Polkadot (DOT) falls as token underperforms wider crypto markets

By Will Canny, CD Analytics|Edited by Stephen Alpher

Dec 29, 2025, 1:44 p.m.

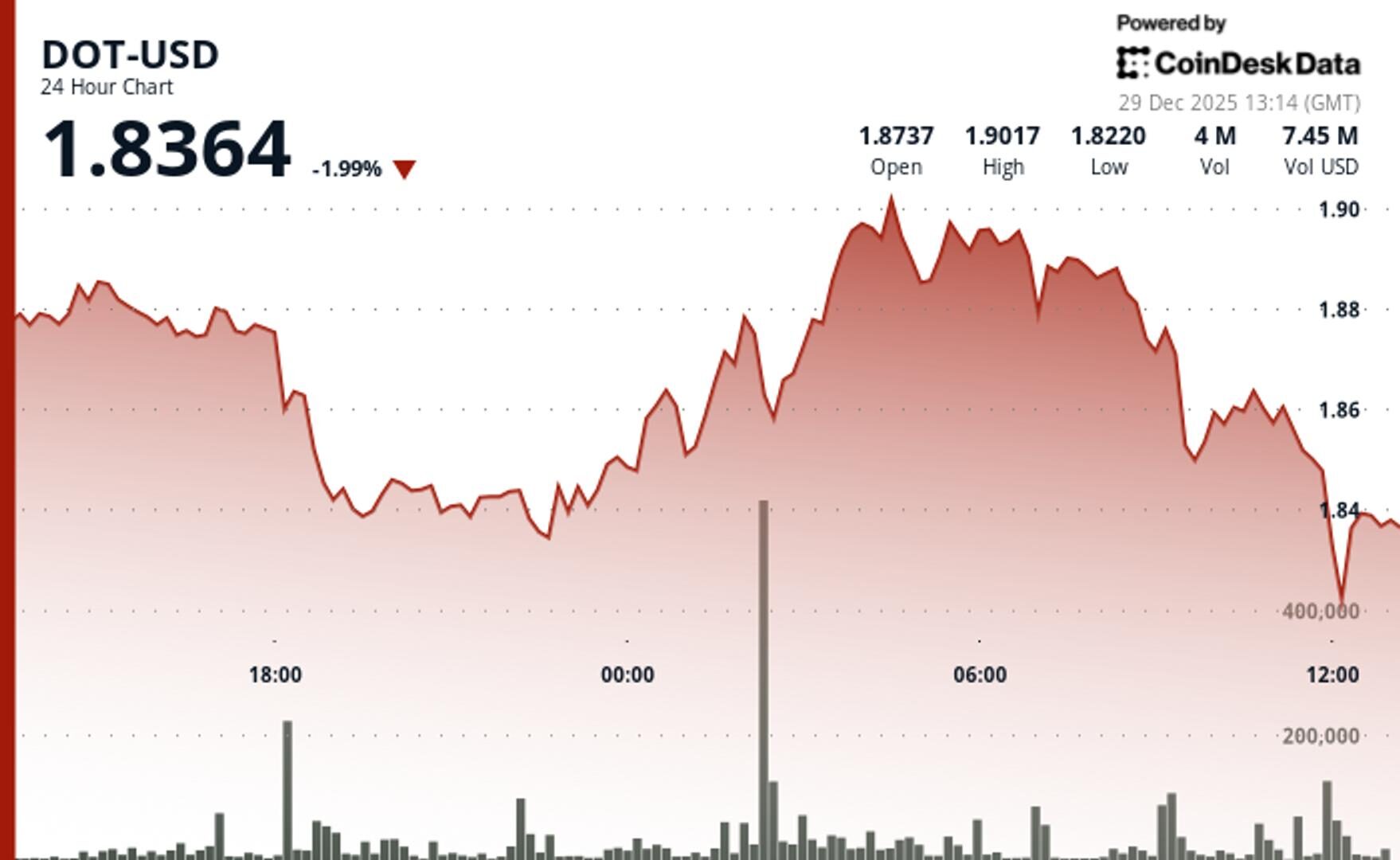

- DOT slipped 2% to $1.84 as the wider crypto market fell just marginally.

- A technical breakout would target the $2.00-$2.50 range.

DOT$1.8901 fell 2% to $1.84 over the last 24 hours.

Trading volumes were 7.8% above the seven-day moving average at 7.76 million tokens, according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

The model showed that the move in DOT occurred without clear fundamental catalysts as technical factors dominated price action.

The token underperformed the broader crypto market. The CoinDesk 20 index was 0.6% lower at publication time.

This modest divergence reflects sector rotation dynamics rather than fundamental weakness in Polkadot’s positioning, according to the model.

In the absence of clear fundamental drivers, technical resistance at $1.88 became paramount, the model said, as DOT worked through a volatile consolidation pattern.

Technical Analysis:

- Primary resistance sits at $1.88 with confirmed selling pressure at this level

- Support base tested at $1.83, immediate support now at $1.825-$1.830 zone

- Upside targets identified at $2.00-$2.50 based on structural break patterns

- 24-hour volume averaged 7.8% above seven-day moving average indicating organic discovery

- Higher lows formed from $1.83 base during initial consolidation phase

- Short liquidation levels above $2.00 provide potential upside catalyst

- Immediate downside risk at $1.825-$1.830 support zone requires monitoring

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

54 minutes ago

Strategy, the largest public BTC holder resumes buying, lifting holdings to 672,497 coins.

What to know:

- Strategy purchased 1,229 bitcoin for $108.8 million last week at an average price of $88,568, lifting total holdings to 672,497 BTC.

- The purchase was funded through the sale of $108.8 million in common stock, with MSTR shares down 1% in premarket trading as bitcoin slipped towards $87,000.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language