BTC

$105,196.69

+

0.09%

ETH

$2,522.92

–

0.61%

USDT

$1.0003

–

0.01%

XRP

$2.1613

–

0.67%

BNB

$649.58

–

0.08%

SOL

$146.99

+

0.94%

USDC

$0.9998

+

0.00%

DOGE

$0.1745

–

2.01%

TRX

$0.2724

+

0.92%

ADA

$0.6278

–

1.35%

HYPE

$40.26

–

1.66%

SUI

$2.9623

–

1.68%

BCH

$443.96

+

1.29%

WBT

$39.59

+

1.86%

LINK

$13.11

–

0.37%

LEO

$9.2129

+

1.55%

XLM

$0.2571

–

1.10%

AVAX

$19.01

–

0.73%

TON

$2.9605

–

1.31%

SHIB

$0.0₄1195

–

2.18%

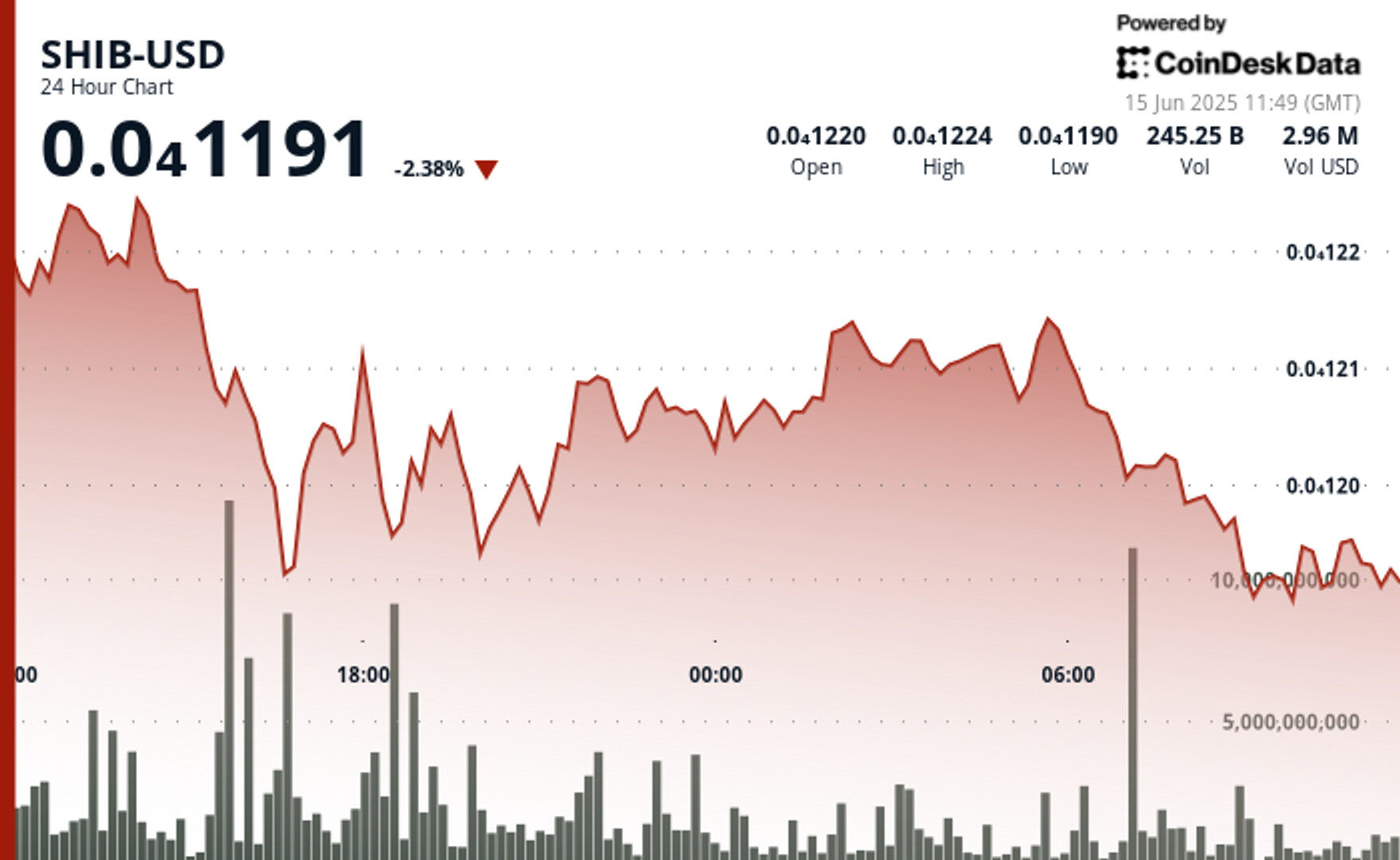

Jun 15, 2025, 11:54 a.m.

- Shiba Inu’s burn rate surged to 112,000% early this week, permanently removing 116 million tokens from circulation.

- Despite strong ecosystem fundamentals and wallet growth, SHIB’s price remains in a downtrend, trading at $0.00001190.

- Technical analysis points to signs of green shoots.

Shiba inu’s (SHIB) supply-side dynamics are screaming bullish, yet the second-largest joke cryptocurrency by market value trades under pressure.

Early this week, SHIB’s burn rate surged to over 112,000%, with more than 116 million coins transferred to wallets that cannot spend money. In other words, these coins were permanently taken out of circulation.

STORY CONTINUES BELOW

The daily burn rate refers to the number of SHIB tokens permanently destroyed or removed from circulation each day. Token burns are designed to decrease the supply of the cryptocurrency over time, bringing a deflationary appeal to the digital asset.

“Over 527 trillion SHIB tokens are approaching profitability, while the burn rate exploded 112,839% with 116 million tokens removed from circulation,” CoinDesk’s AI insights noted.

Furthermore, SHIB’s ecosystem fundamentals demonstrated strength, with record wallet growth exceeding 1.5 million unique addresses and significant increases in Shibarium layer-2 transactions.

Still, the memecoin remained locked in a downtrend at press time, last changing hands at $0.00001190, representing a 2% drop over the past 24 hours and a nearly 5% decline for the week.

Overnight, the token faced strong selling pressure, with above-average volume exceeding 500 billion units, establishing resistance around $0.0000122.

- The double-bottom pattern is forming on charts, signalling a potential 20% rally to $0.000016.

- Key resistance has been established at $0.0000122, backed by above-average volumes.

- The narrow trading range ($0.00001203-$0.000012) indicates the consolidation phase.

- Volume spikes at 07:35 and 07:46-07:47 coincided with price recovery attempts.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.