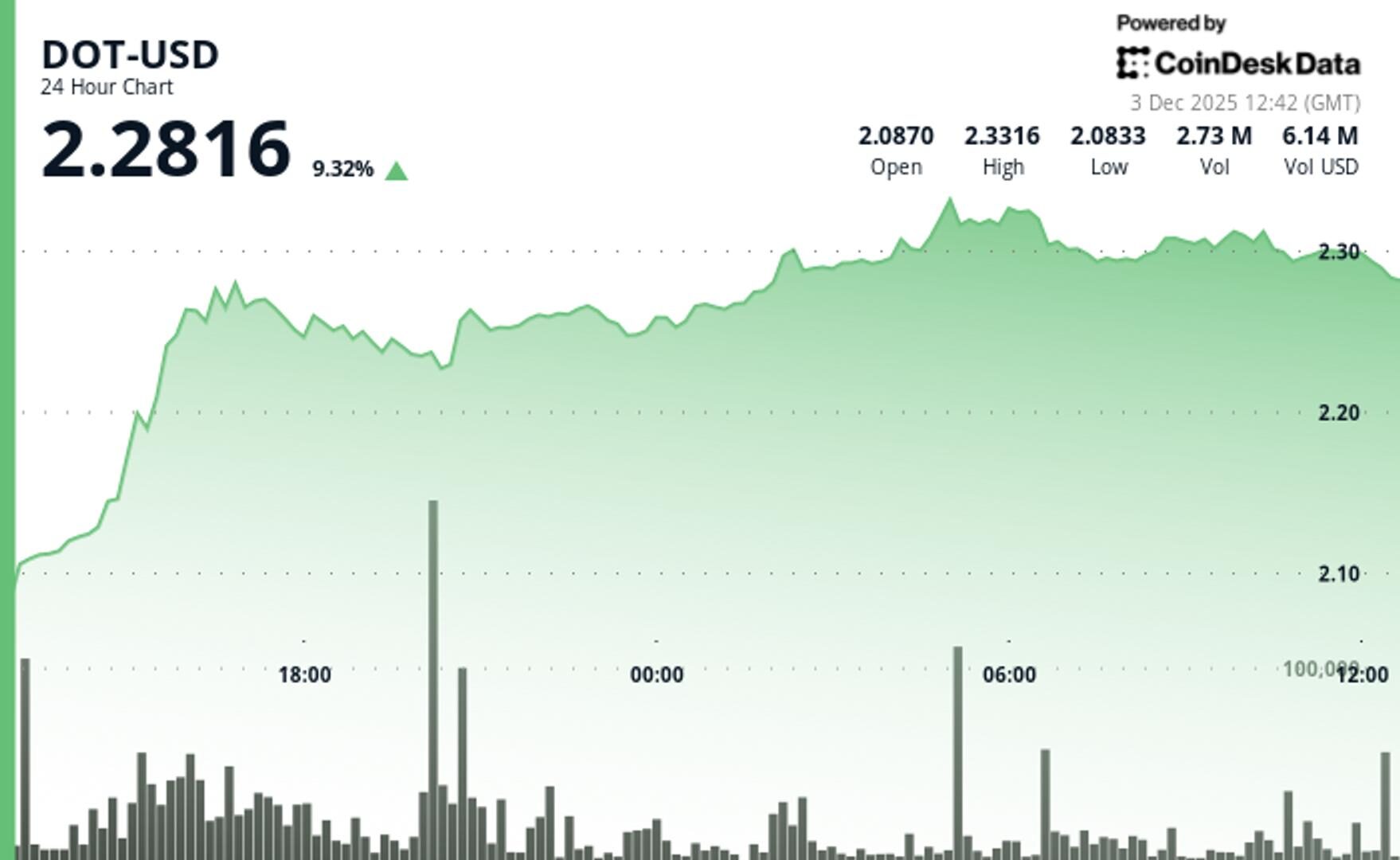

Polkadot Gains 9% After Breaking Key $2.25 Resistance

DOT outperformed the broader crypto market as a 60% volume surge validated the breakout above a critical technical threshold.

By Will Canny, CD Analytics|Edited by Jamie Crawley

Dec 3, 2025, 1:03 p.m.

- DOT climbed from $2.08 to $2.28, posting 9.2% gain with clear uptrend structure

- Trading volume jumped 60% above weekly average, signaling institutional interest

Polkadot gained 9.2% to $2.28 over the last 24 hours, outperforming the broader crypto market.

DOT punched through the critical $2.25 resistance level that capped previous rallies, according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

The model showed that trading volume surged 60% above the seven-day average, confirming genuine institutional interest behind the breakout move.

The price action showed a textbook ascending pattern as DOT climbed from $2.08 to $2.30 across an 11.6% range, according to the model.

Higher lows formed at $2.08, $2.23, and $2.29, establishing clear bullish momentum, the model said.

A double-top formation around $2.301 signals near-term resistance.

Wider crypto markets also surged higher, with the broader market gauge, the CoinDesk 20 index up 8%

- Former $2.25 resistance now serving as key floor; upside faces $2.30-$2.301 double-top formation

- Trading activity 60% above 7-day average confirms institutional flows beyond algorithmic noise; peak volume at breakout validates $2.25 as significant technical milestone

- Ascending trend with higher lows at $2.08, $2.23, and $2.29 supports bullish structure; double-top near $2.301 suggests consolidation before potential continuation

- Clear break above $2.31 opens further upside with $2.25 support providing defined risk; current levels offer favorable risk-reward for continuation trades

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Olivier Acuna|Edited by Jamie Crawley

34 minutes ago

The sustained accumulation of capital by spot XRP ETFs is establishing XRP as the fastest-growing major crypto-asset vehicle.

What to know:

- U.S. spot XRP ETFs have maintained positive momentum for twelve consecutive days, with net inflows reaching $844.9 million as of December 2.

- The rapid growth of XRP ETFs is driven by institutional demand, approaching the $1 billion milestone and expanding regulated crypto exposure beyond bitcoin and ether.

- Wall Street firms like Fidelity, Invesco, and Franklin Templeton have filed to list spot XRP ETFs, highlighting growing interest in this asset class.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language