sellers consistently emerged near $0.000095, making it a clear resistance level for now.

Support near $0.000092 held up during early and mid-session tests but weakened into the final hours. The token showed signs of a higher low formation earlier in the session, a structure often associated with bullish accumulation.

However, declining volume into the close paints a picture of hesitation, not conviction.Temporary surges in trading activity suggest some positioning during short-term breakout attempts, but those efforts lost steam as volume fell off.

Unless buyers return in force, the recent attempt at consolidation may give way to a broader retracement.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Helene Braun, AI Boost|Edited by Stephen Alpher

7 minutes ago

Issuers race against the clock as SEC faces possible furloughs and decision deadlines pile up in October.

What to know:

- A looming U.S. government shutdown threatens to delay SEC decisions on several crypto ETFs, including funds tied to solana and litecoin.

- The SEC had been actively reviewing updated filings, with some issuers expecting approvals as early as next week.

- October decision deadlines for products like Canary Capital’s Litecoin ETF could slip into limbo if key SEC staff are furloughed.