-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Omkar Godbole

Aug 21, 2025, 7:25 a.m.

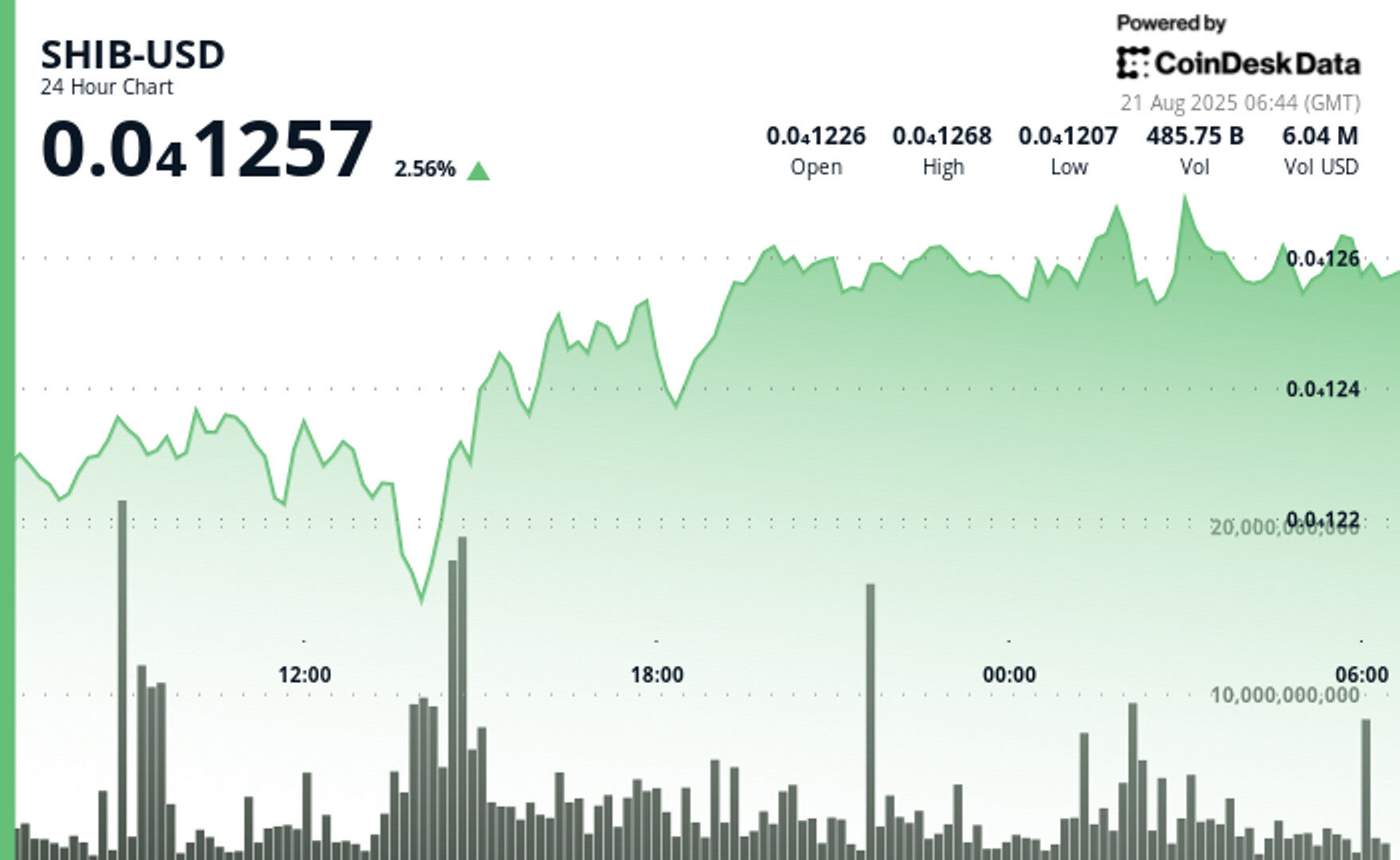

- Shiba Inu (SHIB) rose over 2% in the last 24 hours, maintaining key support levels amid strong trading volumes.

- The cryptocurrency faced early declines due to market de-risking but rebounded above critical levels, including the 61.8% Fibonacci retracement.

- SHIB’s price range saw a 5% spread, with trading volume surging past 1 trillion tokens.

Shiba Inu

has gained over 2% in the past 24 hours, with bulls defending key support levels on the back of strong volumes.

The meme cryptocurrency fell early Wednesday as BTC and the broader market witnessed de-risking ahead of Fed Chair Jerome Powell’s impending speech.

STORY CONTINUES BELOW

Buyers, however, stepped in closer to the $0.00001200 level, ensuring that the psychological support was maintained. The subsequent recovery also lifted prices back above the ascending trendline connecting June 22 and Aug. 2 lows, and the key level of $0.00001231, which is the 61.8% Fibonacci retracement of the June-July rally.

SHIB shakes off volatility, powers from $0.000012295 to $0.000012574 close on heavy bullish flow. Token holds critical support, smashes through resistance barriers. Next target: $0.000012700 psychological level.

According to CoinDesk’s AI technical insights model, $0.000012700 is the next level to beat for the bulls.

- SHIB traded within a $0.000012089-$0.000012705 range, which represents a 5% spread between session extremes.

- Institutional interest peaked between 13:00 and 14:00, andvolume surged past 1 trillion tokens.

- The price held above $0.000012250, confirming a strong demand floor.

- Mid-session selling pressure at 13:00 failed to crack $0.000012089 support.

- Resistance at $0.000012600 was penetrated, triggering a volume surge to 12.8 billion tokens.

CD20 maintained range-bound trading as SHIB volatility spiked. The Index reflected institutional selectivity across major crypto holdings, with the broader market confidence persisting despite individual token swings and near-term uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Omkar Godbole is a Co-Managing Editor and analyst on CoinDesk’s Markets team. He has been covering crypto options and futures, as well as macro and cross-asset activity, since 2019, leveraging his prior experience in directional and non-directional derivative strategies at brokerage firms. His extensive background also encompasses the FX markets, having served as a fundamental analyst at currency and commodities desks for Mumbai-based brokerages and FXStreet. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

Omkar holds a Master’s degree in Finance and a Chartered Market Technician (CMT) designation.

More For You

By Omkar Godbole, AI Boost|Edited by Sheldon Reback

1 hour ago

Kenneth Rogoff reflects that he underestimated BTC’s role in the underground economy, which has put a floor under the cryptocurrency’s price.

What to know:

- Kenneth Rogoff, an economics professor at Harvard, predicted in 2018 that bitcoin would be worth $100 rather than $100,000 in a decade.

- Bitcoin’s price has surpassed $100,000, contrary to Rogoff’s initial prediction.

- Rogoff says he underestimated BTC’s role in the underground economy and overestimated regulators’ ability to restrain its use.