BTC

94,400.52

+1.10%

ETH

3,495.97

+4.53%

USDT

1.00

+0.02%

SOL

237.78

+2.96%

BNB

627.43

+1.22%

XRP

1.44

+5.06%

DOGE

0.39597493

+2.96%

USDC

1.00

+0.01%

ADA

1.01

+10.22%

AVAX

43.38

+3.28%

TRX

0.20174838

+5.26%

TON

6.27

+5.80%

XLM

0.50487362

+10.66%

SHIB

0.0₄25053

+3.24%

WBTC

94,166.22

+1.01%

LINK

18.11

+4.36%

BCH

521.16

+6.11%

SUI

3.37

+4.59%

NEAR

6.76

+9.17%

PEPE

0.0₄18605

+2.44%

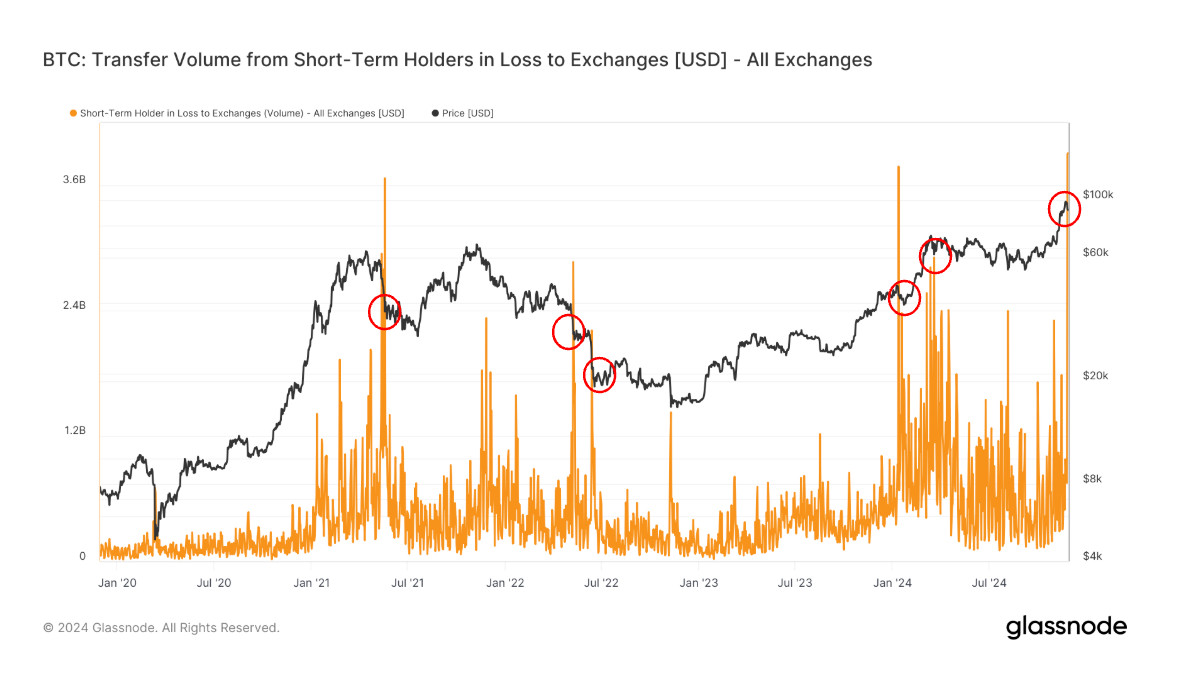

As bitcoin approached $100,000 we saw record notional profit-taking, however, as bitcoin dropped to almost $90,000 we are seeing record notional loss-taking.

By James Van Straten|Edited by Parikshit Mishra

Nov 27, 2024, 12:01 p.m.

What to know:

Bitcoin (BTC) volatility is back and investors have two choices either embrace the volatility or have no part of it.

However, the current bitcoin cycle has been rather muted in terms of realized volatility and drawdowns compared to previous ones. The recent drop from nearly $100,000 to almost $90,000, just shy of a 10% correction, has kept investors on their toes.

Over the past two days, Glassnode data shows that short-term holders or those that have held bitcoin for less than 155 days, have sent $7.8 billion or 83,000 BTC to exchanges at a loss over the past two days.

In notional terms, this is the highest number on record. When this cohort tends to send $2 billion or more worth of tokens to exchanges, at a loss, it generally marks a local bottom.

With bitcoin changing hands at 7% away from its all-time high, investors that have bought in the past week are the only entity that would be sitting in a loss.

Glassnode data shows that approximately 678,000 bitcoin are sitting in a loss. This comes after record notional profit-taking as bitcoin approached $100,000.

Story continues below

As the senior analyst at CoinDesk, specializing in Bitcoin and the macro environment. Previously, working as a research analyst at Saidler & Co., a Swiss hedge fund, introduced to on-chain analytics. James specializes in daily monitoring of ETFs, spot and futures volumes, and flows to understand how Bitcoin interacts within the financial system. James holds more than $1,000 worth of bitcoin, MicroStrategy (MSTR), Semler Scientific (SMLR), IREN (IREN), MARA Holdings (MARA), Cipher Mining (CIFR), Bitfarms (BITF), Riot Platforms (RIOT) and CleanSpark (CLSK).

DISCLOSURE

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

© 2024 CoinDesk