-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Will Canny|Edited by Cheyenne Ligon

Aug 11, 2025, 1:24 p.m.

- DOT declined 6% from its intraday high.

- Selling by institutional investors triggered the reversal.

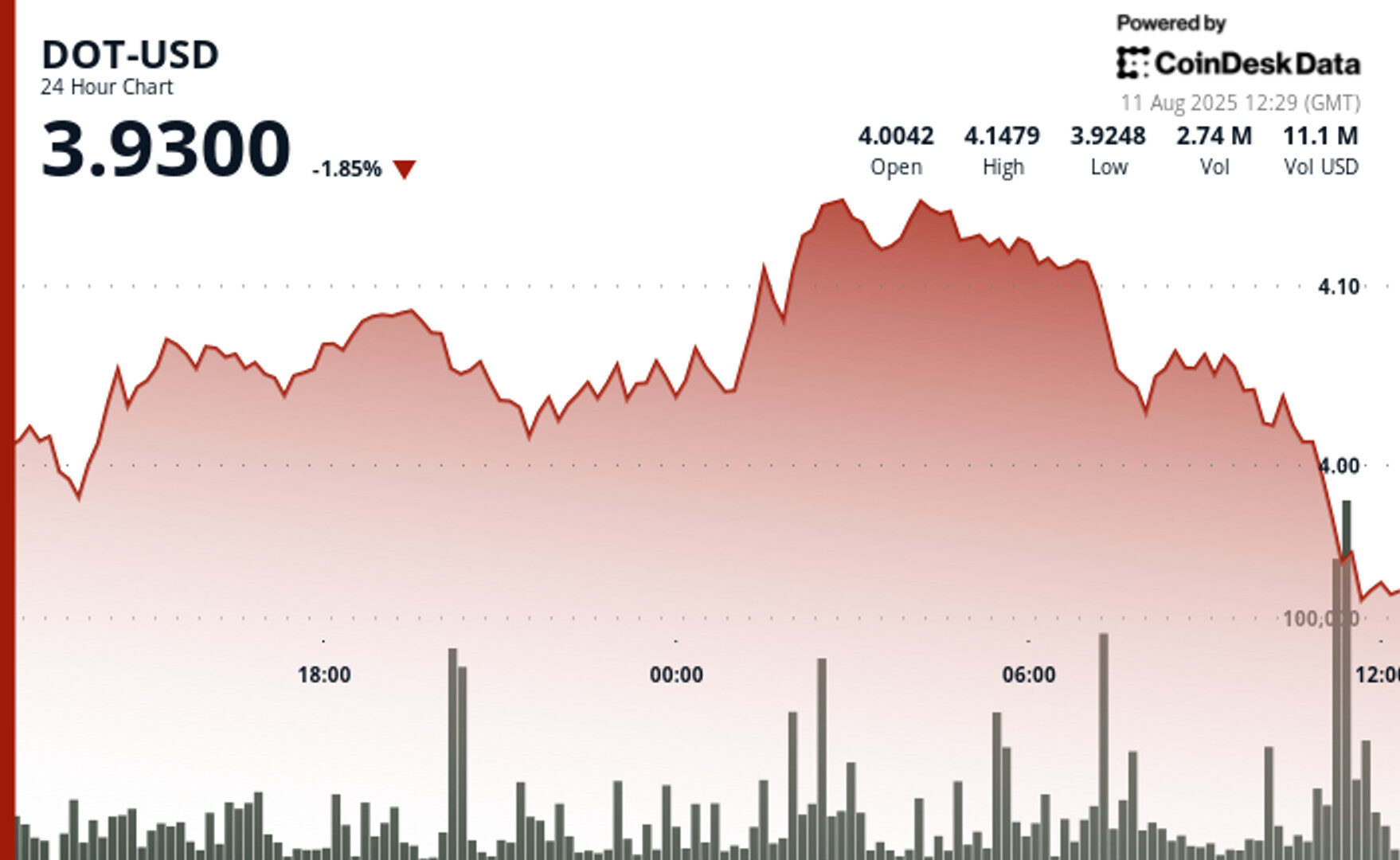

Polkadot’s DOT experienced considerable volatility in the 24-hour trading period with sharp declines wiping out earlier gains, according to CoinDesk Research’s technical analysis model.

The model showed that DOT plummeted 6% in a dramatic 24-hour reversal from August 10 12:00 to August 11 11:00, declining from $4.15 to $3.91 amid exceptionally robust selling volume.

STORY CONTINUES BELOW

Polkadot faced strong selling pressure as institutional liquidation drove prices lower, breaching multiple support thresholds, according to the model.

The decline in DOT came as the wider crypto market rose, with the broader market gauge, the Coindesk 20, recently up 0.5%.

In recent trading, Polkadot was 2.6% lower over 24 hours, trading around $3.91.

Technical Analysis:

- Trading range of $0.24 representing 6% volatility between $3.91 and $4.15 thresholds.

- Volume surge to 4.96 million during final hour decline indicating institutional selling.

- Resistance established at $4.15 level following aborted rally attempt.

- Support level fragile near $3.90 with potential breakdown risk.

- Lower highs formation confirming bearish market structure deterioration.

- Volume exceeding 300,000 across multiple intervals during 11:15-11:30 selling pressure.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Will Canny is an experienced market reporter with a demonstrated history of working in the financial services industry. He’s now covering the crypto beat as a finance reporter at CoinDesk. He owns more than $1,000 of SOL.

More For You

By Shaurya Malwa|Edited by Parikshit Mishra

1 hour ago

Roughly $13 million has reached global VASPs, while $18.8 million sits idle in unattributed wallets — likely to slow detection and await more favorable movement conditions.

What to know:

- Ransomware group Embargo has generated over $34 million since April 2024, potentially rebranding from the defunct BlackCat operation.

- The group targets U.S. sectors like healthcare and manufacturing, demanding ransoms as high as $1.3 million.

- Embargo uses double extortion tactics and may be leveraging AI to enhance phishing and reconnaissance efforts.