BTC Supply in Loss Held by Short-Term Holders at Highest Level Since FTX Collapse

U.S.-listed bitcoin ETF assets under management have slipped only about 4% compared with bitcoin’s 25% price drop, highlighting a divergence.

By James Van Straten|Edited by Jamie Crawley

Nov 17, 2025, 12:11 p.m.

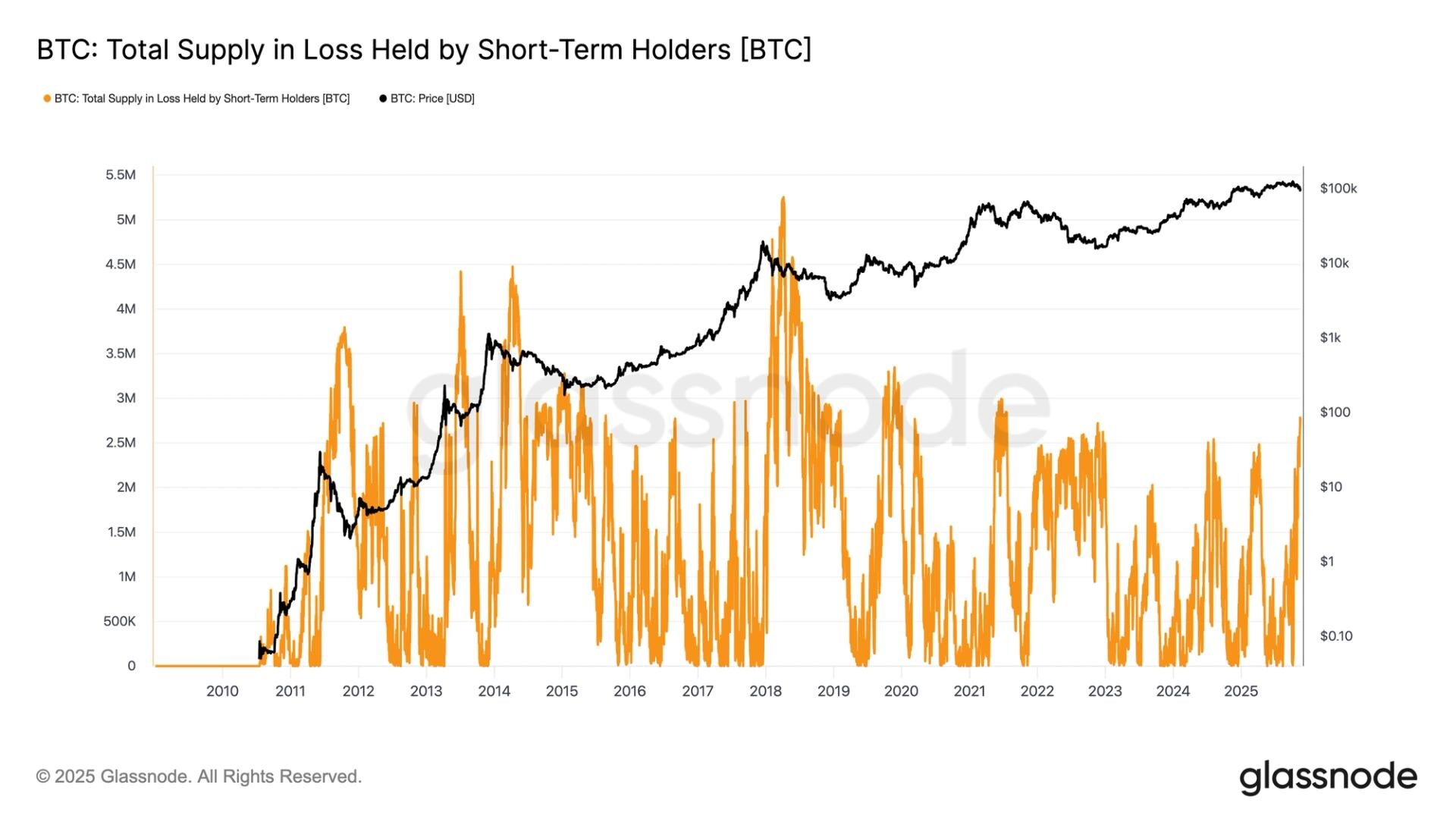

- Short-term holders now collectively hold around 2.8 million BTC at a loss, the largest underwater position recorded since the FTX collapse in late 2022.

- U.S. spot ETFs have held relatively firm through the recent market decline, with AUM dipping only slightly from 1.38 million BTC to 1.33 million BTC.

Short-term holders (STHs) are now almost entirely underwater on their recent bitcoin BTC$95,477.53 purchases. Glassnode defines STHs as entities that have held bitcoin for less than 155 days.

On June 15 (155 days ago), bitcoin was trading at $104,000, meaning nearly all coins acquired since then sit above current spot levels.

STORY CONTINUES BELOW

Glassnode data shows that 2.8 million BTC held by STHs are at a loss, the highest level since the FTX collapse in November 2022, when bitcoin traded near $15,000 per coin.

Bitcoin is now down roughly 25% from its October all time high, which is well within the typical 20% to 30% range for bull market corrections. In contrast with STHs, long term holders (LTHs) have continued distributing. Glassnode data shows that LTH supply has fallen from 14,755,530 BTC in July to 14,302,998 BTC as of Nov. 16, a reduction of 452,532 BTC.

“Many long-standing holders have chosen to sell in 2025 after many years of accumulation,” Bitcoin OG and Fragrant Board Director Nicholas Gregory said.

“These sales are mostly lifestyle driven rather than motivated by negative views of the asset, and that the launch of the U.S. ETFs and a $100,000 price target created an attractive and highly liquid window to sell.”

This decline in bitcoin has created a notable divergence with the U.S. spot bitcoin exchange traded funds (ETFs) which have shown remarkable stability. U.S. ETF assets under management (AUM) remain near their all-time highs when measured in BTC terms. The current AUM stands at 1.33 million BTC compared with the peak of 1.38 million BTC on Oct. 10 a 3.6% decrease, according to checkonchain.

Measuring AUM in BTC rather than dollars avoids distortions from price volatility. This divergence suggests that the recent price decline is not being primarily driven by ETF outflows but by longer term holders.

Más para ti

14 nov 2025

Lo que debes saber:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

Más para ti

Por Oliver Knight, Omkar Godbole|Editado por Sheldon Reback

hace 43 minutos

A bruising weekend confirmed a broader downtrend across major tokens, with shifting Fed rate-cut expectations and thin liquidity accelerating declines.

Lo que debes saber:

- Bitcoin dropped to $93,400 and ether to $3,050, forming lower highs and lows across timeframes

- A $62 million bitcoin liquidation pocket looms at $92,840.

- SOL dropped to $135 and ETH briefly tapped $3,000 as reduced liquidity exaggerated downside moves across major cryptocurrencies and privacy coins alike.

- The crypto fear and greed index fell to 17/100 — its lowest since April — while RSI readings show markets not fully oversold despite sharp monthly losses.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language