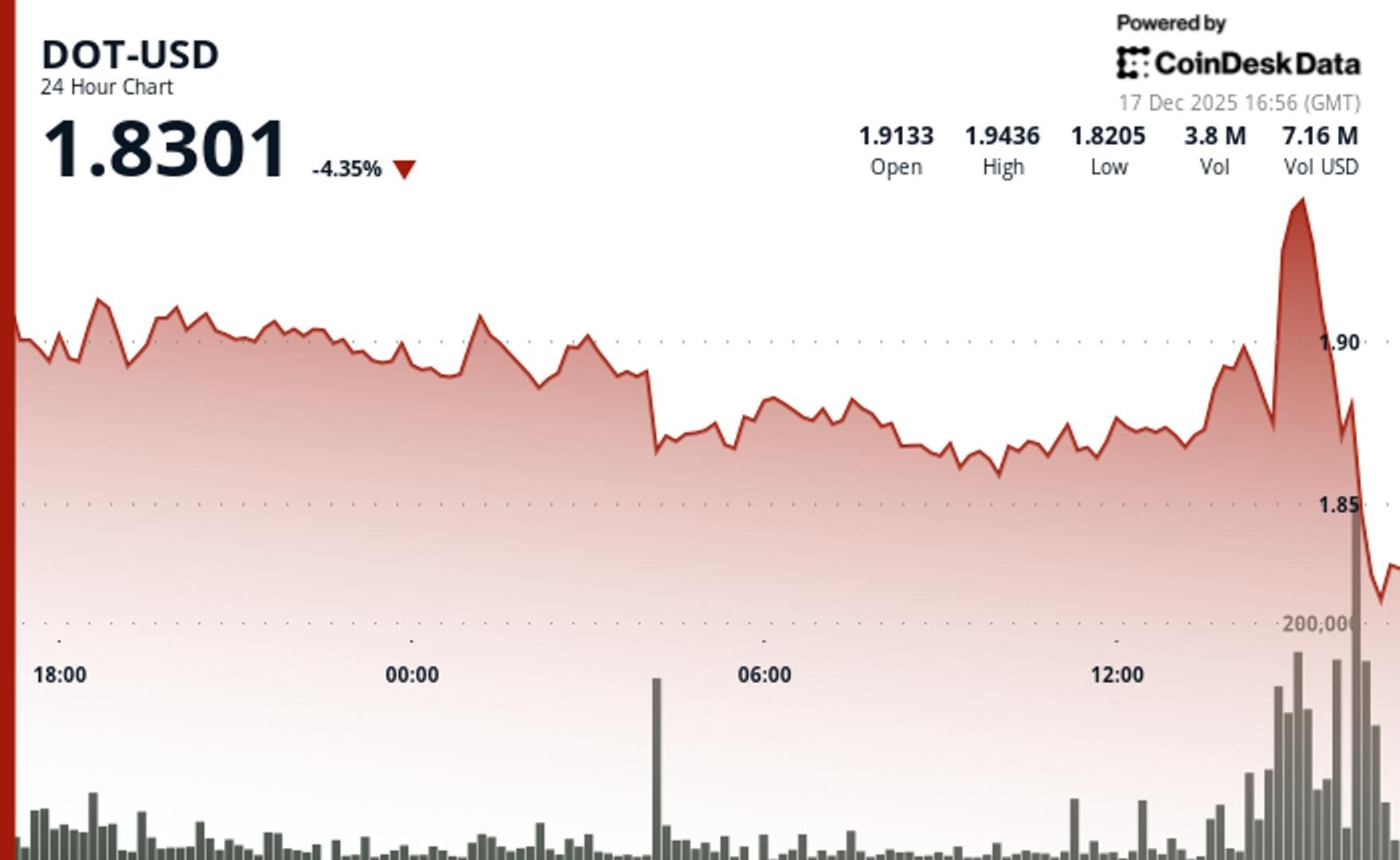

DOT drops 3% to $1.83 as crypto markets reverse lower

Strong selling pressure overwhelmed positive Coinbase integration news as the psychological $1.90 level failed to hold.

By CD Analytics, Will Canny|Edited by Stephen Alpher

Dec 17, 2025, 5:28 p.m.

- DOT declined from $1.91 to $1.84 over 24 hours, breaking key support levels

- Volume was 340% above average during the final breakdown.

DOT$1.8273 crashed through critical support Wednesday, tumbling 3% to $1.83 as technical selling overwhelmed bullish USDC integration news.

DOT broke decisively below the psychological $1.90 floor despite Coinbase (COIN) announcing direct Polkadot network support.

STORY CONTINUES BELOW

Heavy distribution emerged during the final two trading hours, according to CoinDesk Research’s technical analysis model, as the token collapsed from $1.93 to $1.82 and stop-losses cascaded through multiple support zones.

The model showed that volume spiked to 9.47 million tokens, or 340% above the 24-hour average.

This surge confirmed institutional distribution at the $1.95 level, the model said.

The breakdown established clear bearish momentum with lower highs from the $1.92 peak, according to the model.

Wider crypto markets also fell. The CoinDesk 20 index was 2% lower at publication time.

- Primary support established at $1.82 demand zone after $1.90 psychological level failed

- Resistance now sits at broken $1.90 level, with secondary barrier at $1.95 rejection point

- Breakdown volume at 340% of 24-hour average confirmed institutional distribution

- Descending channel formed from $1.92 high through $1.90 support break

- Lower highs structure established bearish intermediate-term bias

- Failed breakout above $1.95 created double-top formation risk

- Immediate resistance at $1.90 must hold as support on any recovery attempt

- Downside risk extends toward $1.75-1.80 zone if current support fails

- Recovery above $1.95 needed to negate bearish technical structure and resume uptrend

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Will Canny|Edited by Stephen Alpher

17 minutes ago

The token has resistance at the $1.53 and then the $1.64 levels.

What to know:

- APT fell from $1.59 to $1.51 over the 24-hour period.

- Volume jumped 23% above the 30-day moving average, signaling institutional participation.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language