BTC

$105,900.42

–

1.65%

ETH

$2,576.25

–

5.79%

USDT

$1.0004

+

0.04%

XRP

$2.1594

–

3.67%

BNB

$654.70

–

1.44%

SOL

$148.12

–

6.19%

USDC

$0.9997

+

0.01%

DOGE

$0.1795

–

4.25%

TRX

$0.2694

–

1.97%

ADA

$0.6432

–

5.56%

HYPE

$41.72

–

2.54%

SUI

$3.0694

–

7.72%

LINK

$13.55

–

5.37%

BCH

$425.59

–

2.96%

LEO

$9.0486

+

2.39%

AVAX

$19.49

–

7.30%

XLM

$0.2612

–

4.86%

WBT

$35.75

+

5.63%

TON

$3.0118

–

5.54%

SHIB

$0.0₄1207

–

4.47%

By Krisztian Sandor|Edited by Stephen Alpher

Updated Jun 13, 2025, 4:15 p.m. Published Jun 13, 2025, 4:05 p.m.

- SharpLink Gaming acquired 176,271 ether for nearly $463 million, becoming the largest ETH holder among publicly traded companies.

- The firm raised $79 million through its at-the-market facility, primarily for ETH acquisition, following a regulatory filing that allowed private placement investors to sell shares.

- SharpLink’s shares remain lower by 66% on Friday, but even with that plunge are still ahead by more than 500% since announcing the ETH treasury strategy several weeks ago.

SharpLink Gaming (SBET), the public firm pivoting to a crypto treasury strategy focused on Ethereum, revealed on Friday it acquired 176,271 ether

for nearly $463 million.

The purchase makes the firm the largest ETH holder among publicly traded companies, SharpLink said in a press release.

STORY CONTINUES BELOW

The company tapped its $1 billion at-the-market (ATM) common stock share facility for $79 million to help fund the ETH acquisition.

The ETH purchase announcement came on the heels of a Thursday regulatory filing that potentially enabled investors in the firm’s private placement round to sell shares, sending stock prices down 70% after market hours. Some speculated that the firm might have leaned more heavily into the ATM to announce a bigger larger crypto purchase. Shares remain lower by 66% in Friday action.

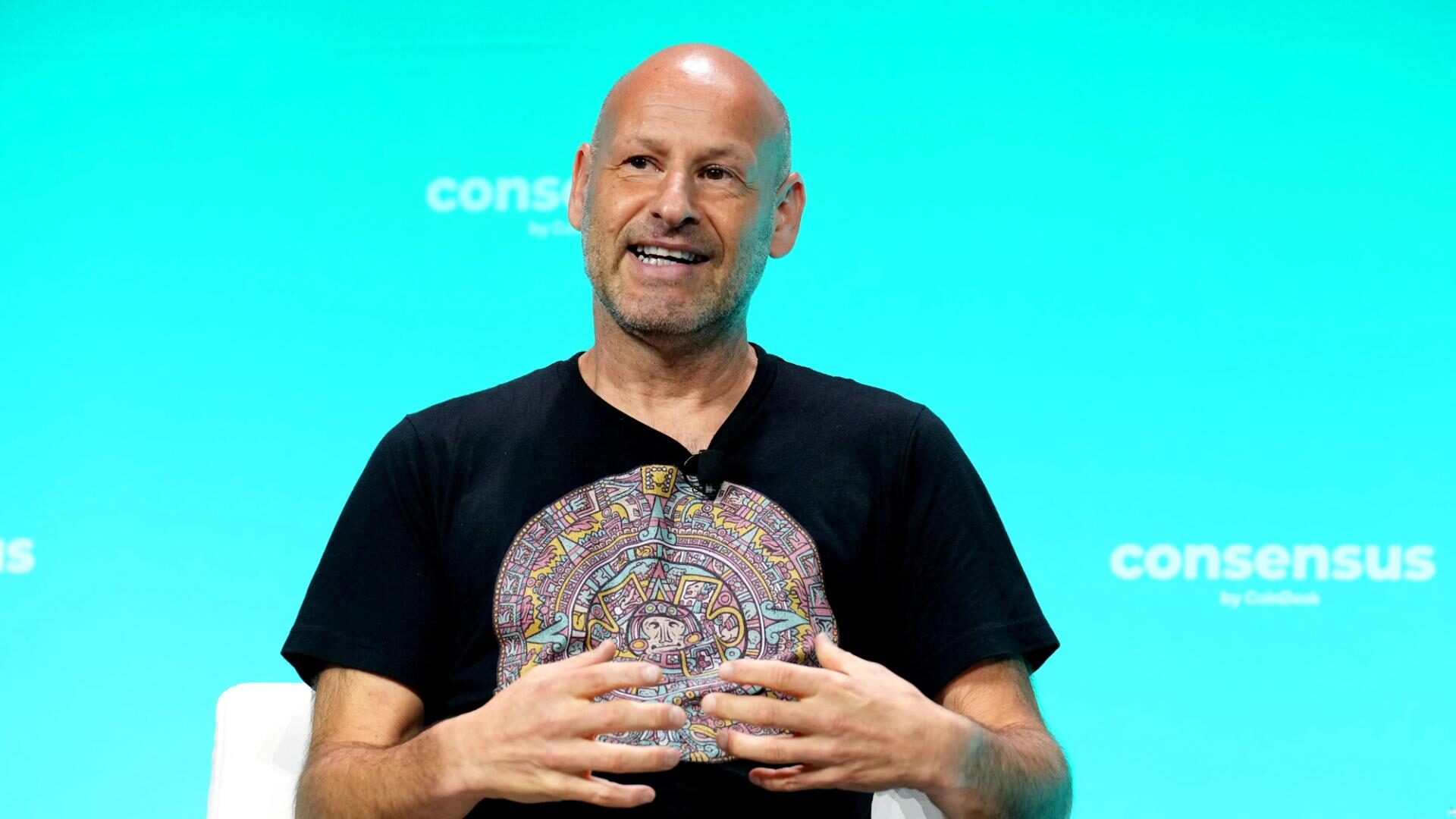

SharpLink in one of the growing roster of public companies that recently pivoted to add cryptocurrencies to their balance sheets. It raised $450 million earlier this month through a private round from a wide range of investors, including ConsenSys, Galaxy, and Pantera Capital, to buy ETH. Ethereum co-founder and ConsenSys CEO Joseph Lubin also joined the firm as board chairman.

Shares exploded 4,300% higher in a bit more than a week following the firm’s crypto strategy in May, but have given back more than 90% of the rally this month.

After the massive price swings and today’s decline, shares still trade around 500% higher than before the treasury pivot.

Read more: Ethereum Treasury Firm SharpLink Gaming Plunges 70% – But There May Be a Twist

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.