-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley|Edited by Aoyon Ashraf

Aug 22, 2025, 2:25 p.m.

- SharpLink Gaming has authorized a stock purchase program of up to $1.5 billion.

- The Minneapolis-based company holds 740,760 ETH, worth $3.19 billion at current prices.

Ether treasury firm SharpLink Gaming (SBET) has authorized a stock purchase program of up to $1.5 billion.

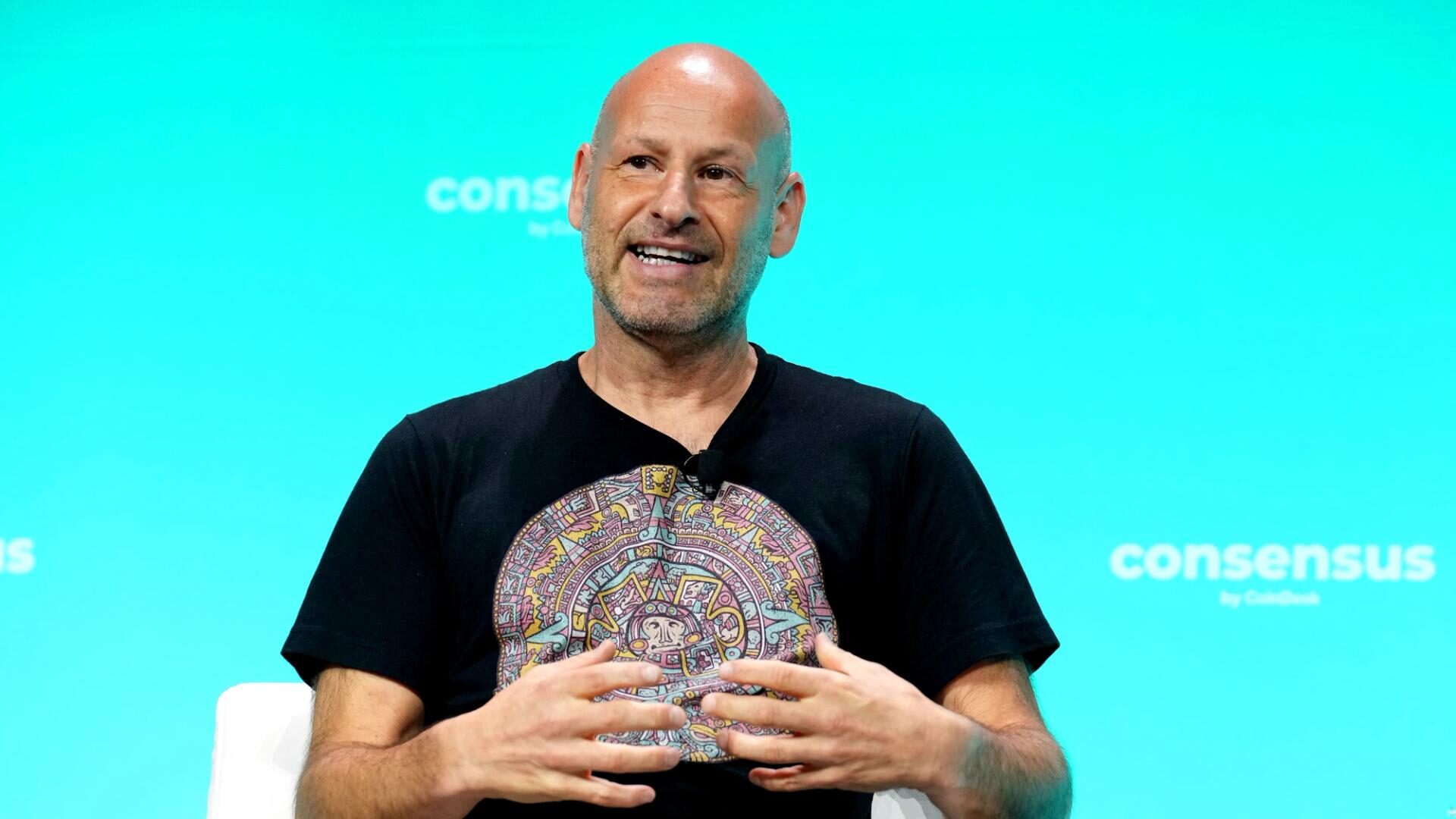

SharpLink, which is helmed by Ethereum co-founder and ConsenSys CEO Joseph Lubin, said it will make the repurchases at a time and in amounts that depend on market conditions and share price in an announcement on Friday.

STORY CONTINUES BELOW

“Should there exist periods where our stock trades at or below the net asset value of our ETH holdings, it would be dilutive on an ETH per share basis to issue new equity through our capital raising efforts,” co-CEO Joseph Chalom said in the announcement.

“In this scenario, the accretive course of action may be to repurchase our common stock.”

The Minneapolis-based company holds 740,760 ETH, worth $3.19 billion at current prices. Numerous companies have unveiled ether treasury strategies in recent months to capture the upside from generating passive yield through ETH staking.

SharpLink shares traded over 10% higher at $19.85 on Friday morning following the buyback program announcement and as bitcoin surged after Fed Chair Jerome Powell’s comments opened the door to a September rate cut.

Read more: Powell Puts September Rate Cut in Play; Bitcoin Pushes Higher

Jamie has been part of CoinDesk’s news team since February 2021, focusing on breaking news, Bitcoin tech and protocols and crypto VC. He holds BTC, ETH and DOGE.

More For You

By Helene Braun, AI Boost|Edited by Aoyon Ashraf

10 minutes ago

Circle, eToro and Marathon led sharp gains on Friday after Federal Reserve Chair Jerome Powell hinted that a policy shift could come next month.

What to know:

- Crypto-related equities rose sharply after Jerome Powell suggested that the Fed may begin cutting interest rates in September.

- Circle’s stock jumped 7%, while eToro and Marathon Digital each gained 6% on the day.

- Powell faces mounting political pressure to cut rates but continues to warn about risks tied to inflation and labor market weakness.