-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Updated Aug 12, 2025, 4:15 a.m. Published Aug 12, 2025, 4:14 a.m.

- XRP fell 2% from $3.19 to $3.14 in the 24-hour period ending August 12, after reaching an intraday high of $3.32.

- Ripple Labs and the SEC have settled their legal dispute, boosting XRP trading volumes by 208% to $12.4 billion.

- Despite the settlement, XRP’s price remains influenced by macroeconomic factors, including trade disputes and monetary policy shifts.

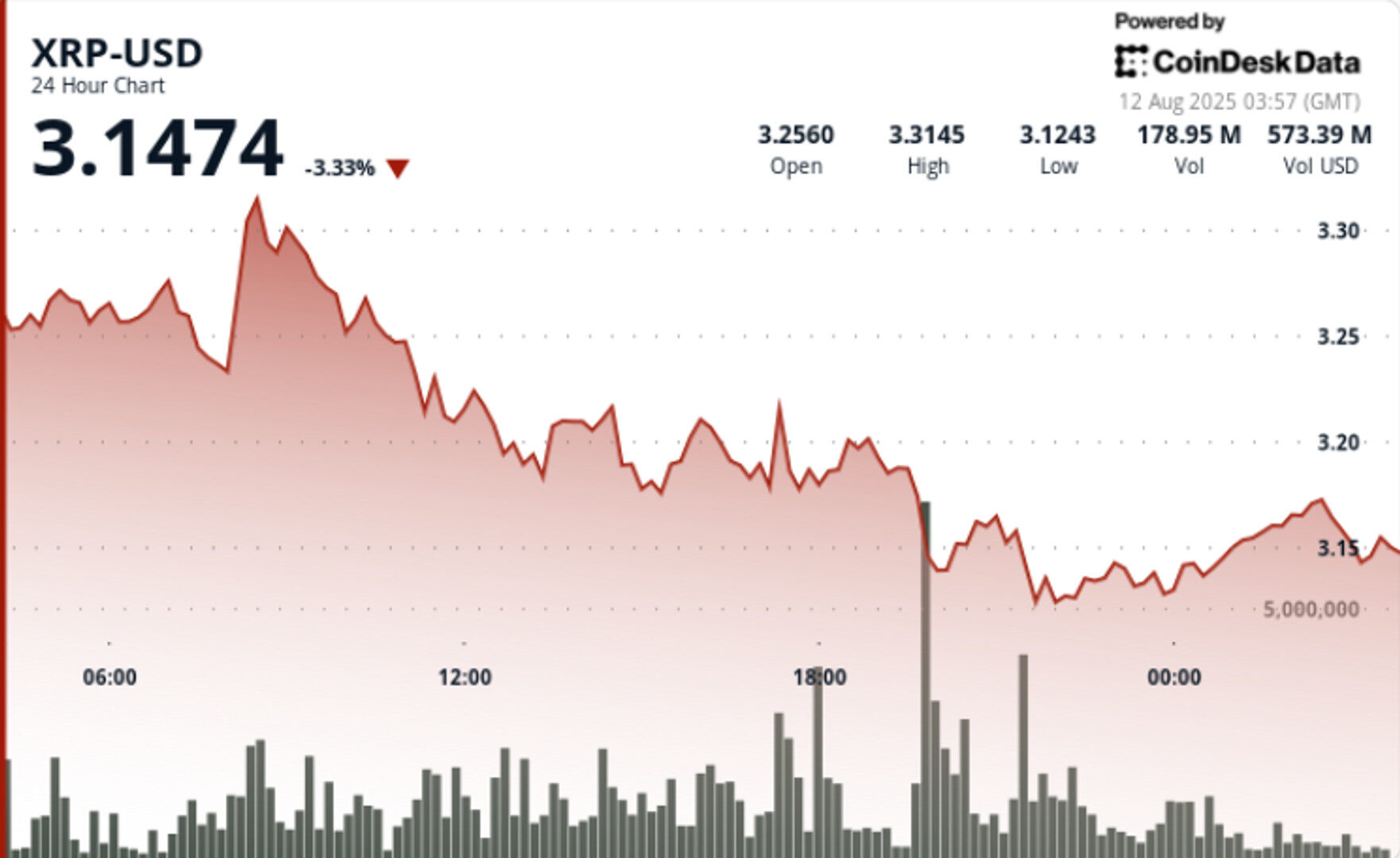

XRP drops 2% in the 24-hour period ending August 12, sliding from $3.19 to $3.14 after touching an intraday peak of $3.32 at 08:00. The move comes after two days of double-digit gains on regulatory clarity, with selling pressure concentrated in the 19:00 hour — a $3.20 to $3.15 drop on 73.87 million volume.

Support holds at $3.13 after multiple successful tests, while resistance builds at $3.27, setting a defined near-term range. Final-hour trade sees a bounce from $3.13 to $3.14 on late buying, with volume spikes of 3.21M and 4.45M signaling dip-buying interest.

STORY CONTINUES BELOW

Ripple Labs and the Securities and Exchange Commission have formally ended their nearly five-year legal battle, jointly dismissing appeals in the XRP case. The settlement removes a significant compliance overhang, unlocking greater institutional participation. Daily trading volumes have jumped 208% to $12.4B since the announcement, with open interest also climbing.

Despite the legal breakthrough, broader crypto sentiment remains tied to macro factors, including ongoing international trade disputes and shifting monetary policy expectations.

• XRP declines from $3.19 to $3.14 in the August 11 01:00–August 12 00:00 window

• Intraday peak of $3.32 at 08:00 meets heavy resistance, triggering selloff

• 19:00 hour sees $3.20 to $3.15 drop on 73.87M volume — session’s heaviest print

• Support confirmed at $3.13; resistance locked at $3.27

The pullback reflects natural profit-taking after XRP’s post-settlement rally. Large holders appear to be rebalancing positions while maintaining bids at $3.13-$3.15, indicating no deterioration in longer-term sentiment. Macro uncertainty continues to influence broader flows, though XRP’s regulatory clarity gives it relative insulation versus peers.

• Support: $3.13 (multiple volume-backed tests)

• Resistance: $3.27-$3.32 (repeated rejection)

• Intraday range: $0.19 (6% volatility)

• Heavy 19:00 volume suggests coordinated institutional selling

• Late-session accumulation keeps price above $3.13

• Breakout potential above $3.27 to resume upward momentum

• Stability of $3.13 support on further profit-taking waves

• Persistence of institutional inflows post-regulatory settlement

• Macro spillover effects from trade and monetary policy developments

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

More For You

By Shaurya Malwa, CD Analytics

46 minutes ago

Memecoin slides sharply on high-volume distribution before consolidating near key support levels.

What to know:

- DOGE fell 6.88% from $0.24 to $0.22 as sellers dominated the market.

- Resistance was established at $0.238, with significant selling pressure observed.

- Broader market factors, including regulatory uncertainty and trade tensions, contributed to the decline.