-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Helene Braun|Edited by Stephen Alpher

Aug 14, 2025, 8:40 p.m.

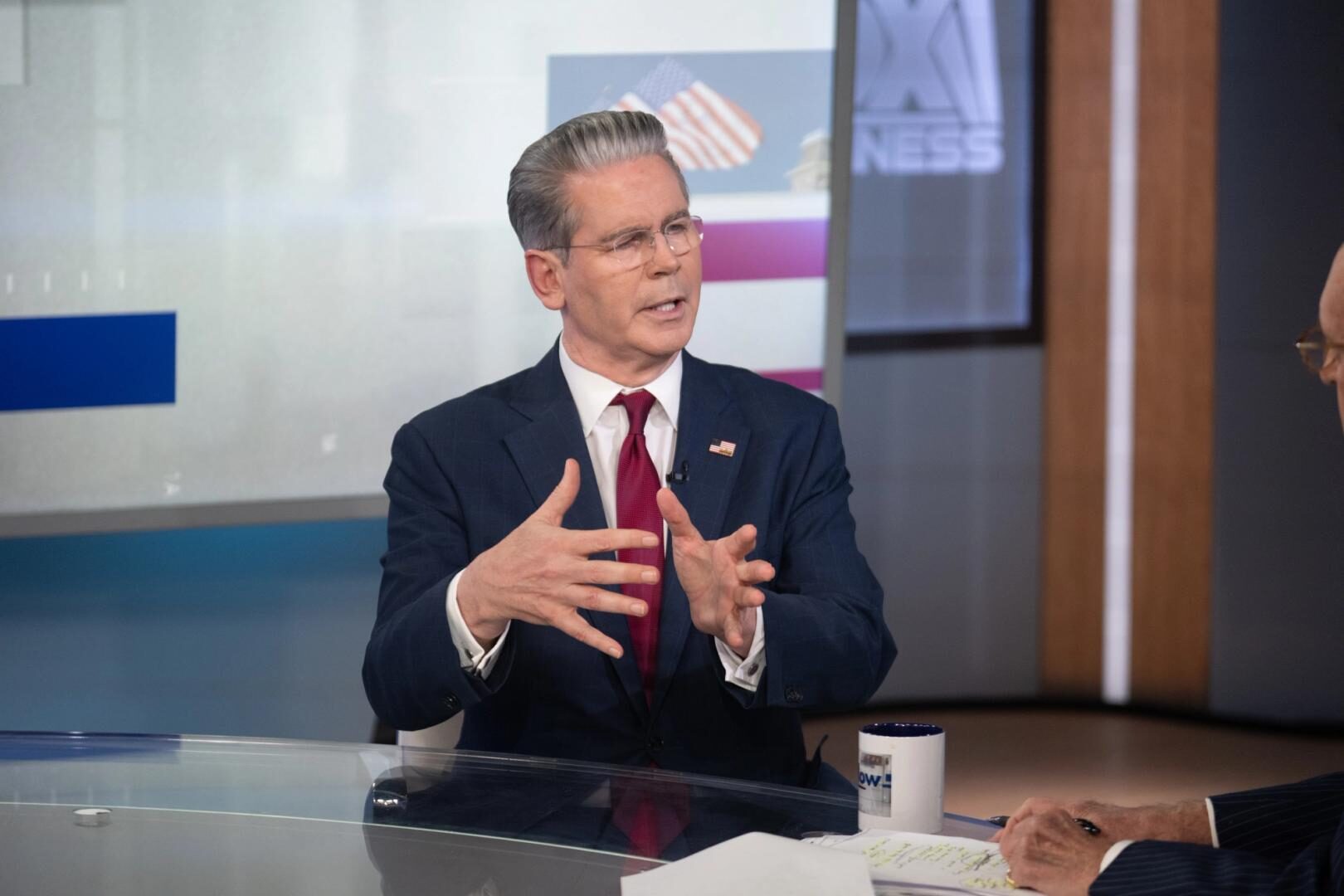

- Treasury Secretary Scott Bessent appeared to reverse course Thursday, saying the government remains committed to adding to its bitcoin holdings in a budget-neutral way.

- Earlier in the day, Bessent said the Strategic Bitcoin Reserve would only consist of the $15 billion to $20 billion in coins already held, but no new purchases were being contemplated.

- Bitcoin remained sharply lower for the day at $118,000 after touching a new record high of $124,000 in overnight action.

Treasury Secretary Scott Bessent began Thursday by dashing the hopes of at least some bitcoiners, saying the Strategic Bitcoin Reserve would be made up of the $15 billion to $20 billion already held by the government, but that there was no intention of making any fresh purchases.

He ended the day, however, by seemingly contradicting those remarks, saying his department is “committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.”

STORY CONTINUES BELOW

The fresh buys would be in addition to tokens forfeited to the government, which will be the “foundation” of the reserve, Bessent said.

U.S. President Donald Trump signed an executive order in March to create a strategic bitcoin reserve which Bessent has advocated for. Earlier this month, Bo Hines, the leader of the White House’s Council of Advisors on Digital Assets — whose tasks, among other things, included the SBR — exited his position.

Bitcoin

continued to trade at about $118,000 late in the U.S. afternoon Thursday, down sharply since hitting a new record high of $124,000 just hours earlier.

The bulk of the decline came after a far stronger than anticipated Producer Price Index report, which called into question the idea that inflation is receding enough for the Federal Reserve to trim interest rates in September.

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

More For You

By CD Analytics, Helene Braun|Edited by Cheyenne Ligon

2 hours ago

The token’s rejection at $0.26 came amid a broad crypto pullback, with the CoinDesk 20 Index sliding 4% and rate-cut hopes fading.

What to know:

- Polygon’s POL token slid 6% to $0.24 Thursday after breaking key support, as surging U.S. wholesale inflation rattled risk assets.

- Trading volume spiked to 1.1 million units — more than triple its daily average — after a sharp rejection at the $0.26 resistance level.

- The CoinDesk 20 Index fell 4% over the same period, with profit-taking accelerating across major cryptocurrencies.