-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Krisztian Sandor, AI Boost|Edited by Sheldon Reback

Sep 1, 2025, 3:52 p.m.

- Polygon’s native token, POL, surged 16% over the weekend, reaching $0.29 for the first time since March.

- The surge occurred despite the broader crypto market remaining steady, with bitcoin and ether showing only modest gains.

- Positive developments, such as the U.S. government’s blockchain initiative and a new integration with a Tether-focused protocol, may have supported POL’s performance.

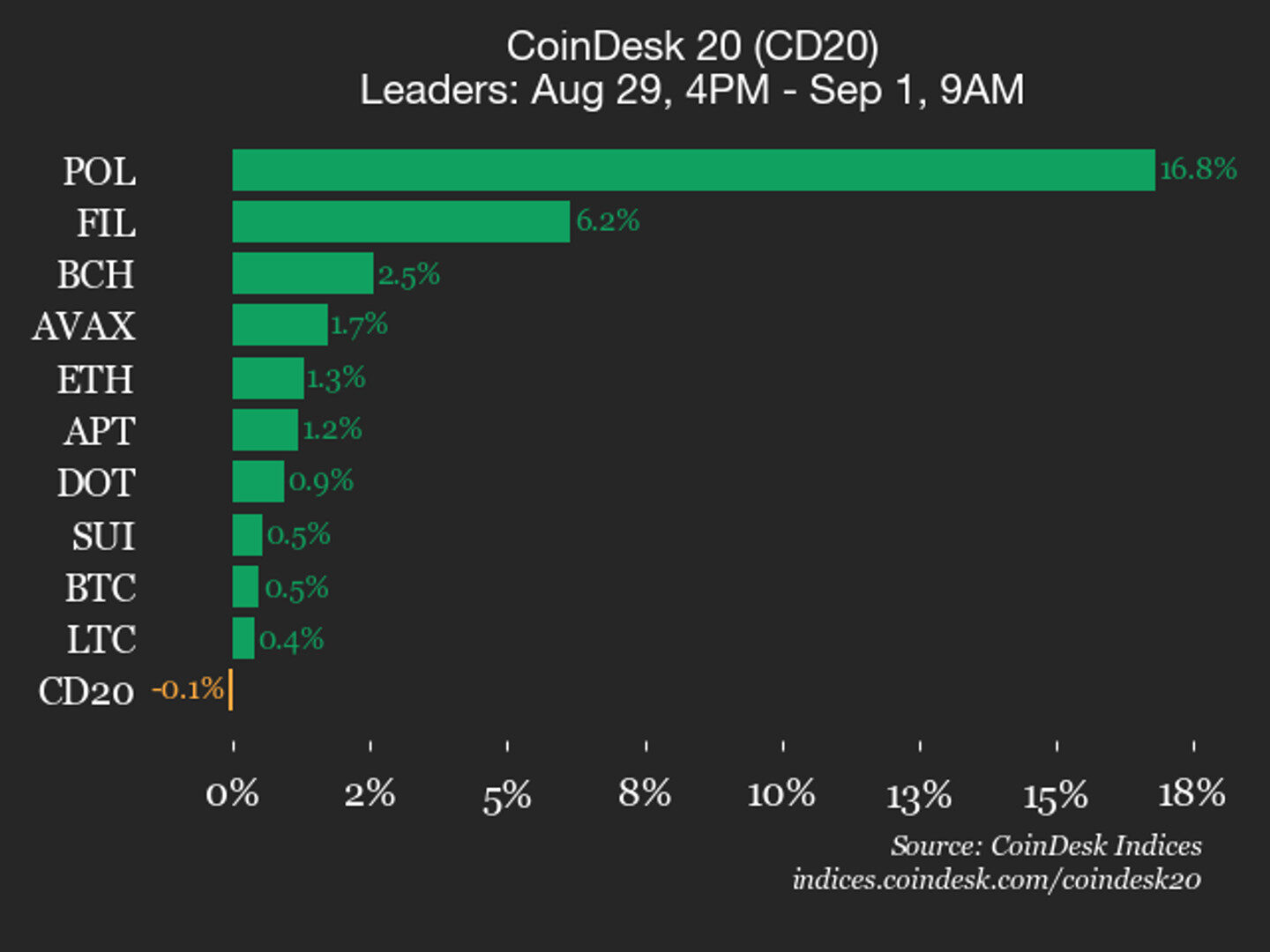

The native token of Polygon (POL), an Ethereum scaling network, led gains through the weekend in the broad-market crypto benchmark CoinDesk 20 Index .

POL surged 16% from Friday through early Monday, topping $0.29 for the first time since early March, CoinDesk data shows. Recently, it pared back some of the advance slipping below $0.28.

STORY CONTINUES BELOW

The move happened as the CD20 remained little changed with bitcoin BTC$109,034.49 and Ethereum’s ether (ETH) posting only modest gains.

While there wasn’t any clear catalyst behind POL’s surge, some positive developments may have bolstered the token’s performance.

Polygon was one of the chains mentioned last week in the U.S. government’s initiative to release key economic data such as GDP on blockchain rails.

The network also announced an integration last week with USDT0, a Tether-focused cross-chain stablecoin protocol, that could help boost the network’s position as a key liquidity hub for stablecoin flows.

On the technical front, POL’s breakout signals strong bullish momentum, CoinDesk’s Research model showed. Despite the consolidation from its recent peak, buying pressure in the $0.277-$0.278 range could signals continued support for further gains, the model said.

Read more: U.S. Government Starts Pushing Economic Data Onto Blockchains as ‘Proof of Concept’

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

9 minutes ago

Network upgrades trigger exchange halts while African expansion fuels institutional buying amid volatile price action.

What to know:

- XLM faced sharp volatility, trading between $0.34 and $0.36 in a 24-hour window, with heavy selloffs and volume spikes exceeding 70 million units.

- Bithumb will suspend deposits Sept. 3 as Stellar undergoes critical network upgrades, even as Ripple’s bank pilots boost sector confidence.

- Stellar is expanding in Africa, pushing mobile money integrations in Nigeria, Kenya and Ghana, with analysts still eyeing long-term targets of $0.62–$0.95 despite recent declines.