-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 20, 2025, 6:40 a.m. Published Aug 20, 2025, 6:40 a.m.

- Dogecoin’s price fell sharply after the Qubic blockchain community voted to target it for a potential 51% attack.

- Despite security concerns, large holders accumulated 680 million DOGE in August, indicating long-term interest.

- DOGE futures open interest declined by 8%, reflecting reduced confidence in short-term gains.

Dogecoin tumbled sharply on Tuesday after the Qubic blockchain community voted to target DOGE for a potential 51% attack, days after it claimed responsibility for compromising Monero’s network. Security fears collided with broad crypto weakness, pushing DOGE into heavy sell pressure despite continued whale accumulation.

• Qubic’s governance forum approved a proposal to direct hashpower toward Dogecoin, raising the possibility of a coordinated 51% attack. The group recently executed a similar move against Monero, successfully disrupting block validation.

• The news fueled jitters across the Dogecoin community, with traders pricing in heightened security risks.

• At the same time, whales accumulated 680 million DOGE in August, showing long-term interest despite the threat.

• Derivatives positioning weakened, with DOGE futures open interest sliding 8%, signaling declining confidence in near-term upside.

STORY CONTINUES BELOW

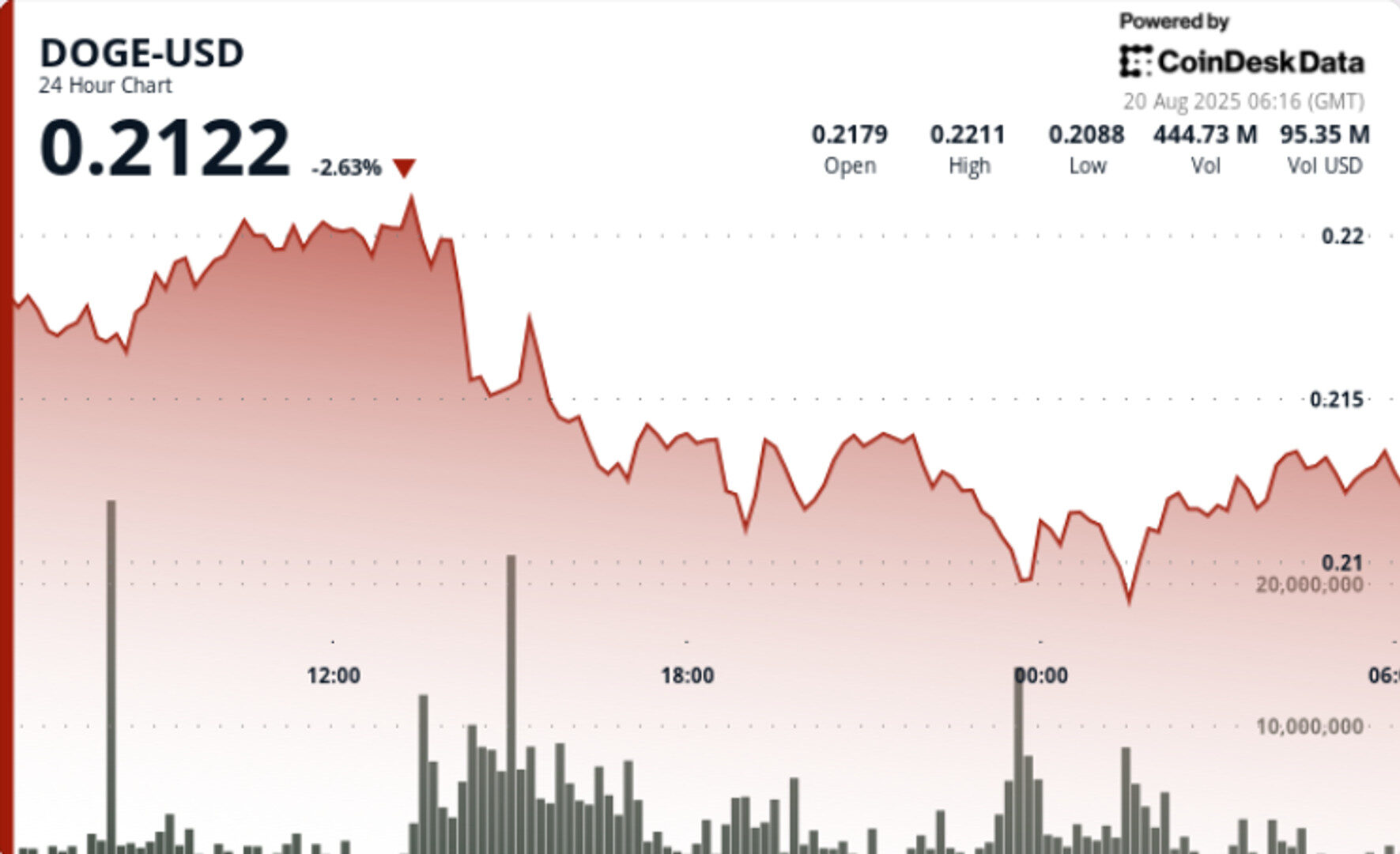

• DOGE dropped 5% in the 24-hour period from August 19 06:00 to August 20 05:00, falling from $0.22 to $0.21.

• The heaviest selling occurred between 13:00-15:00 UTC on August 19, when DOGE crashed from $0.22 to $0.21 amid 916 million tokens traded — double the 24-hour average.

• $0.22 emerged as a strong resistance zone after repeated rejections, while $0.21 acted as a key support level into the close.

• Overnight action was range-bound, with DOGE oscillating between $0.2120-$0.2130 before closing at $0.2124.

• Resistance: $0.22 confirmed as heavy supply zone with high-volume rejection.

• Support: $0.21 holding as a psychological floor, with risk of a $0.208 retest if selling persists.

• Volume: 916 million traded, up 100% over baseline, reflecting panic selling.

• Structure: Range-bound consolidation between $0.2120-$0.2130 in late hours shows uncertainty rather than recovery momentum.

• Futures: Open interest fell 8%, suggesting leverage longs are unwinding.

• Whether Qubic follows through on its DOGE attack plan after Monero disruption.

• Whale accumulation versus retail capitulation — will large players defend $0.21 support?

• Market reaction to continued declines in derivatives open interest.

• A decisive move above $0.22 or below $0.21 to set next directional bias.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Shaurya Malwa, CD Analytics

1 hour ago

The SEC delayed rulings on multiple XRP ETF applications, including Nasdaq’s CoinShares filing, until October.

What to know:

- XRP fell below $3.00 due to security concerns and regulatory delays.

- A security audit ranked XRP Ledger lowest among 15 blockchains, affecting investor confidence.

- The SEC’s delay on XRP ETF applications has increased market uncertainty.