BTC

$110,984.16

+

2.02%

ETH

$2,778.33

+

5.68%

USDT

$1.0004

+

0.03%

XRP

$2.4195

+

4.02%

BNB

$672.59

+

1.27%

SOL

$157.12

+

2.60%

USDC

$1.0000

+

0.01%

TRX

$0.2915

+

1.59%

DOGE

$0.1806

+

4.85%

ADA

$0.6202

+

4.18%

HYPE

$41.44

+

5.57%

SUI

$3.1494

+

7.37%

BCH

$511.20

+

0.52%

WBT

$46.35

+

3.62%

LINK

$14.28

+

1.23%

XLM

$0.2891

+

8.96%

LEO

$8.9796

–

0.48%

AVAX

$19.40

+

5.23%

HBAR

$0.1753

+

7.59%

SHIB

$0.0₄1244

+

4.60%

By Shaurya Malwa|Edited by Parikshit Mishra

Jul 10, 2025, 5:22 a.m.

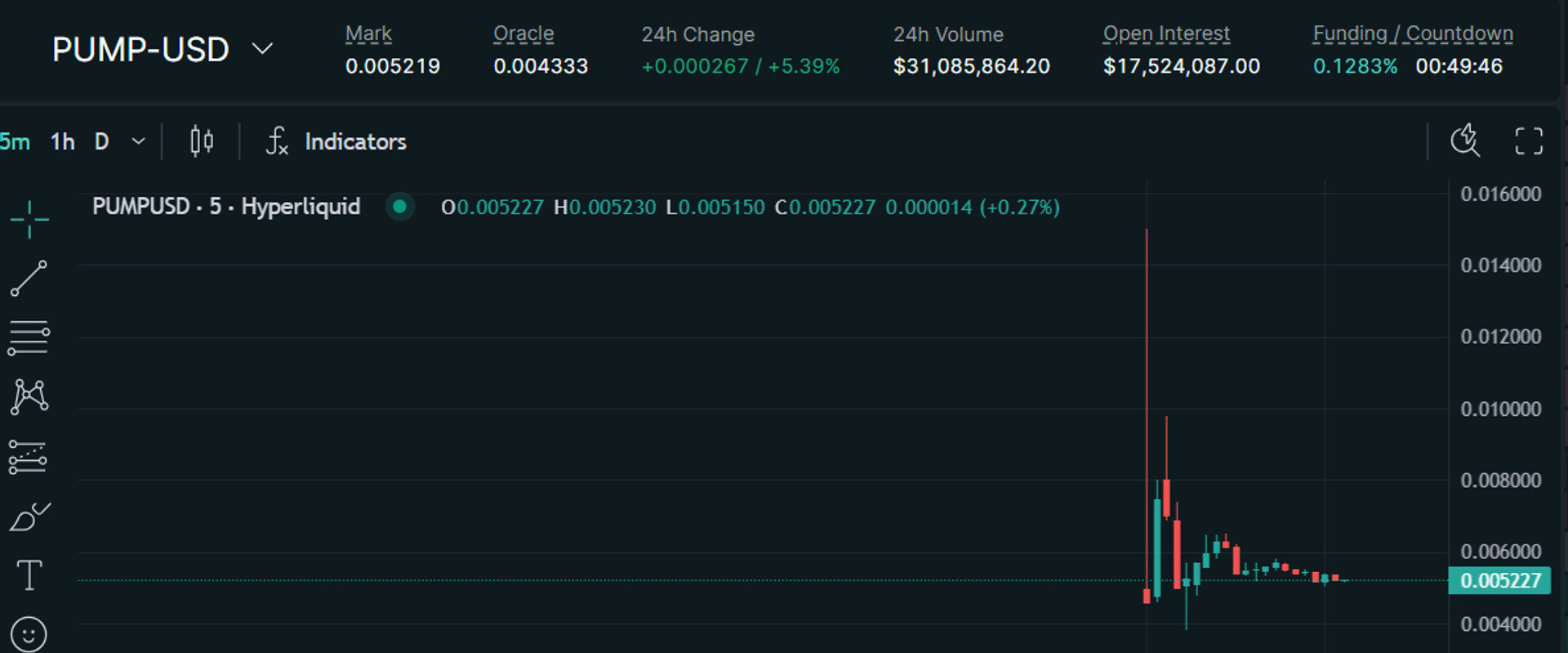

- Pump.fun’s token, PUMP, is trading at $0.0056, 40% above its ICO price, ahead of its July 12 sale.

- The PUMP-USD perpetual pair launched on July 9, generating $30 million in trading volume in its first 24 hours.

- Pump.fun aims to create a decentralized social platform as a Web3 alternative to TikTok, Twitch, and Facebook.

Pump.fun’s official token, PUMP, is trading at a mark price of $0.0056 on derivatives platform Hyperliquid, a value 40% above its upcoming ICO price, as futures begin pricing in demand ahead of the July 12 token sale.

The token’s PUMP-USD perpetual pair went live on July 9 following community requests, offering up to 3x leverage. In its first 24 hours, the pair generated $30 million in trading volume, suggesting strong speculative interest despite the token not yet being live on-chain.

STORY CONTINUES BELOW

Open interest stood at over $17 million as of Asian morning hours Thuesday, but activity is expected to accelerate after Binance Futures launches its own PUMP perpetual contract on July 10 at 07:30 UTC.

The Pump.fun ICO will distribute 33% of PUMP’s total 1 trillion token supply, with 18% already sold in a private round and 15% reserved for the public sale, both priced at $0.004. All tokens will be fully unlocked at launch.

Pump.fun is positioning the token as part of a broader strategy to build a decentralized social platform pitched as a Web3-native alternative to TikTok, Twitch, and Facebook, where users are rewarded with money, not just engagement.

The protocol has already generated over $600 million in revenue, largely from fees on meme coin launches, and has been at the center of Solana’s low-friction token boom since early 2024.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.