-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa|Edited by Oliver Knight

Updated Aug 8, 2025, 8:57 a.m. Published Aug 8, 2025, 8:57 a.m.

- Pump.fun has launched the Glass Full Foundation to provide liquidity to select projects as its revenues decline.

- The foundation will inject liquidity into ecosystem tokens, but has not disclosed funding sources or selection criteria.

- Pump.fun’s daily revenue has dropped from $7 million in January to $200,000 recently, while rival LetsBonk.fun gains market share.

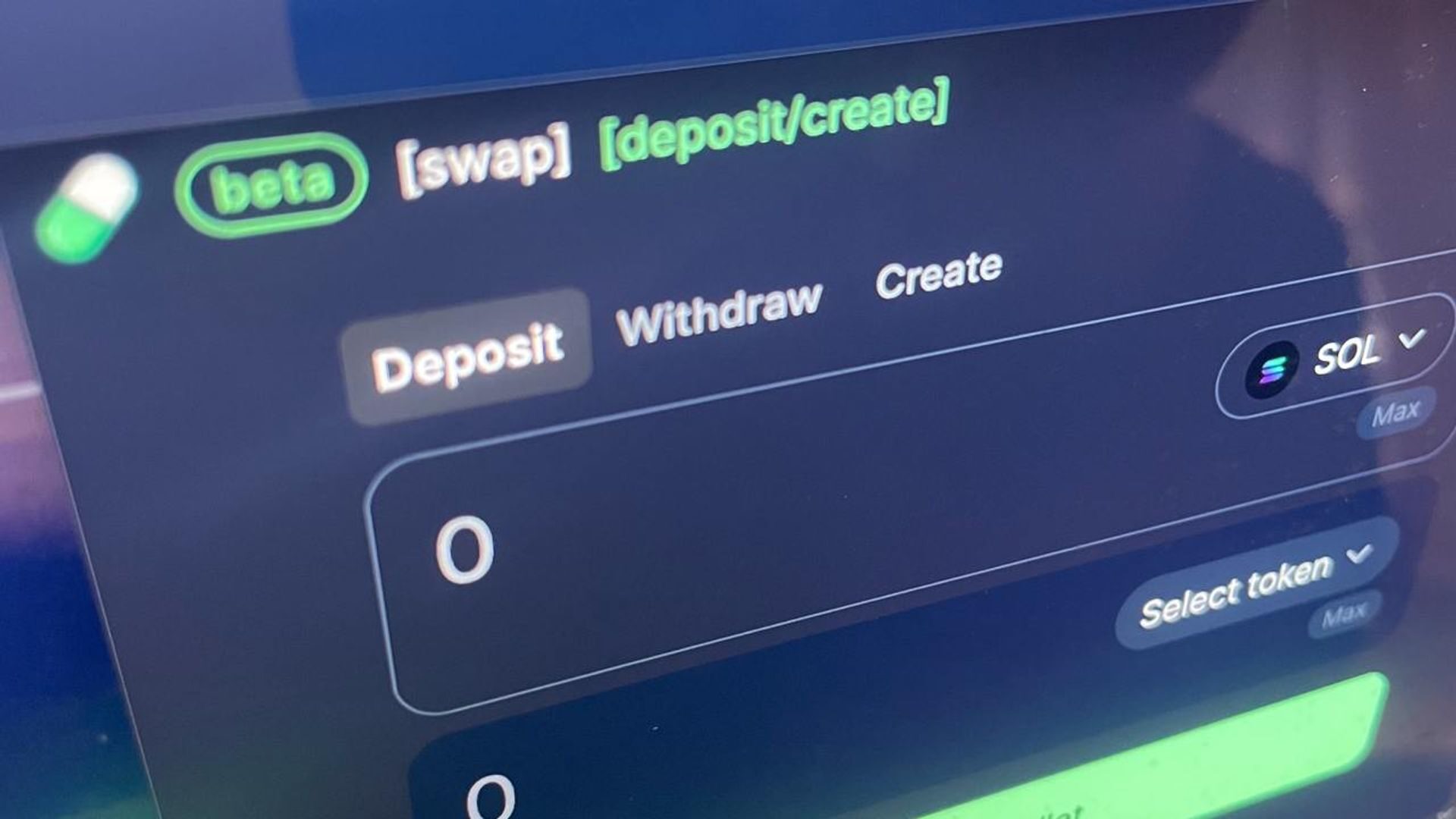

Solana memecoin launchpad Pump.fun has created the Glass Full Foundation, an initiative aimed at providing liquidity to selected projects in its ecosystem as platform revenues slide from early-year highs.

The group said GFF will “inject significant liquidity into ecosystem tokens to support our most diehard cults,” without disclosing the source of funds or the selection criteria for recipients. Initial deployments have already been made, with more planned, according to posts on X.

STORY CONTINUES BELOW

The top Pump ecosystem token is fartcoin (FART), valued at over $1 billion as of Friday. The second-largest token is peanut the squirrel — a reference to a viral Instagram pet that was put down last year to huge social media backlash — which boasts a market cap over $253 million.

The Glass Full announcement comes as Pump.fun’s daily revenue has dropped sharply from more than $7 million at the height of January’s memecoin frenzy to around $200,000 earlier this month, based on on-chain data.

That slump came as LetsBonk.fun, a rival Solana launchpad tied to the Bonk community, gained market share in recent weeks to become the highest grossing and most-active launchpad by issuances last month.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

More For You

By Sam Reynolds|Edited by Parikshit Mishra

10 minutes ago

IVD Medical’s ETH buy will serve as both the backbone of its ivd.xyz tokenization platform and a yield-generating treasury asset, powering settlements, stablecoin backing, and staking strategies.

What to know:

- IVD Medical Holdings has invested $19 million ether to support its strategy of tokenizing healthcare assets.

- The company plans to utilize Ethereum for on-chain ownership confirmation and automated revenue distribution.

- IVD’s move aligns with a partnership with HashKey Group, enhancing its crypto treasury alongside other Hong Kong-listed companies.