BTC

$107,100.29

+

1.75%

ETH

$2,424.36

+

0.54%

USDT

$1.0005

–

0.01%

XRP

$2.1935

+

0.22%

BNB

$647.00

+

1.27%

SOL

$146.03

+

0.91%

USDC

$0.9999

+

0.00%

TRX

$0.2729

+

0.01%

DOGE

$0.1649

+

0.66%

ADA

$0.5789

–

1.13%

HYPE

$38.37

+

1.08%

WBT

$47.99

–

0.84%

BCH

$478.47

+

2.67%

SUI

$2.7775

–

1.04%

LINK

$13.26

+

0.68%

LEO

$8.9908

–

1.42%

XLM

$0.2445

–

1.36%

AVAX

$17.93

–

1.20%

TON

$2.8859

–

0.53%

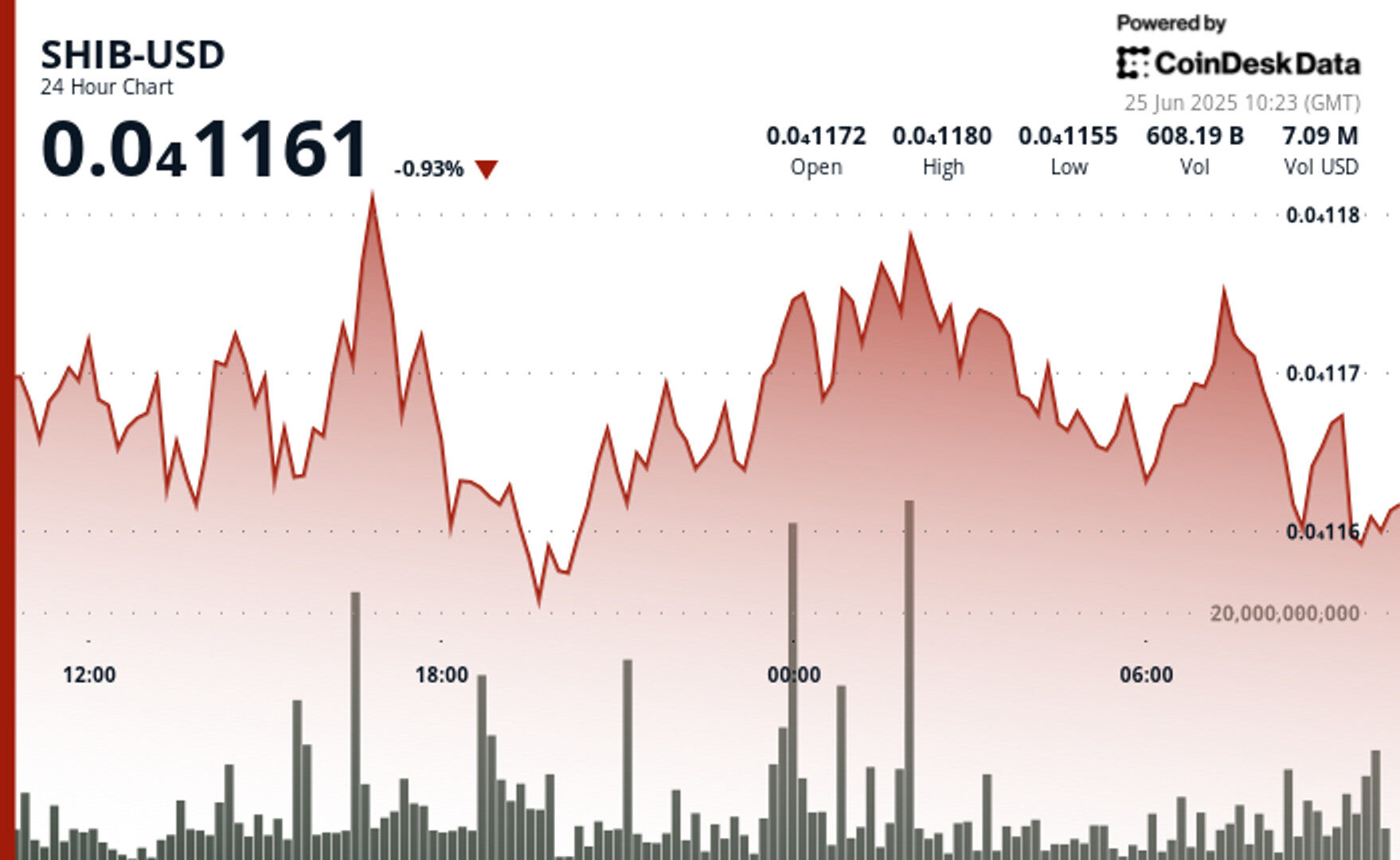

SHIB

$0.0₄1163

–

0.55%

By CD Analytics, Omkar Godbole

Jun 25, 2025, 10:45 a.m.

- Shiba Inu (SHIB) whales purchased 10.4 trillion tokens worth over $110 million, marking the largest daily accumulation in five months.

- SHIB’s price bounced 17% from a 16-month low, with the broader crypto market stabilizing after initial reactions to Middle East tensions.

- The token’s price action suggests potential for continued upside if the $0.00001175 resistance is cleared, despite recent consolidation in a descending triangle pattern.

Shiba inu (SHIB) whales went bargain hunting early this week after prices dropped to a 16-month low of $0.00001005.

According to CoinDesk’s AI research, whales purchased 10.4 trillion SHIB tokens, worth over $110 million, on Monday, marking the largest daily accumulation in five months.

STORY CONTINUES BELOW

The whale action has likely contributed to the cryptocurrency’s 17% price bounce from the 16-month low reached Sunday. Note that the broader crypto market has stabilized following the initial knee-jerk reaction to the tensions in the Middle East. BTC, which fell below $100K over the weekend, last changed hands near $106,000.

Market data indicate that SHIB is maintaining a generally constructive posture, with higher lows forming a subtle uptrend channel. The token found significant volume support at the $0.00001158 level during the 24 hours from June 24, 09:00 to June 25, 08:00, with trading volume surging to 439 billion, well above the daily average.

This accumulation at support levels suggests the potential for continued upside momentum if the $0.00001175 resistance can be decisively cleared. As of writing, SHIB traded at around $0.00001162 on major exchanges, according to CoinDesk data.

- Higher lows formed a subtle uptrend channel, suggesting accumulation at support levels and potential for continued upside momentum if $0.00001175 resistance is cleared.

- During the 60 minutes from 25 June 07:06 to 08:05, SHIB climbed from $0.00001169 to $0.00001171, representing a 0.2% gain.

- A significant price surge occurred between 07:25-07:27, with volume peaking at 12.36 billion SHIB as prices reached the session high of $0.00001175.

- Price action formed an ascending channel with higher lows, though a sharp correction at 08:03 tested the $0.00001171 support level, suggesting consolidation after the earlier rally.

SHIB’s recovery has stalled since Tuesday, with prices trading in what appears to be a descending triangle, characterized by a falling trendline and a horizontal support line.

A price move through the descending trendline would signal a continuation of the recovery rally, exposing the June 16 resistance above $0.00001230. Conversely, a breakdown of the triangle would signal a bearish reversal lower.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.